305

PART III: FINANCIAL HIGHLIGHTS AND RISK MANAGEMENT

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED CONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE IN NOTE I. OF SECTION THREE

TÜRKİYE VAKIFLAR BANKASI TÜRK ANONİM ORTAKLIĞI AND

ITS FINANCIAL SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS AT AND

FOR THE YEAR ENDED 31 DECEMBER 2015

(Amounts expressed in thousands of Turkish Lira (“TL”) unless otherwise stated.)

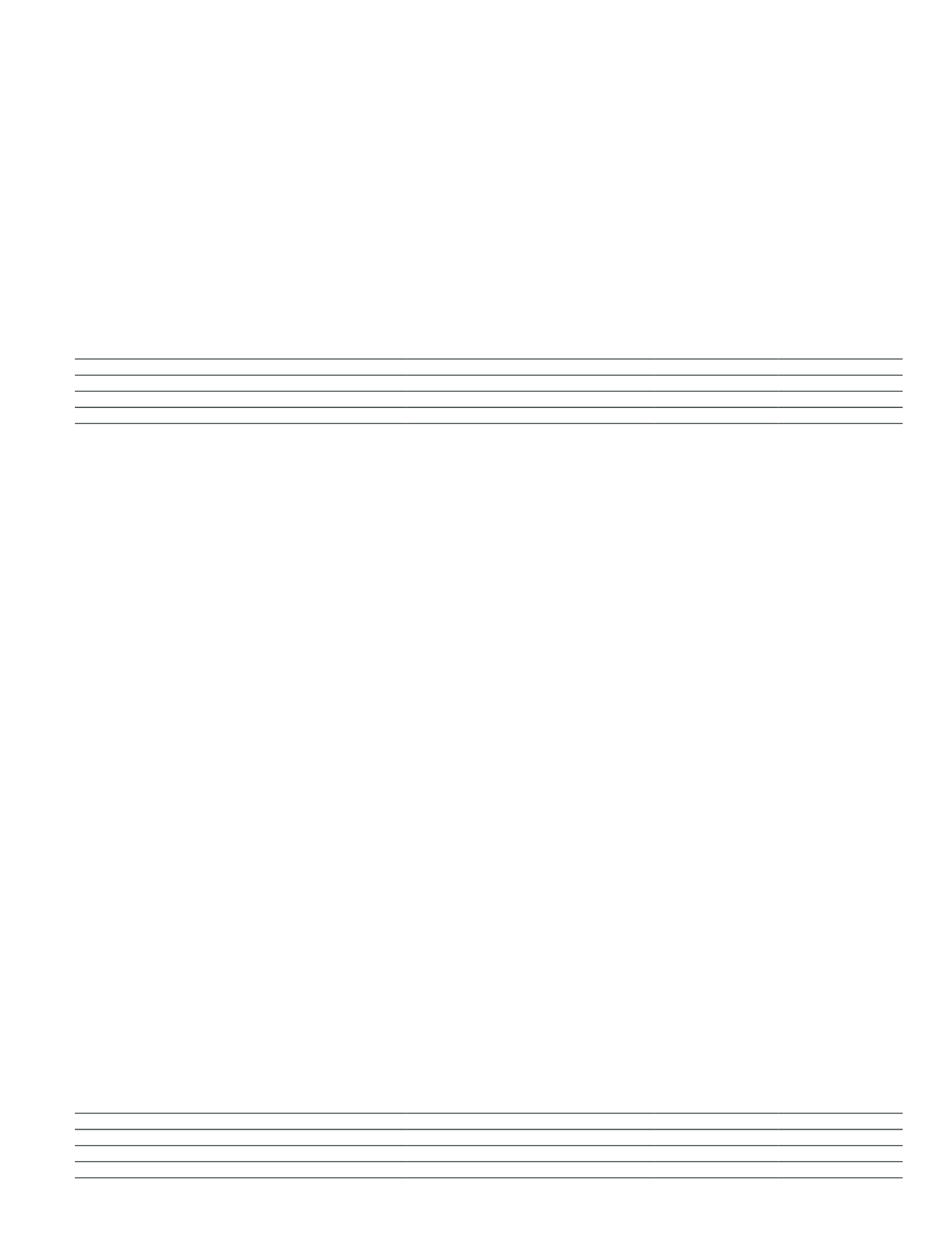

Maturity information of funds borrowed

Current Period

Prior Period

TL

FC

TL

FC

Short-term

(*)

479,073

2,024,300

1,283,259

7,322,336

Medium and Long-term

(*)

453,278

17,238,396

286,364

7,368,696

Total

932,351

19,262,696

1,569,623

14,691,032

(*)

Maturity profile of funds borrowed has been prepared in accordance with their original maturities.

