293

PART III: FINANCIAL HIGHLIGHTS AND RISK MANAGEMENT

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED CONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE IN NOTE I. OF SECTION THREE

TÜRKİYE VAKIFLAR BANKASI TÜRK ANONİM ORTAKLIĞI AND

ITS FINANCIAL SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS AT AND

FOR THE YEAR ENDED 31 DECEMBER 2015

(Amounts expressed in thousands of Turkish Lira (“TL”) unless otherwise stated.)

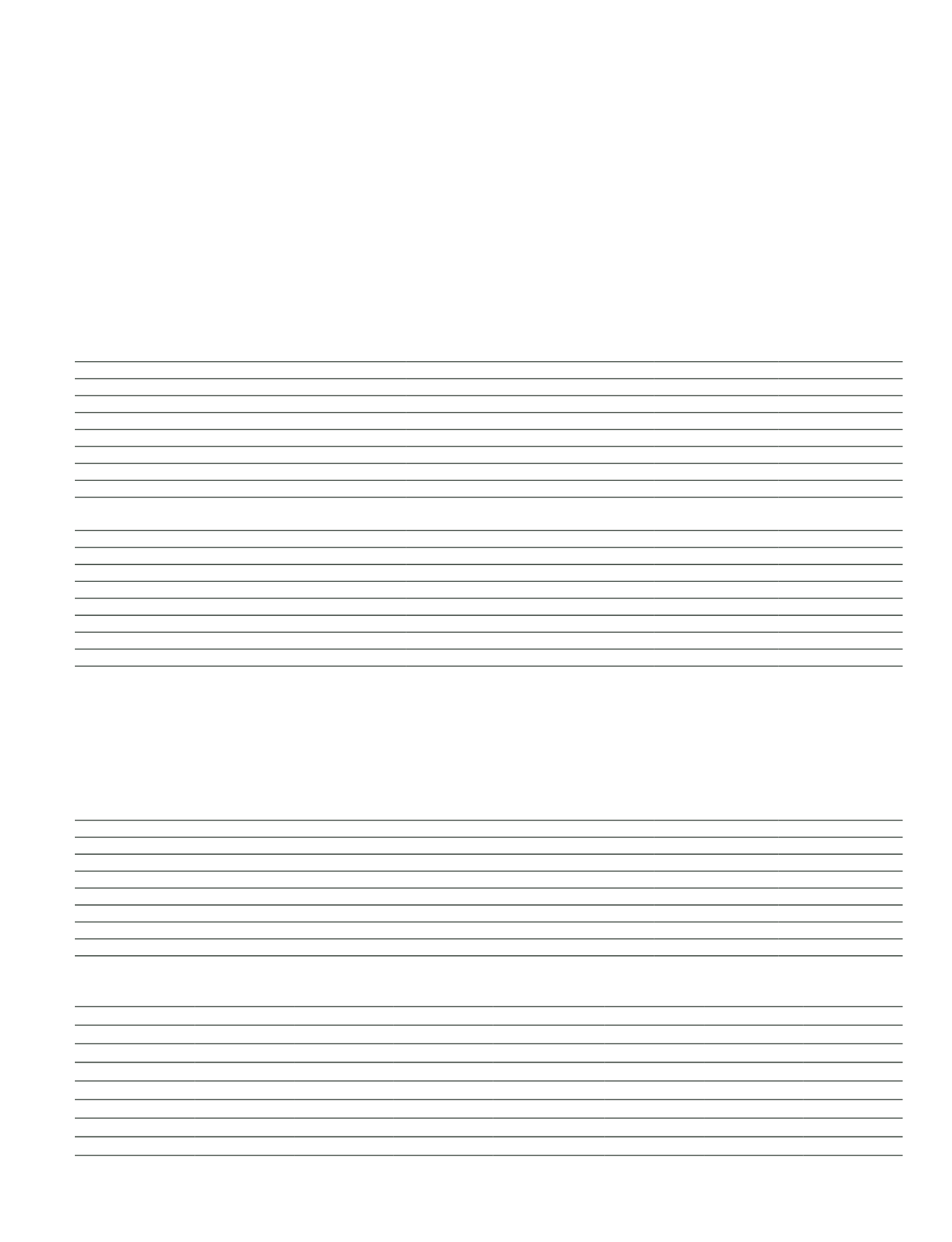

Information on held-to-maturity investments

Current Period

Cost

Carrying Value

TL

FC

TL

FC

Collateralized/blocked investment securities

495,970

130,950

527,655

130,981

Investments subject to repurchase agreements

5,428,798

-

6,050,350

-

Held for structural position

-

-

-

-

Receivable from security borrowing markets

-

-

-

-

Collateral for security borrowing markets

-

-

-

-

Other

(*)

935,631

-

968,743

-

Total

6,860,399

130,950

7,546,748

130,981

Prior Period

Cost

Carrying Value

TL

FC

TL

FC

Collateralized/blocked investment securities

931,961

92,800

972,002

92,844

Investments subject to repurchase agreements

5,289,597

-

5,629,267

-

Held for structural position

-

-

-

-

Receivable from security borrowing markets

-

-

-

-

Collateral for security borrowing markets

-

-

-

-

Other

(*)

150,772

-

160,480

-

Total

6,372,330

92,800

6,761,749

92,844

(*)

The securities held as free that are not subject to collateral/blockage or other transactions are presented in the “Other” line.

