VAKIFBANK

ANNUAL REPORT 2014

31

In May 2014, the uncertainties in domestic and

international markets diminished to some extent,

risk premium indicators showed some recovery and

market interest rates began to decline. In light of these

developments, the CBT decided to lower its policy interest

rate for the first time in 2014 at the MPC meeting in

May. The CBT cut the one-week repo rate, referred to

as policy interest rate, which it had raised sharply at the

intermediary meeting on January 28, from 10% to 9.5%.

Expecting that inflation peaked in May, the CBT cut the

policy interest rate by 75 basis points at its meeting in

June following a comment pointing to a considerable drop

in inflation starting in June. On the other hand, despite

the policy rate cut, making no change in the interest rate

corridor was an indication of the CBT’s preference for

sustaining the existing tight monetary policy. While the

CBT reduced the lower band of the interest rate corridor

and the policy interest rate by 50 basis points at its July

meeting, it did not change the upper band of the interest

rate corridor. This enabled the CBT to keep the interest

rates higher in the market by limiting the liquidity it was

pumping via the one-week repo rate, maintaining a tight

monetary policy in case of an unprecedented development

in the economy. In August, the CBT kept the policy rate and

the lower band of the interest rate at the same level while

it reduced the upper band by 75 basis points.

Thanks to both the base effect and declining commodity

prices, inflation is expected to go down starting in the first

quarter of 2015. In this scenario, the CBT is also expected to

lower interest rates starting from the first quarter of 2015.

On the other hand, the monetary policy to be followed in

2015 by the Fed, which is widely anticipated to start raising

interest rates as soon as at the second quarter of 2015, will

continue to affect capital inflows into developing countries.

The Fed’s decision on hiking interest rates is regarded as

one of the key factors influencing the CBT’s policies.

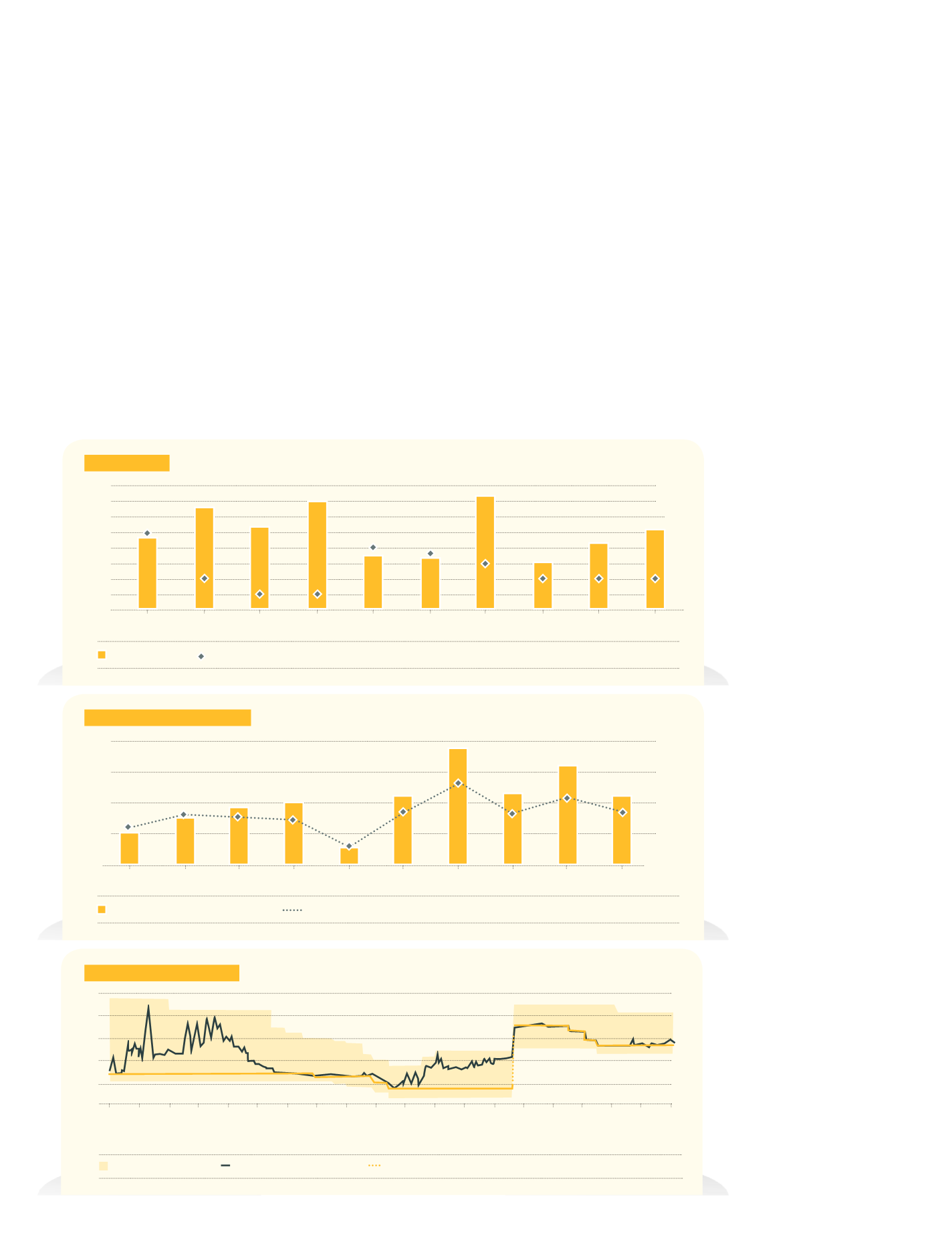

CURRENT ACCOUNT DEFICIT

Current Account Deficit (% GDP, right axis)

Current Account Deficit (annual, billion US$, left axis)

Source: CBT

80

15

60

10

40

5

20

0

0

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014*

*Current Account Deficit/GDP rate Q3 data

CBT INTEREST RATES (%)

One-Week Repo Auction

Lending Borrowing

Average Cost of Funding

13

11

9

7

5

3

10/2011

12/2011

02/2012

04/2012

06/2012

08/2012

10/2012

12/2012

04/2013

06/2013

08/2013

10/2013

12/2013

12/2013

02/2014

04/2014

06/2014

08/2014

10/2014

12/2014

Source: CBT

CPI BY YEAR

11

10

9

8

7

6

5

4

3

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

CPI (y-y, %)

CBT Target

Source: CBRT, TÜİK

7.7

9.7

8.4

10.1

6.5

6.4

10.5

6.2

7.4

8.2