35

PART I: INTRODUCTION

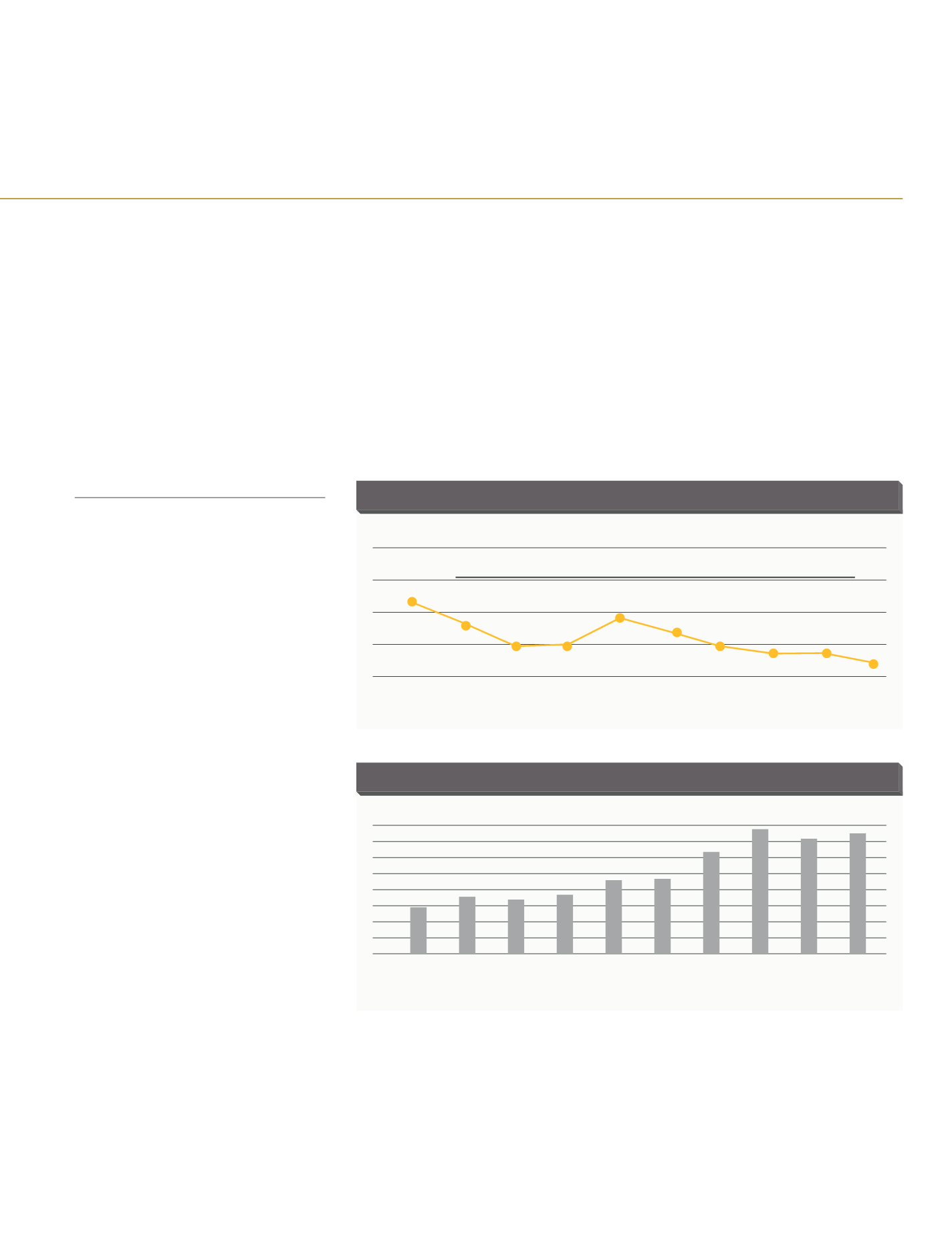

CENTRAL GOVERNMENT GROSS DEBT STOCK

(% GDP)

