225

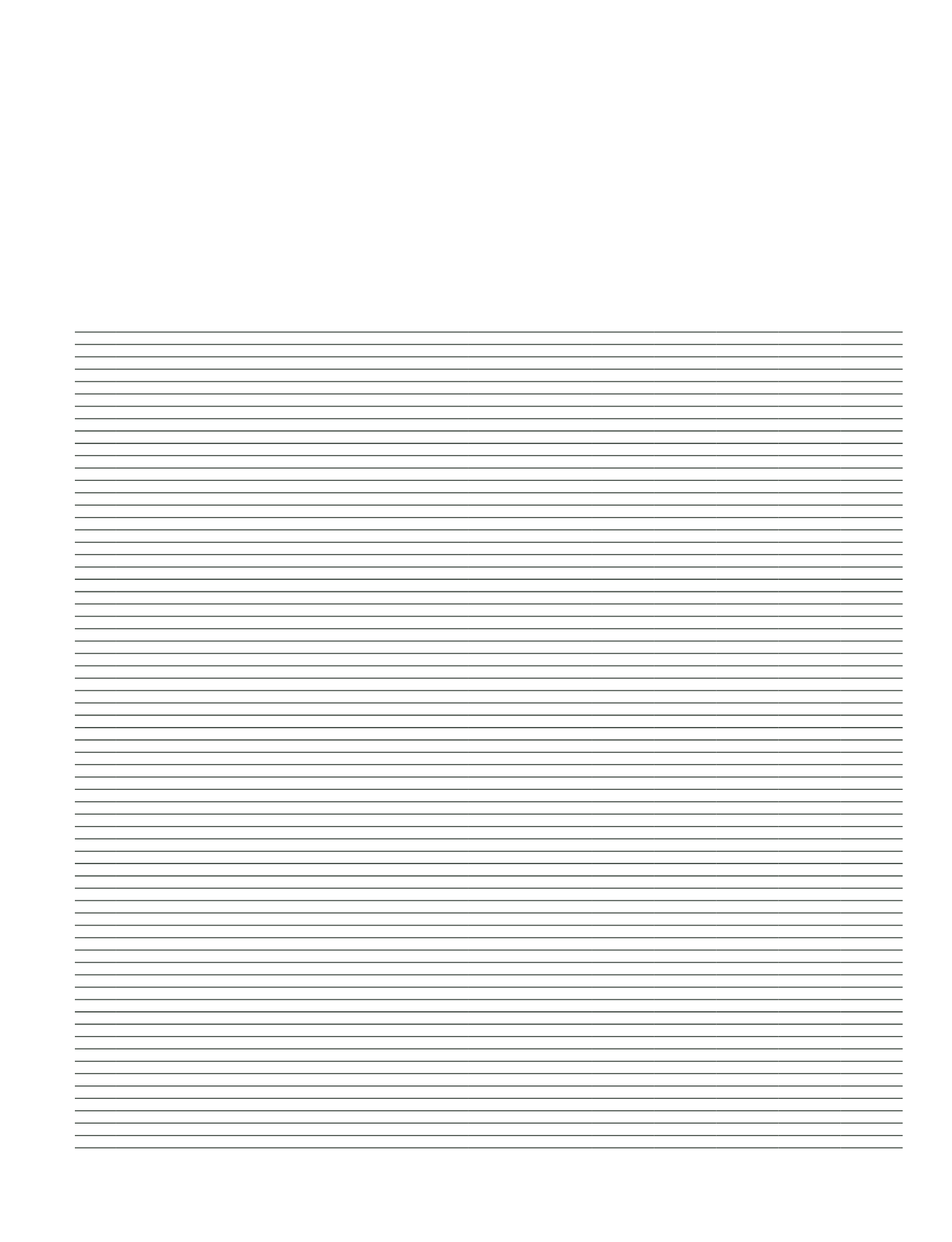

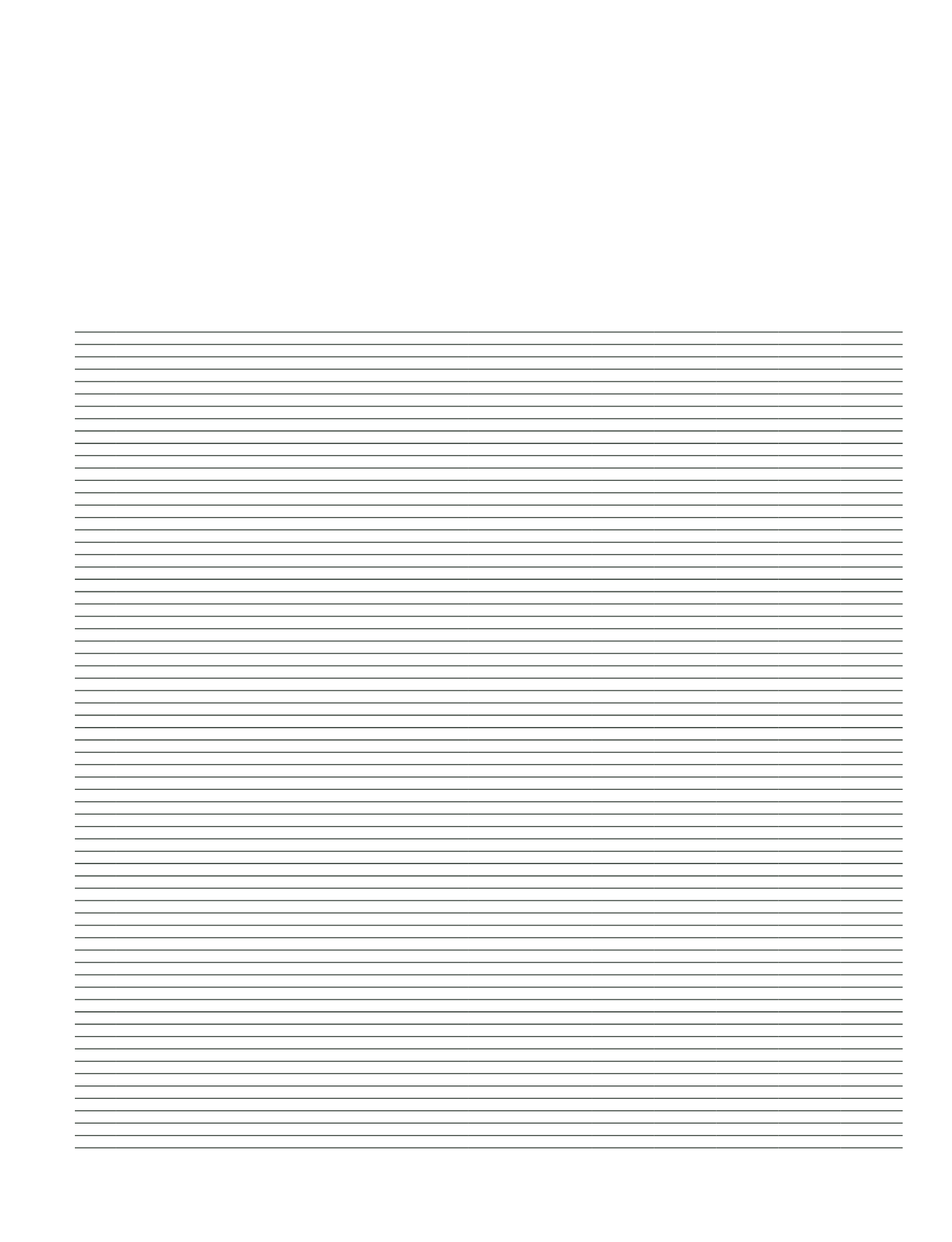

PART III: FINANCIAL HIGHLIGHTS AND RISK MANAGEMENT

The accompanying explanations and notes form an integral part of these consolidated financial statements.

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED CONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE IN NOTE I. OF SECTION THREE

TÜRKİYE VAKIFLAR BANKASI TÜRK ANONİM ORTAKLIĞI AND

ITS FINANCIAL SUBSIDIARIES

CONSOLIDATED BALANCE SHEET (STATEMENT OF FINANCIAL POSITION)

AS AT 31 DECEMBER 2015

(Amounts expressed in thousands of Turkish Lira (“TL”) unless otherwise stated.)

Audited Current Period

31 December 2015

Audited Prior Period

31 December 2014

LIABILITIES AND EQUITY

Notes

TL

FC

Total

TL

FC

Total

I.

DEPOSITS

V-II-1

76,054,788

35,955,209

112,009,997

65,144,101

28,258,512

93,402,613

1.1

Deposits of risk group

V-VII-1

1,209,289

110,608

1,319,897

953,746

63,178

1,016,924

1.2