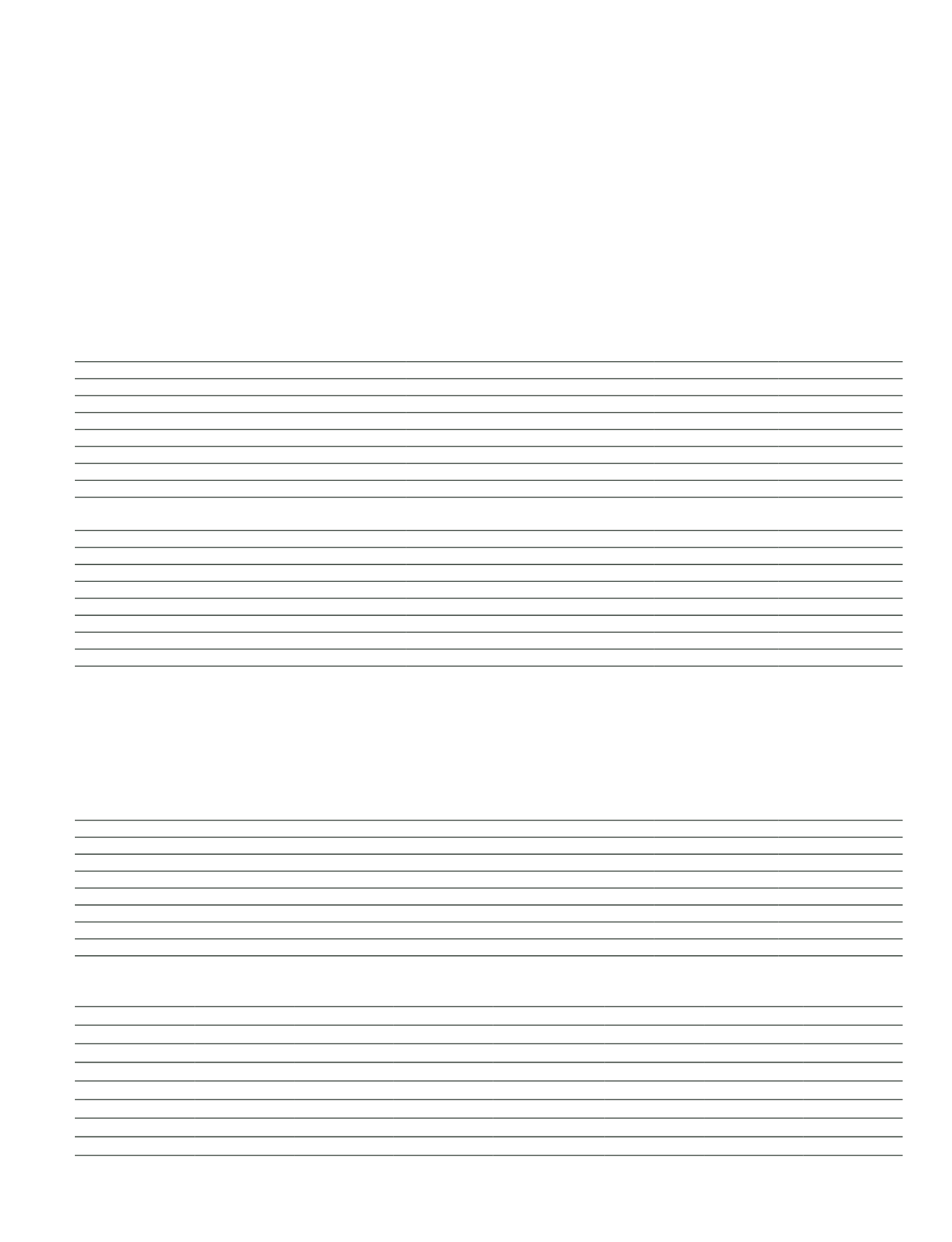

7. Investments in associates

Unconsolidated investments in associates

Title

Address

(City/ Country)

Parent Bank’s

Share – If Different,

Voting Rights (%)

Bank Risk

Group’s Share (%)

1 Roketsan Roket Sanayi ve Ticaret A.Ş.

(*)

Ankara/Turkey

9.93

9.93

2 Bankalararası Kart Merkezi A.Ş.

İstanbul/Turkey

9.70

9.70

3 Kredi Kayıt Bürosu A.Ş.

(*)

İstanbul/Turkey

9.09

9.09

4 Güçbirliği Holding A.Ş.

İzmir/Turkey

0.07

0.07

5 İzmir Enternasyonel Otelcilik A.Ş.

İstanbul/Turkey

5.00

5.00

6 İstanbul Takas ve Saklama Bankası A.Ş.

İstanbul/Turkey

4.37

4.37

7 Kredi Garanti Fonu A.Ş.

(*)

Ankara/Turkey

1.69

1.69

8 Tasfiye Halinde World Vakıf UBB Ltd.

Lefkoşa/NCTR

82.00

85.25

Total Assets

Equity

Tangible

Assets

Interest

Income

Income on

Securities Portfolio

Current Year’s

Profit/(Loss)

Prior Period’s

Profit/Loss

Fair Value

1

2,960,026

557,498

514,006

7,060

-

(50,090)

96,304

-

2

68,358

29,660

42,971

1,019

-

3,869

3,490

-

3

129,527

104,842

62,914

3,663

-

26,782

18,547

-

4

135,958

(32,158)

88,031

571

-

(17,521)

(8,600)

-

5

108,514

371

88,782

6

-

(18,136)

(5,610)

-

6

7,092,438

911,026

101,803

217,407

16,228

174,728

121,492

-

7

316,348

278,439

5,500

9,906

-

19,899

10,213

-

8

1,390

(78,268)

-

-

-

(7,452)

(5,465)

-

(*)

Financial information as at 30 September 2015 has been presented for these subsidiaries.