70.0

60.0

50.0

40.0

30.0

2005

51.1

45.5

39.6

40.0

46.3

43.1

39.9

37.6

37.4

35

2014

2009

2008

2013

2012

2011

2010

2007

Maastricht Criteria 60%

2006

Source: Undersecretariat of Treasury

80

70

60

50

40

30

20

10

0

2006

28

2007

34

2008

31.7

2009

35.3

2010

44.1

2011

44.7

2012

60.8

2013

74.3

2014

68.5

2015

71.8

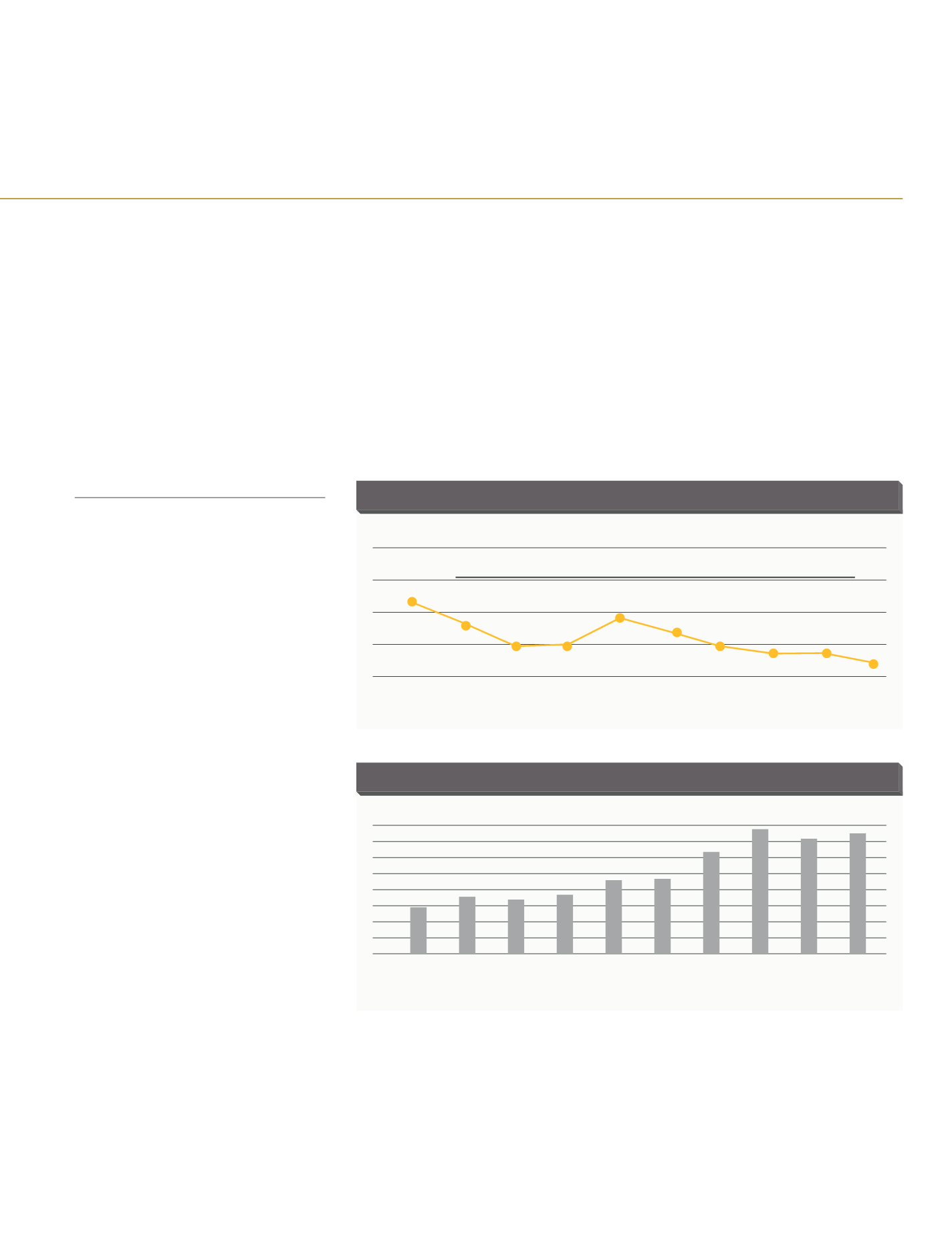

DOMESTIC DEBT MATURITY

(MONTHS)

Source: Undersecretariat of Treasury

CENTRAL GOVERNMENT GROSS DEBT STOCK

The Central Government Gross Debt Stock

stood at TL 677.6 billion at end-December

2015; of which, TL 440.1 billion was in the

form of local currency debt and TL 237.5

billion in foreign currency denominated debt.

Within the framework of the Maastricht

Criteria, also referred as the “EU’s Financial

Rule,” the debt stock to GDP ratio has been

declining steadily, particularly since 2009.

This proves the importance of progress in

fiscal policies and public administration in

Turkey, which boasts an investment-grade

credit rating.

As per 2015 realizations, the average cost of

fixed income TL-denominated debt declined

from 9.7% in 2014 to 9.5% while the average

maturity of domestic cash debt decreased to

71.8 months in 2015 from 68.5 months in

2014. In order to broaden the investor base and

diversify the funding base, Turkey continued

to issue lease certificates, which were issued

for the first time in 2012 and regularly issued

in the domestic market since 2013. In this

scope, lease certificates totaling TL 3.4 billion

were issued in the domestic market during the

months of february and august. According to

the 2016 borrowing strategy announced by the

Undersecretariat of Treasury, domestic borrowing

will reach TL 79.9 billion and the total domestic

debt roll-over ratio will reach 85%.