37

PART I: INTRODUCTION

THE SHARE OF DEPOSITS IN LIABILITIES

ROSE SLIGHTLY IN 2015

Displaying a mild upward trend in the third

quarter of 2015, the share of deposits in the

funding sources of the banking sector reached

52.8% in December 2015. The growth rate of

deposits gained momentum from the beginning

of 2015 onwards and accelerated further in the

final quarter of 2015: Deposits closed the year at

an annual growth of 18.3%. An analysis of the

annual change in domestic and foreign currency

deposits reveals that both of these showed an

increase in the third quarter over the previous

quarter, however, the growth in domestic

currency deposits lost steam in the final quarter.

As in 2014, most deposits were had short

maturity terms. The weight of deposits with a

maturity term of 1 to 3 months in total deposits

went up from 53.72% in December 2014 to

54.82% in December 2015.

Non-deposit sources (NDS), considered to

be the alternative financing means of the

banking sector, gained further importance

owing to the rise in overall funding costs.

After exhibiting in August 2015 its largest

increase since April 2014, the NDS lost some

steam in december, and on the whole, rose

19.7% the year-on-year to reach TL 849.8

billion. During the same period, the weight

of NDS in total liabilities stood at 36%.

Shareholders’ equity, whose annual growth

rate dropped from year-end 2014 until July

2015, stood at 13% in december. The share

of shareholders’ equity in total liabilities was

11% in the said month.