Other deposits

74,845,499

35,844,601

110,690,100

64,190,355

28,195,334

92,385,689

II.

DERIVATIVE FINANCIAL LIABILITIES HELD FOR TRADING PURPOSE

V-II-2

153,177

151,175

304,352

65,776

204,851

270,627

III.

FUNDS BORROWED

V-II-3

932,351

19,262,696

20,195,047

1,569,623

14,691,032

16,260,655

IV.

INTERBANK MONEY MARKET

9,423,761

3,403,437

12,827,198

10,063,573

6,591,668

16,655,241

4.1

Interbank money market takings

1,150,343

-

1,150,343

200,000

-

200,000

4.2

Istanbul Stock Exchange money market takings

83,157

-

83,157

269,939

-

269,939

4.3

Obligations under repurchase agreements

8,190,261

3,403,437

11,593,698

9,593,634

6,591,668

16,185,302

V.

SECURITIES ISSUED (Net)

V-II-3

3,257,620

7,389,088

10,646,708

2,866,343

7,518,365

10,384,708

5.1

Bills

3,257,620

-

3,257,620

2,866,343

-

2,866,343

5.2

Asset backed securities

-

-

-

-

-

-

5.3

Bonds

-

7,389,088

7,389,088

-

7,518,365

7,518,365

VI.