Funds borrowed comprise syndication and securitization loans bearing various interest rates and maturities and account for 11.70% (31 December 2014:

10.94%) of the Group’s liabilities. There is no risk concentration on funding sources of the Group.

On 16 April 2014, the Parent Bank has obtained syndicated loan at the amount of US Dollar 270.5 million and Euro 525 million with the interest rate

of US Libor +0.90% and Euribor +0.90% at a maturity of one year, with participation of 35 banks with the coordination of Wells Fargo Bank N.A.,

London Branch and Sumitomo Mitsui Banking Corporation, Brussels Branch acting as agent. On 17 April 2015, the loan has been renewed with a new

syndicated loan amounting to US Dollar 204 million and Euro 763 million with the interest rate of US Libor +0.8% and Euribor +0.8% at a maturity of

367 days with participation of 35 banks, Wells Fargo Bank, N.A., London Branch acting as coordinator and agent bank.

On 22 September 2014, the Parent Bank has obtained syndicated loan amounting to US Dollar 168.5 million and Euro 528.75 million with interest rates

of US Libor + 0.90% and Euribor + 0.90% at a maturity of one year, with the participation of 26 banks, ING Bank, London Branch acting as coordinator

and agent bank. On 14 September 2015, the loan has been renewed with a new syndicated loan amounting to US Dollar 168.5 million and Euro 679.5

million with the interest rate of US Libor +0.75% and Euribor +0.75% at a maturity of one year with participation of 30 banks, ING Bank, London Branch

acting as coordinator and agent bank.

On 19 December 2014, the Parent Bank has obtained securitization loan amounting to US Dollar 928.6 million related to foreign transfers and treasury

transactions in Euro and US Dollar. Loan amounting to US Dollar 500 million has been obtained related to foreign transfers at a maturity of five years

and loan amounting to US Dollar 428.6 million has been obtained related to treasury transactions at a maturity of seven years in seven different

segments in total.

The loan obtained from European Bank for Reconstruction and Development Bank (EBRD) amounting to US Dollar 125 million in 2014-A segment in

order to finance medium term loans including to meet the needs of agricultural enterprises and support woman entrepreneurs.

2014-B segment of the loan has been obtained from Wells Fargo Bank, N.A., 2014-C segment of the loan has been obtained from Raiffeisen Bank

International AG, 2014-D segment of the loan has been obtained from Standard Chartered Bank, 2014-E segment of the loan has been obtained from

Societe Generale, 2014-G segment of the loan has been obtained from Bank of America, N.A. and 2014-F segment of the loan related to treasury

transactions has been obtained from JP Morgan Securities plc. in the scope of programme. As at 31 December 2015, total securitization loan amounts to

US Dollar 936 million and Euro 260 million.

Information on securities issued

Within the context of Global Medium Term Notes (GMTN), the Parent Bank has issued Turkey’s first Eurobond apart from Undersecretariat of Treasury.

The bond has been issued in GMTN programme on 17 June 2014 has a nominal value of Euro 500 million, maturity date on 17 June 2019 with fixed

rate, 5 years maturity and annually coupon paid with 3.65% return and coupon rate 3.50%.

Within the context of Global Medium Term Notes (GMTN), 190 private placements have been realized with 16 separate banks since June 2013. These

placements have been realized in different currencies (US Dollar, Euro and CHF) at the maturities of 3 months, 6 months, 1 year and 2 years and in

total amount to US Dollar 4,265 million equivalents. As at 31 December 2015 total private placement transactions amount to US Dollar 390 million

equivalents.

