297

PART III: FINANCIAL HIGHLIGHTS AND RISK MANAGEMENT

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED CONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE IN NOTE I. OF SECTION THREE

TÜRKİYE VAKIFLAR BANKASI TÜRK ANONİM ORTAKLIĞI AND

ITS FINANCIAL SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS AT AND

FOR THE YEAR ENDED 31 DECEMBER 2015

(Amounts expressed in thousands of Turkish Lira (“TL”) unless otherwise stated.)

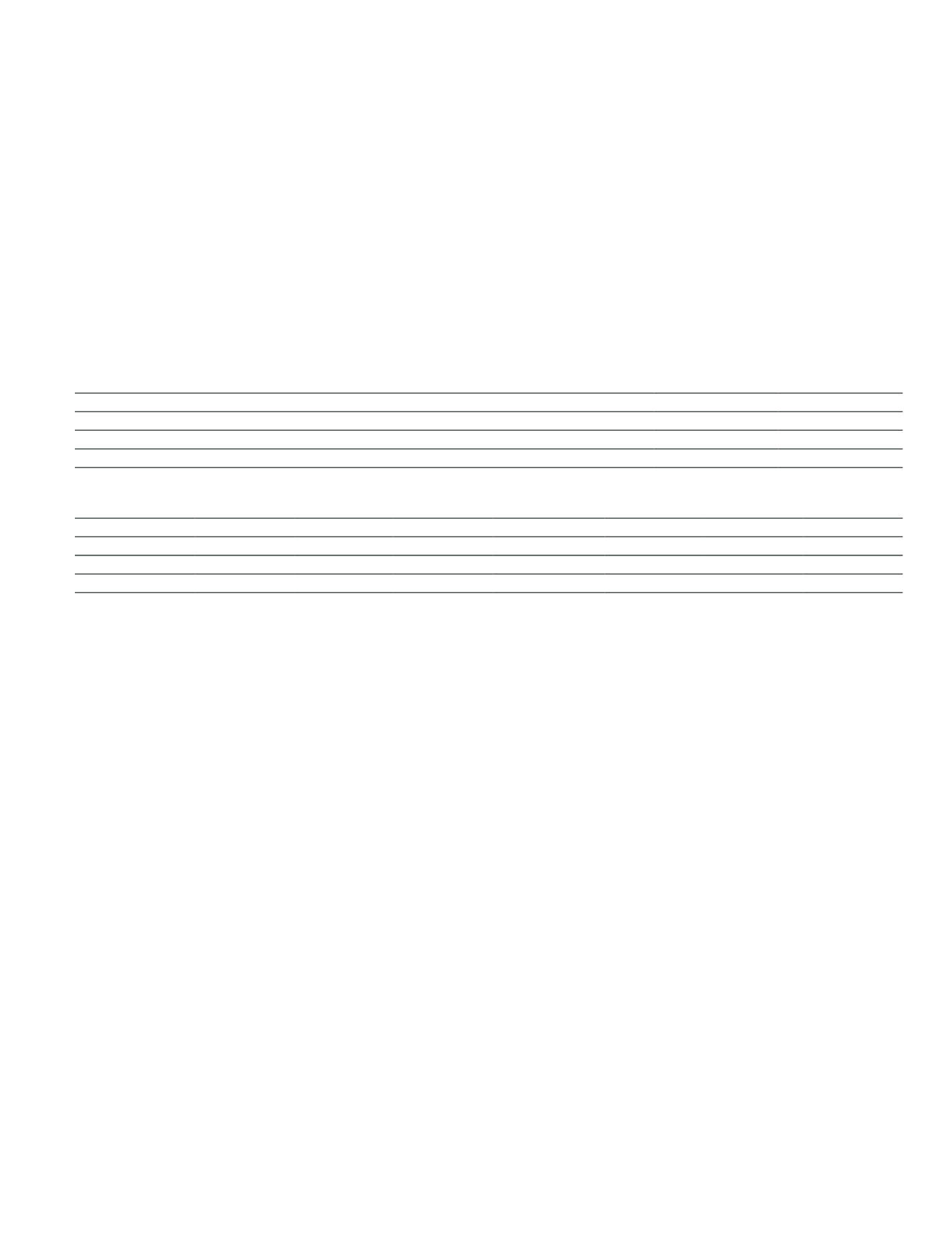

Unconsolidated investments in subsidiaries

Title

Address

(City / Country)

Bank’s Share –

If Different,

Voting Rights (%)

Bank’s Risk

Group Share (%)

1 Vakıf Enerji ve Madencilik A.Ş.

(**)

Ankara/Turkey

65.50

84.96

2 Taksim Otelcilik A.Ş.

(*)

İstanbul/Turkey

51.00

51.52

3 Vakıf Pazarlama Sanayi ve Ticaret A.Ş.

(***)

İstanbul/Turkey

69.33

74.98

4 Vakıf Gayrimenkul Değerleme A.Ş.

(*)

Ankara/Turkey

54.29

58.57

Total Assets

Equity

Tangible

Assets

Interest

Income

Income on

Securities Portfolio

Current Year’s

Profit/(Loss)

Prior Years’

Profit/(Loss)

Fair Value

1

22,604

6,167

1,073

287

-

(1,736)

182

14,100

2

371,186

359,071

243,396

6,512

-

9,112

6,080

364,500

3

47,990

40,368

653

2,828

1,272

3,861

3,420

53,100

4

30,049

25,648

389

2,213

122

829

4,362

40,900

(*)

Financial information as at 30 September 2015 has been presented for these subsidiaries.

(**)

Financial information as at 30 June 2015 has been presented for these subsidiaries.

(***)

Financial information as at 31 December 2014 has been presented for these subsidiaries.

Unconsolidated subsidiaries, reasons for not consolidating such investments and accounting treatments applied for such investments:

Vakıf Enerji ve Madencilik A.Ş., Taksim Otelcilik A.Ş., Vakıf Pazarlama Sanayi ve Ticaret A.Ş. and Vakıf Gayrimenkul Değerleme A.Ş. have not been

consolidated since they are not among the financial subsidiaries of the Bank. Therefore, the subsidiaries whose fair value can be reliably measured are

reflected in the consolidated financial statements at their fair values.

In the current period, subsequent to the approval of the decision to increase the paid-in capital of Vakıf Gayrimenkul Değerleme A.Ş. from TL 7,000 to TL

14,000 by a bonus increase of TL 7,000 in the Ordinary Meeting of General Assembly of the Company dated 20 March 2015. After the capital increase,

The Parent Bank’s current nominal share has been increased from TL 3,800 to TL 7,600 by TL 3,800 and The Parent Bank’s share percentage has been

remained the same (54.29%).

In the prior period, at the Extraordinary General Assembly of Taksim Otelcilik A.Ş. dated 24 June 2014, the decision of increasing the capital from TL

269,257 to TL 334,257 through rights offering by TL 65,000. The related change has been registered on 22 July 2014. The nominal share of the Bank

TL 137,324 has been increased by cash TL 33,151 to TL 170,474. The share percentage of the Bank is remained the same 51.00%. TL 8,288 of the cash

commitment amounting to TL 33,151 is paid on 15 July 2014, TL 24,863 is paid on 2 October 2014.