FUNDS

4,228

-

4,228

20,089

-

20,089

6.1

Funds against borrower’s note

-

-

-

-

-

-

6.2

Other

4,228

-

4,228

20,089

-

20,089

VII.

MISCELLANEOUS PAYABLES

3,647,401

750,360

4,397,761

2,920,619

423,800

3,344,419

VIII.

OTHER EXTERNAL RESOURCES PAYABLE

V-II-4

662,279

1,783,682

2,445,961

573,091

947,128

1,520,219

IX.

FACTORING PAYABLES

-

5

5

-

-

-

X.

LEASE PAYABLES

V-II-5

-

-

-

-

-

-

10.1

Finance lease payables

-

-

-

-

-

-

10.2

Operational lease payables

-

-

-

-

-

-

10.3

Other

-

-

-

-

-

-

10.4

Deferred finance leasing expenses ( - )

-

-

-

-

-

-

XI.

DERIVATIVE FINANCIAL LIABILITIES HELD FOR RISK MANAGEMENT PURPOSE

V-II-6

-

-

-

-

-

-

11.1

Fair value hedges

-

-

-

-

-

-

11.2

Cash flow hedges

-

-

-

-

-

-

11.3

Hedges of net investment in foreign operations

-

-

-

-

-

-

XII.

PROVISIONS

5,025,269

31,277

5,056,546

4,086,058

25,879

4,111,937

12.1

General provisions

V-II-7

1,944,150

13,453

1,957,603

1,591,002

12,240

1,603,242

12.2

Restructuring reserves

-

-

-

-

-

-

12.3

Reserve for employee benefits

700,635

1,544

702,179

626,273

838

627,111

12.4

Insurance technical provisions (Net)

2,082,428

9,127

2,091,555

1,633,739

8,973

1,642,712

12.5

Other provisions

V-II-7

298,056

7,153

305,209

235,044

3,828

238,872

XIII.

TAX LIABILITIES

V-II-8

531,561

7,888

539,449

485,576

8,419

493,995

13.1

Current tax liabilities

514,681

1,678

516,359

477,758

1,029

478,787

13.2

Deferred tax liabilities

V-I-15

16,880

6,210

23,090

7,818

7,390

15,208

XIV.

PAYABLES FOR ASSETS HELD FOR SALE AND ASSETS RELATED TO DISCONTINUED OPERATIONS (Net)

V-II-9

-

-

-

-

-

-

14.1

Payables related to the assets held for sale

-

-

-

-

-

-

14.2

Payables related to the discontinued operations

-

-

-

-

-

-

XV.

SUBORDINATED LOANS

V-II-10

-

4,155,551

4,155,551

-

2,126,436

2,126,436

XVI.

EQUITY

16,437,456

565,299

17,002,755

14,408,274

552,249

14,960,523

16.1

Paid-in capital

V-II-11

2,500,000

-

2,500,000

2,500,000

-

2,500,000

16.2

Capital reserves

1,390,356

257,405

1,647,761

1,025,056

280,801

1,305,857

16.2.1

Share premium

727,780

-

727,780

727,780

-

727,780

16.2.2

Share cancellation profits

-

-

-

-

-

-

16.2.3

Valuation differences of the marketable securities

V-II-11

(227,394)

257,405

30,011

240,729

280,801

521,530

16.2.4

Revaluation surplus on tangible assets

940,657

-

940,657

52,864

-

52,864

16.2.5

Revaluation surplus on intangible assets

-

-

-

-

-

-

16.2.6

Revaluation surplus on investment properties

-

-

-

-

-

-

16.2.7

Bonus shares of associates, subsidiaries and joint-ventures

3,683

-

3,683

3,683

-

3,683

16.2.8

Hedging reserves (effective portion)

-

-

-

-

-

-

16.2.9

Revaluation surplus on assets held for sale and assets related to the discontinued operations

-

-

-

-

-

-

16.2.10

Other capital reserves

(54,370)

-

(54,370)

-

-

-

16.3

Profit reserves

10,163,563

170,099

10,333,662

8,664,406

130,184

8,794,590

16.3.1

Legal reserves

1,228,224

7,942

1,236,166

1,062,732

6,513

1,069,245

16.3.2

Status reserves

6,337

-

6,337

6,337

-

6,337

16.3.3.

Extraordinary reserves

8,475,454

4,594

8,480,048

7,341,533

4,594

7,346,127

16.3.4.

Other profit reserves

453,548

157,563

611,111

253,804

119,077

372,881

16.4

Profit or loss

1,921,411

94,530

2,015,941

1,772,859

101,133

1,873,992

16.4.1

Prior years’ profit/loss

(34,277)

101,630

67,353

(14,354)

82,669

68,315

16.4.2

Current period’s profit/loss

1,955,688

(7,100)

1,948,588

1,787,213

18,464

1,805,677

16.5

Non-controlling interest

462,126

43,265

505,391

445,953

40,131

486,084

TOTAL LIABILITIES AND EQUITY

116,129,891

73,455,667

189,585,558

102,203,123

61,348,339

163,551,462