VAKIFBANK

ANNUAL REPORT 2015

32

FOREIGN TRADE DEFICIT LOWERED TO

USD 63.3 BILLION IN 2015

In 2015, there was a considerable improvement

in the foreign trade deficit over the prior year.

The said improvement is closely related to the

drop in imports. As lower oil prices brought

down Turkey’s energy import bill, foreign trade

deficit contracted in 2015. Besides, sluggish

domestic demand during the said period also

contributed to the contraction of the foreign

trade deficit. However, exports were also seen

to drop in the said period, due to ongoing

economic woes in Turkey’s main commercial

partners and the depreciation of the euro

against the dollar.

The fall in energy prices and its favorable

base effect on the foreign trade deficit will

end in 2016, and the Turkish lira continues

to appreciate against the euro, both of

which suggest that the improvement in

Turkish foreign trade could be interrupted.

Furthermore, the de-escalation of the

tension between Turkey and Russia and the

disappearance of electoral uncertainties

could lead to a surge in domestic

consumption, which could reverse the

improved foreign trade performance.

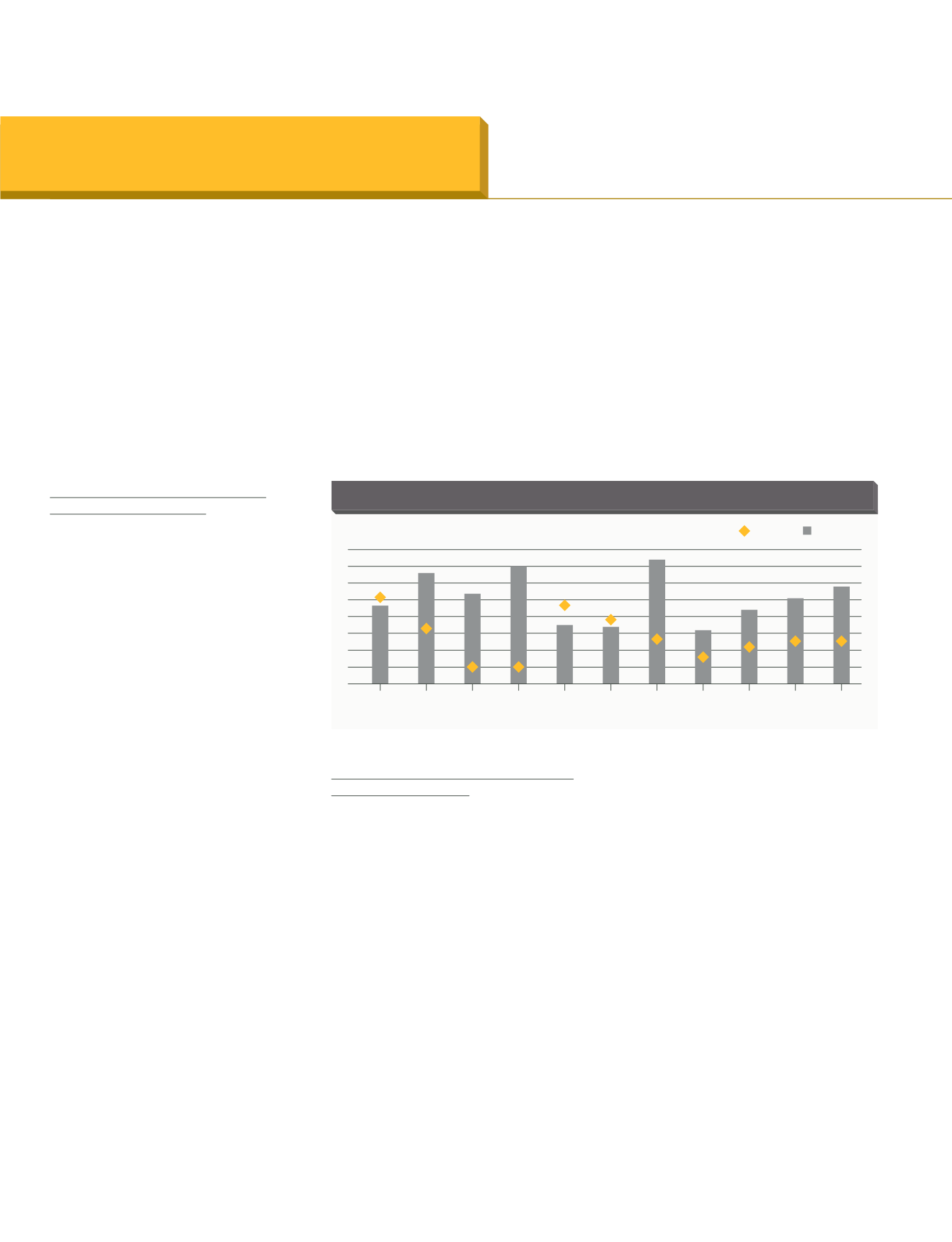

INFLATION REMAINED HIGH IN 2015 DUE

TO THE EXCHANGE RATE

The inflation rate closed the year 2015 at

8.81%, higher than the previous year and

the objective set by Central Bank of Turkey.

In 2015, the exchange rate, food prices, and

lower international oil prices were key factors

determining the inflation rate. Although inflation

tilted downwards due to the global drop in oil

prices in 2015, the fluctuation of the exchange

rate during the year led to a spike. Overall,

the inflation rate closed the year at higher

than expected levels. In the coming era, the

evolution of food prices and the exchange rate

are set to remain key factors affecting inflation.

Furthermore, the 30% increase in the minimum

wage could add 0.5 to 0.8 points to the inflation

for 2016. Taking all these factors into account,

it should be expected that upward pressures on

inflation will continue in 2016 and that the year-

end inflation rate could once again be higher

than anticipated.

Pursuing a policy focused on price stability

as well as financial stability, Central Bank of Turkey

continued to employ interest rates and other

instruments in 2015.

11

10

9

8

7

6

5

4

3

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

CPI (y-y, %)

Source: CBT, TURKSTAT

7.7

9.7

8.4

10.1

6.5

6.4

10.5

6.2

7.4

8.2

8.8

CPI BY YEAR

CBT Target

THE WORLD AND TURKEY IN 2015