301

PART III: FINANCIAL HIGHLIGHTS AND RISK MANAGEMENT

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED CONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE IN NOTE I. OF SECTION THREE

TÜRKİYE VAKIFLAR BANKASI TÜRK ANONİM ORTAKLIĞI AND

ITS FINANCIAL SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS AT AND

FOR THE YEAR ENDED 31 DECEMBER 2015

(Amounts expressed in thousands of Turkish Lira (“TL”) unless otherwise stated.)

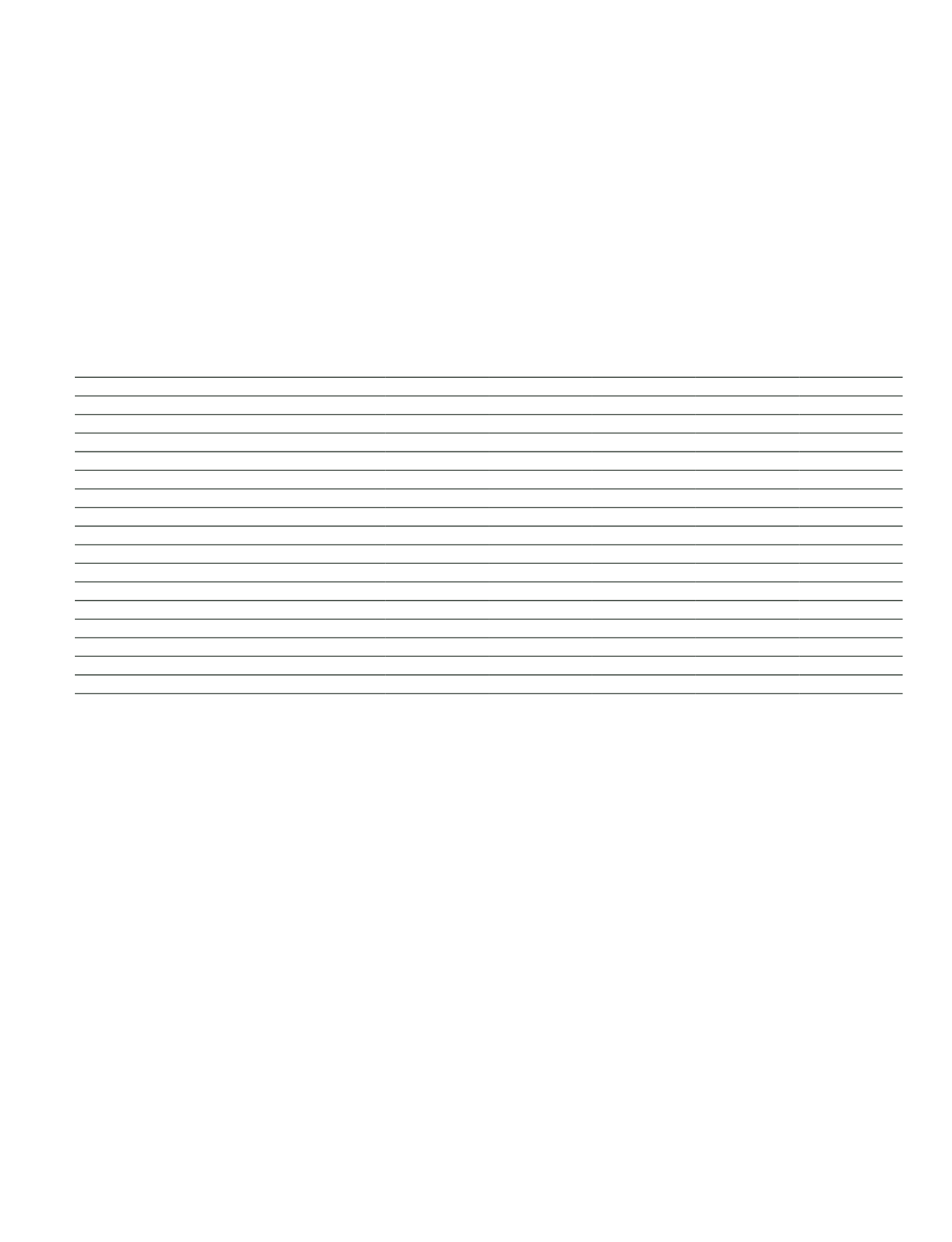

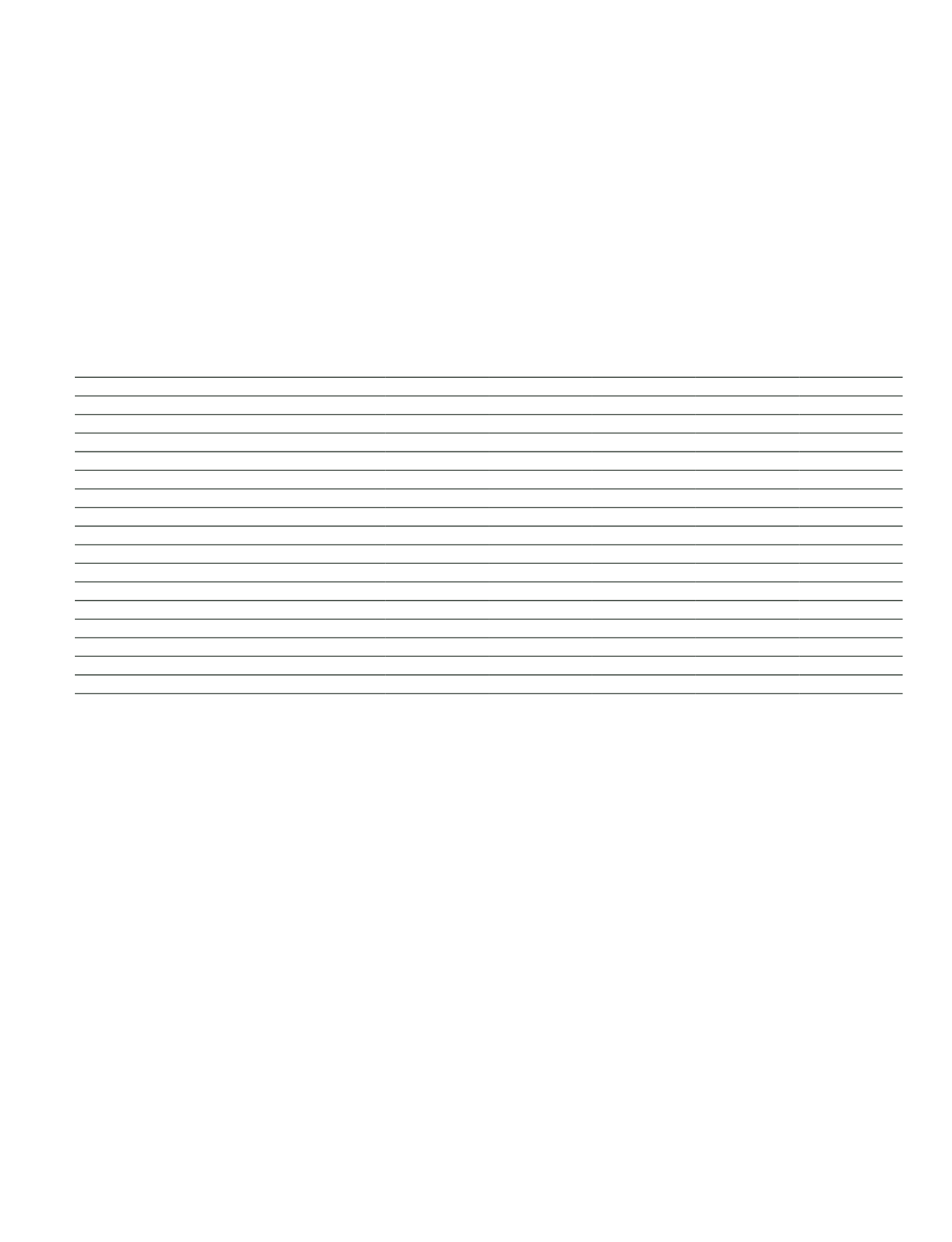

12. Information on tangible assets

Real Estates

Leased

Tangible Assets

Vehicles

Other

Tangible Assets

Total

Balance at the end of the prior year:

Cost

693,825

137,264

45,929

941,529

1,818,547

Accumulated depreciation(-)

262,319

128,354

36,855

587,922

1,015,450

Impairment(-)

18,224

-

-

-

18,224

Net book value

413,282

8,910

9,074

353,607

784,873

Balance at the end of the current year:

Net book value at the beginning of the current year

413,282

8,910

9,074

353,607

784,873

Additions

1,064,712

5,211

1,935

234,534

1,306,392

Cost of the disposals

539,076

9,743

9,664

18,433

576,916

Depreciation of the disposals (-)

268,421

9,695

8,652

8,326

295,094

Depreciation of the current year

16,578

3,237

4,704

108,691

133,210

Impairment (-)

6,475

1,930

406

13,380

22,191

Exchange differences related to foreign associates

32

-

-

44

76

Cost at the end of the current year

1,219,493

132,732

38,200

1,157,674

2,548,099

Accumulated depreciation at the end of the year (-)

10,476

121,896

32,907

688,287

853,566

Impairment (-)

24,699

1,930

406

13,380

40,415

Net book value at the end of the current year

1,184,318

8,906

4,887

456,007

1,654,118

13. Information on intangible assets

Group’s intangible assets consist of computer softwares and licenses. The estimated useful life of intangible assets is five years. Intangible assets are

amortized on a straight-line basis through the estimated useful lives over their costs adjusted for inflation for the items purchased before 31 December

2004, over their initial costs for the items purchased after 31 December 2004.

In the current year an intangible asset that presents severity for the financial statements does not exist.

Additionally the Group does not have intangible assets, which are obtained by government incentives, recorded at fair value, have utulisation

restrictions or have been pledged.

The Group has not declared a commitment to purchase intangible assets.

14. Information on investment properties

As at 31 December 2015, the Group has investment property amounting to TL 9,924 (31 December 2014: TL 24,185) which belongs the subsidiaries

operating in the insurance business and TL 277,802 (31 December 2014: 167,815) which belongs the subsidiaries operating in real estate investment.

15. Information on tax assets

Current tax assets

As at 31 December 2015 the current tax asset of the Group amounts to TL 3,731 (31 December 2014: TL 9,331).