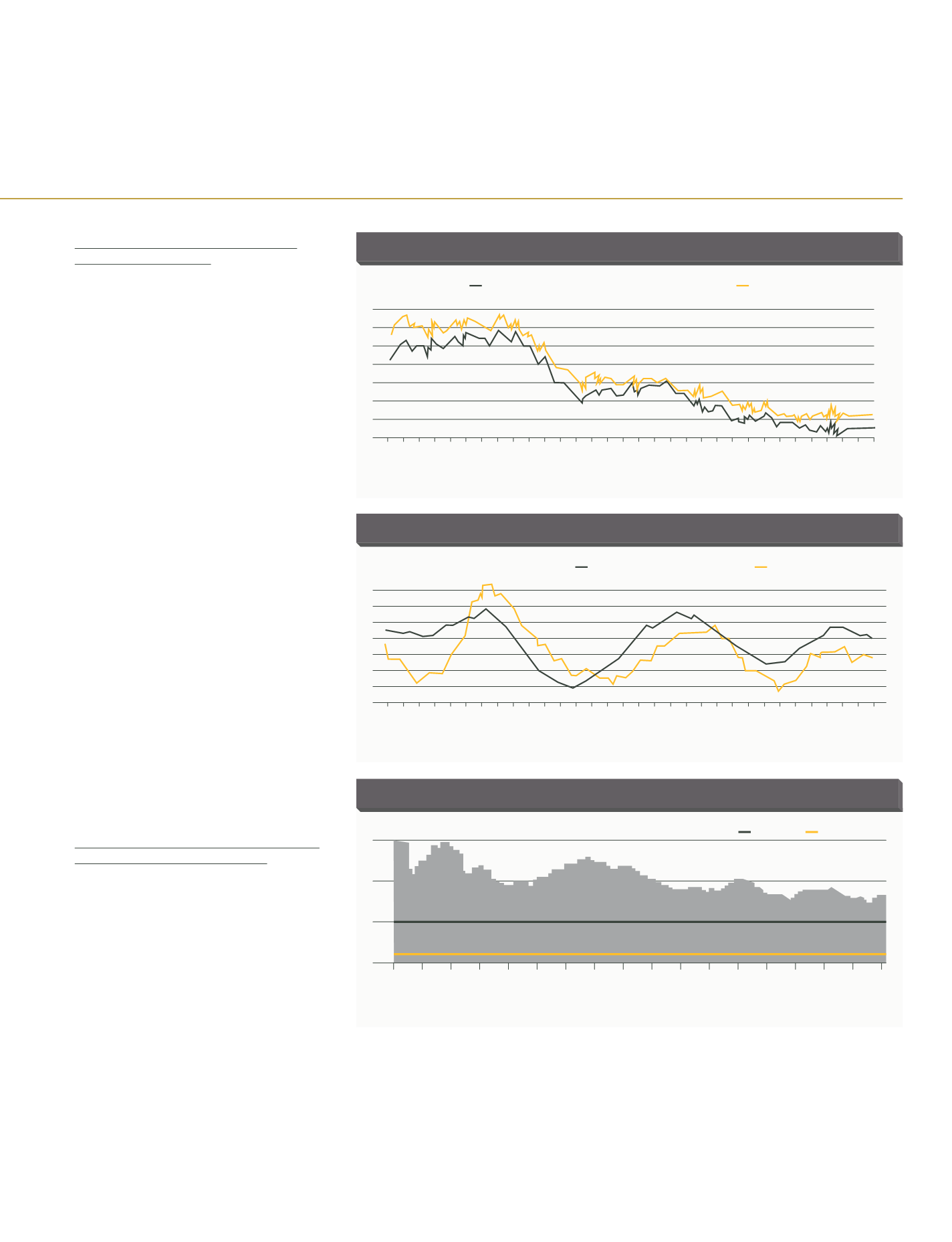

PROFITABILITY RECOVERED IN 2015 AFTER

THE DROP IN THE PREVIOUS YEAR

The sector’s annual net profit, after dropping in

the first half of 2014, tilted upwards in 2015 in

part due to the base effect, and reached 5.9%

on an annual basis despite another slowdown

in the third quarter of 2015. As a result, the net

profit for the period stood at TL 26.1 billion as of

december. The rise in net interest income was

key to this increase in profitability. Net interest

revenue soared by 18% in december on annual

basis to hit TL 77.3 billion. Profitability ratios

continued their trends in 2014. The sector’s RoA

declined to 1.11%, from 1.23% in 2014, while

RoE declined to 9.94%, from 10.6% in 2014.