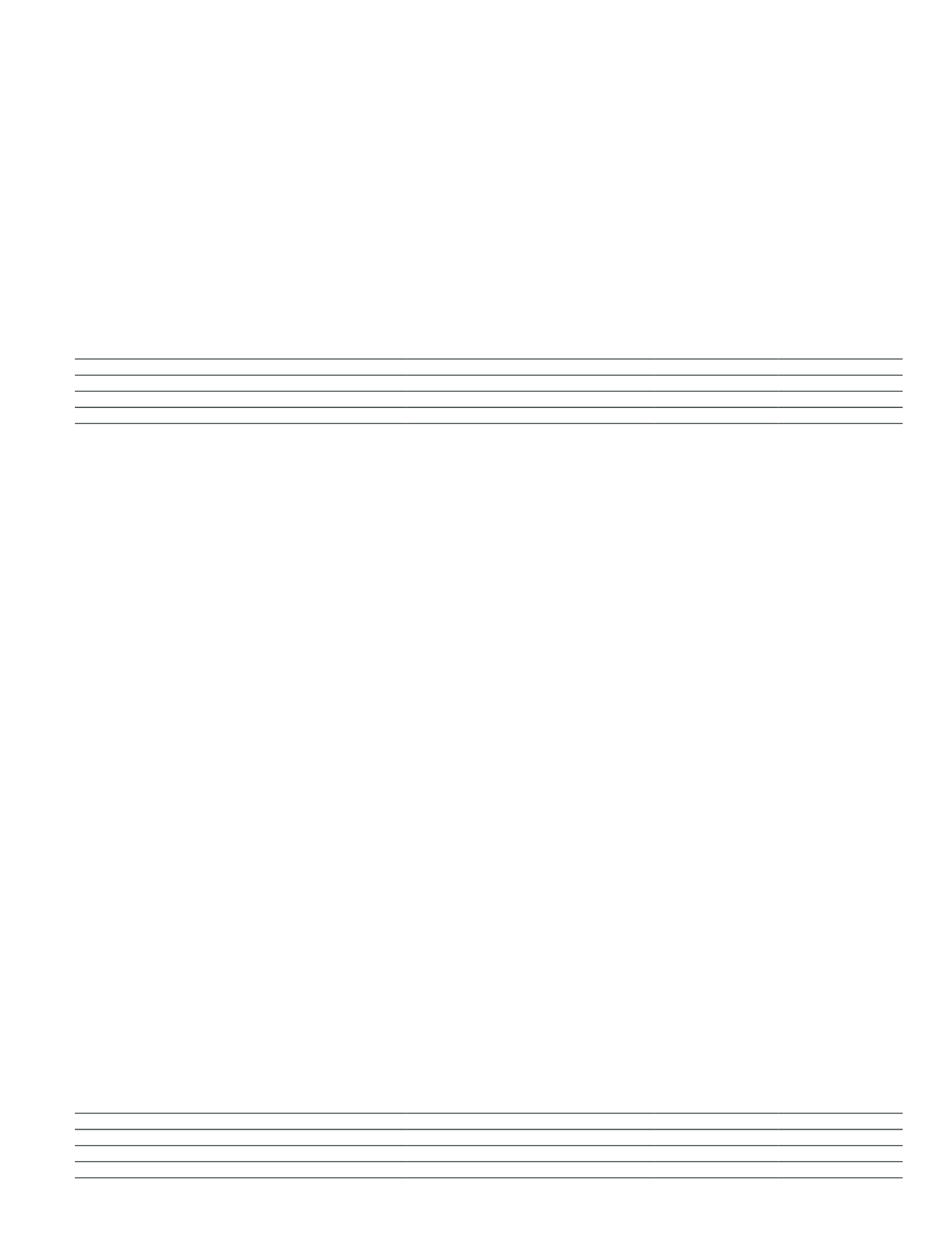

Current Period

TL

FC

Short Term Medium-Long Term

Short Term Medium-Long Term

Nominal

3,202,374

-

946,566

6,388,240

Cost

3,198,134

-

946,565

6,341,816

Net Book Value

3,257,620

-

949,615

6,439,473