229

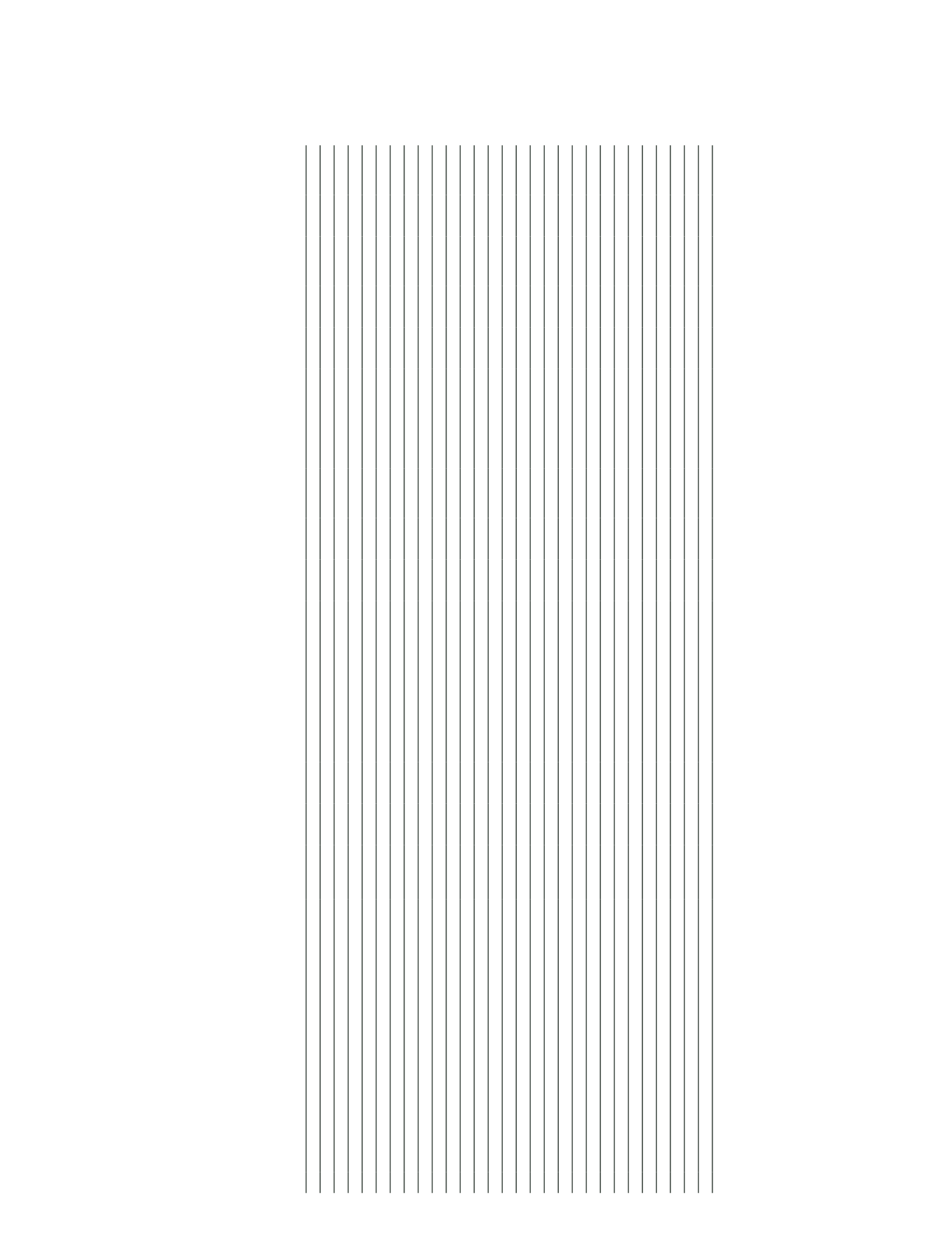

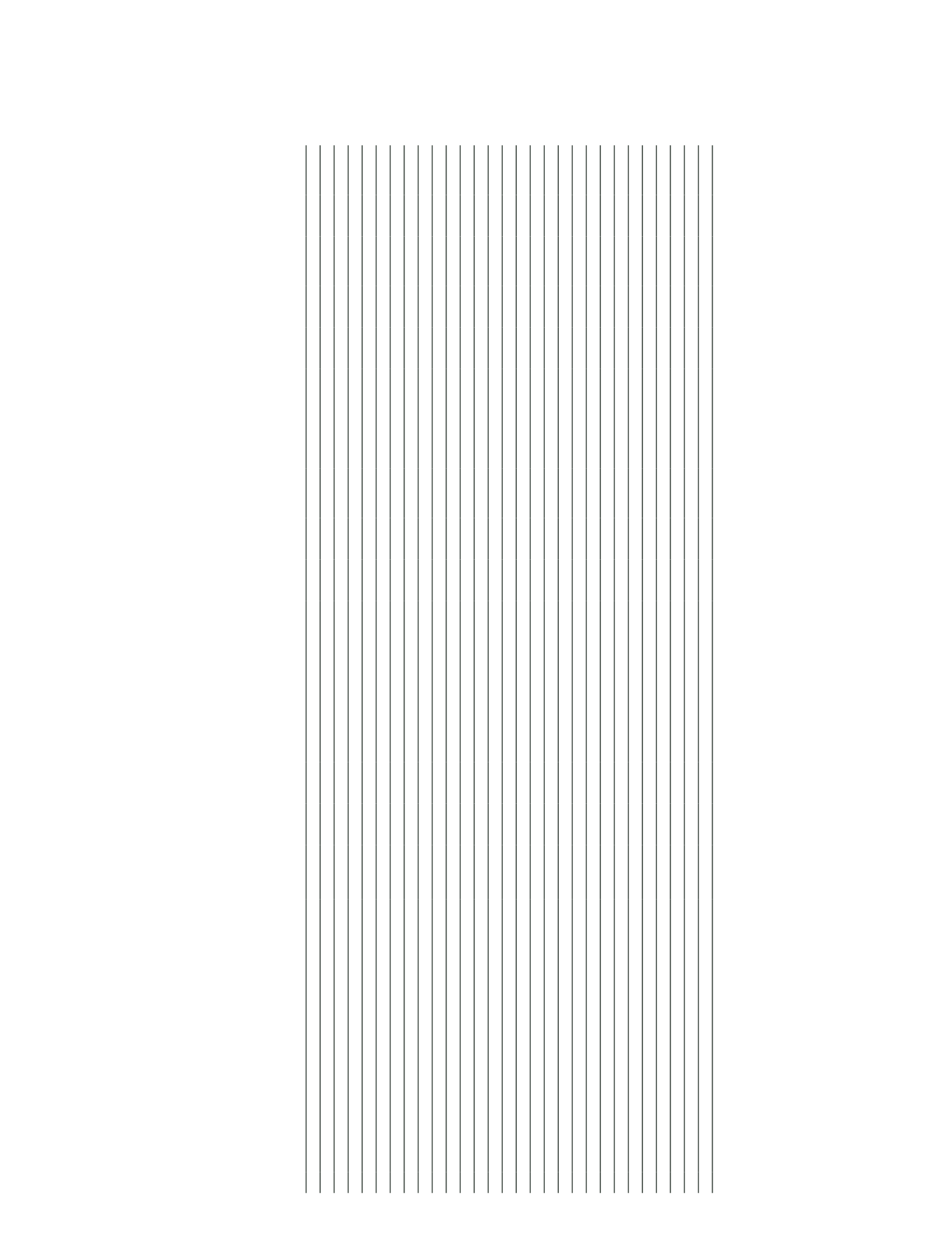

PART III: FINANCIAL HIGHLIGHTS AND RISK MANAGEMENT

Audited

Notes

Paid in

Capital

Capital Reserves

from Inflation

Adj. to Paid in

Capital

Share

Premium

Cancel-

lation

Share

Profits

Legal

Reserves

Status

Reserves

Extra-

ordinary

Reserves

Other

Profit

Reserves

Current

Year’s Net

Profit/

(Loss)