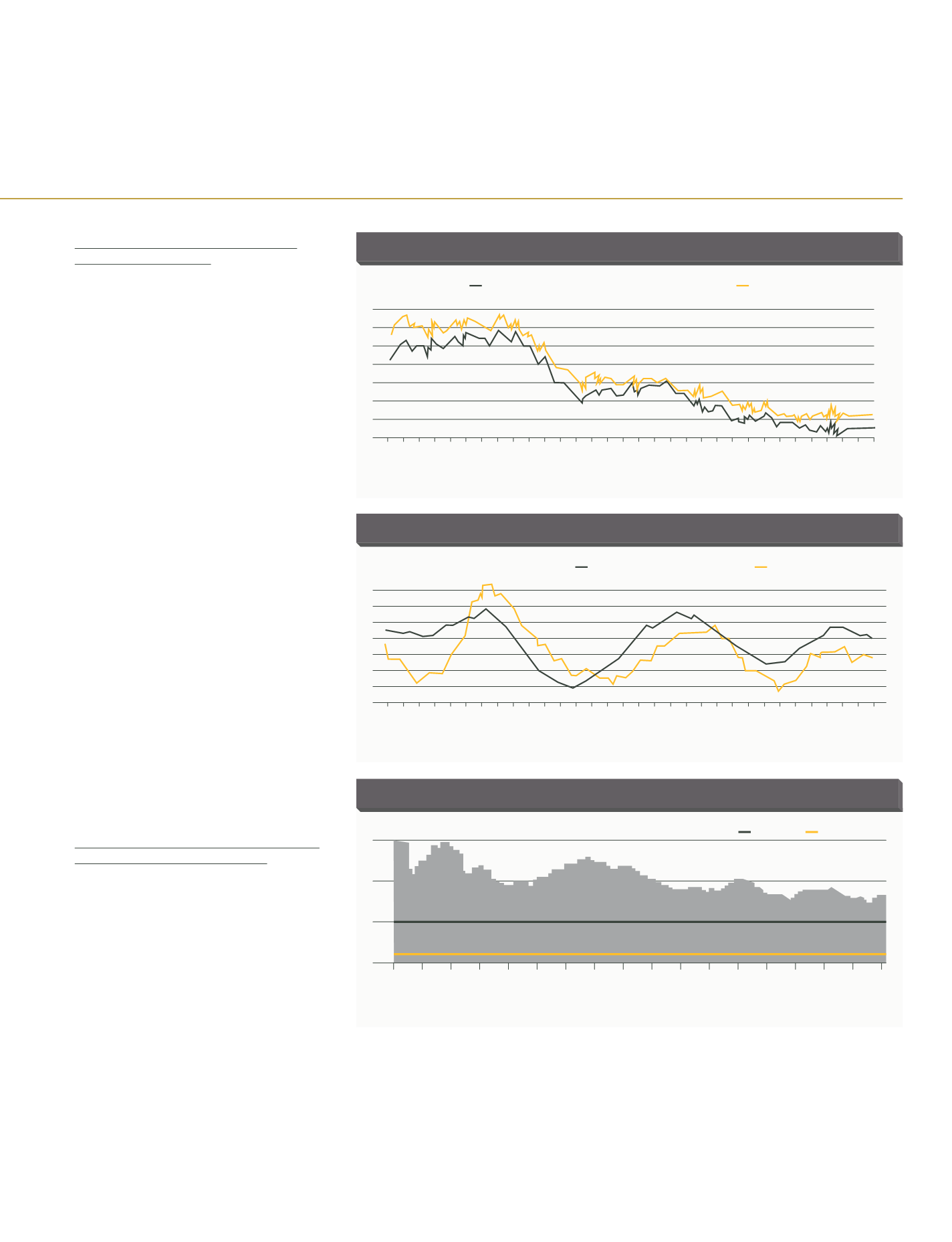

The capital adequacy ratio, which shows the ratio

of the sector’s capital to its risk-bearing assets, is

above the legal limit of 8% and the target ratio

of 12%; nevertheless, exhibited a downtrend

in 2015 and tilted upward only from october

onwards. As such, the capital adequacy ratio

dropped from 16.28% in 2014 to 15.6% in 2015.

The fact that the capital adequacy ratio has been

falling since the first quarter suggests that the

banks need to further expand their shareholders’

equity to meet their risk-bearing assets.

The Fed’s decision in December 2015 to raise

its policy rate has eliminated a significant

uncertainty factor. Furthermore, it was

announced that rate rises would continue

gradually in 2016. This announcement has

lessened the pressure on interest rates and

exchange rate. In 2015, the rise in the exchange

rate played a crucial role in the rapid loan and

asset growth of the banking industry. In 2016,

however, the annual growth rate of loans and

assets is expected to decelerate to a certain

degree.

NET PROFIT AND NET INTEREST INCOME

50

40

30

20

10

0

-10

-20

June 08

Sept 08

Dec 08

Marc 09

June 09

Sept 09

Dec 09

Marc 10

June 10

Sept 10

Dec 10

Marc 11

June 11

Sept 11

Dec 11

Marc 12

June 12

Sept 12

June 13

Dec 12

Marc 13

June 13

Sept 13

Dec 13

Marc 14

June 14

Sept 14

Dec 14

Marc 15

June 15

Sept 15

Dec 15

Source: BRSA

Net Interest Income (Annual % change)

Net Profit (Annual % change)

CAPITAL ADEQUACY RATIO

(CAR)

22

17

12

7

Target Rate Legal Boundaries

Source: BRSA

Jan 06

August 06

Marc 07

Oct 07

May.08

Dec 08

July 09

Feb 10

Sept 10

Apr 11

Nov 11

June 12

Jan 13

August 13

Marc 14

Oct 14

May.15

Dec 15

SHARE OF DEPOSITS IN LIABILITIES

64

20

62

60

58

56

54

52

50

38

36

34

32

30

28

26

24

22

June 08

Sept 08

Dec 08

Marc 09

June 09

Sept 09

Dec 09

Marc 10

June 10

Sept 10

Dec 10

Marc 11

June 11

Sept 11

Dec 11

Marc 12

June 12

Sept 12

June 13

Dec 12

Marc 13

June 13

Sept 13

Dec 13

Marc 14

June 14

Sept 14

Dec 14

Marc 15

June 15

Sept 15

Dec 15

Source: BRSA

Share of non-Deposits in Liabilities (%) (Right, Opposite Axis)

Share of Deposits in Liabilities (%)