Prior

Period’s

Net Profit/

(Loss)

Valuation

Differences

of the

Marketable

Securities

Revaluation

Surplus on

Tangible,

Intangible

Assets and

Investment

Property

Bonus

Shares of

Associates,

Subsidiaries

and Joint

Ventures

Hedging

Reserves

Revaluation

Surp. On

Assets Held

for Sale and

Assets of

Discount.

Op.s.

Shareholders’

Equity

before

Minority

Shares

Non-

controlling

Interest

Total

Shareholders’

Equity

Prior Period – 31 December 2014

I.

Balances at the beginning of the period

2,500,000

-

726,686

-

904,166

6,337 6,007,191 420,752

- 1,688,833 (149,719)

51,329

6,282

-

-

12,161,857 309,101 12,470,958

Changes during the period

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

II.

Mergers

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

III.

Valuation differences of the marketable securities

-

-

-

-

-

-

-

-

-

-

671,249

-

-

-

-

671,249

3,006

674,255

IV.

Hedging reserves

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

4.1 Cash flow hedges

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

4.2 Net investment hedges

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

V.

Revaluation surplus on tangible assets

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

VI.

Revaluation surplus on intangible assets

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

VII.

Bonus shares of associates, subsidiaries and joint-ventures

-

-

-

-

-

-

-

-

-

-

-

-

(2,599)

-

-

(2,599)

-

(2,599)

VIII. Translation differences

-

-

-

-

-

-

- (14,098)

-

-

-

-

-

-

-

(14,098)

(1,566)

(15,664)

IX.

Changes resulted from disposal of the assets

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

X.

Changes resulted from reclassifications of the assets

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

XI.

Effect of change in equities of associates on the Group’s equity

-

-

-

-

-

-

-

-

-

(777)

-

-

-

-

-

(777)

-

(777)

XII.

Capital increase

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

12.1 Cash

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

12.2 Internal sources

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

XIII. Share issuance

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

XIV. Share cancellation profits

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

XV.

Capital reserves from inflation adjustments to paid-in capital

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

XVI. Other

-

-

1,094

-

860

-

5,824 (33,886)

-

(20,762)

-

-

-

-

-

(46,870)

169,748

122,878

XVII. Current period’s net profit/loss

-

-

-

-

-

-

-

- 1,805,677

-

-

-

-

-

-

1,805,677

8,166 1,813,843

XVIII Profit distribution

-

-

-

-

164,219

- 1,333,112

113

- (1,598,979)

-

1,535

-

-

-

(100,000)

(2,371)

(102,371)

18.1 Dividends

V-V-5

-

-

-

-

-

-

-

-

- (100,000)

-

-

-

-

-

(100,000)

(2,371)

(102,371)

18.2 Transferred to reserves

V-V-5

-

-

-

-

164,219

- 1,333,112

113

- (1,498,979)

-

1,535

-

-

-

-

-

-

18.3 Other

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Balances at the end of the period

2,500,000

-

727,780

- 1,069,245

6,337 7,346,127 372,881 1,805,677 68,315

521,530

52,864

3,683

-

-

14,474,439 486,084 14,960,523

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED CONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE IN NOTE I. OF SECTION THREE

TÜRKİYE VAKIFLAR BANKASI TÜRK ANONİM ORTAKLIĞI AND

ITS FINANCIAL SUBSIDIARIES

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEAR ENDED 31 DECEMBER 2015

(Amounts expressed in thousands of Turkish Lira (“TL”) unless otherwise stated.)

The accompanying explanations and notes form an integral part of these consolidated financial statements.