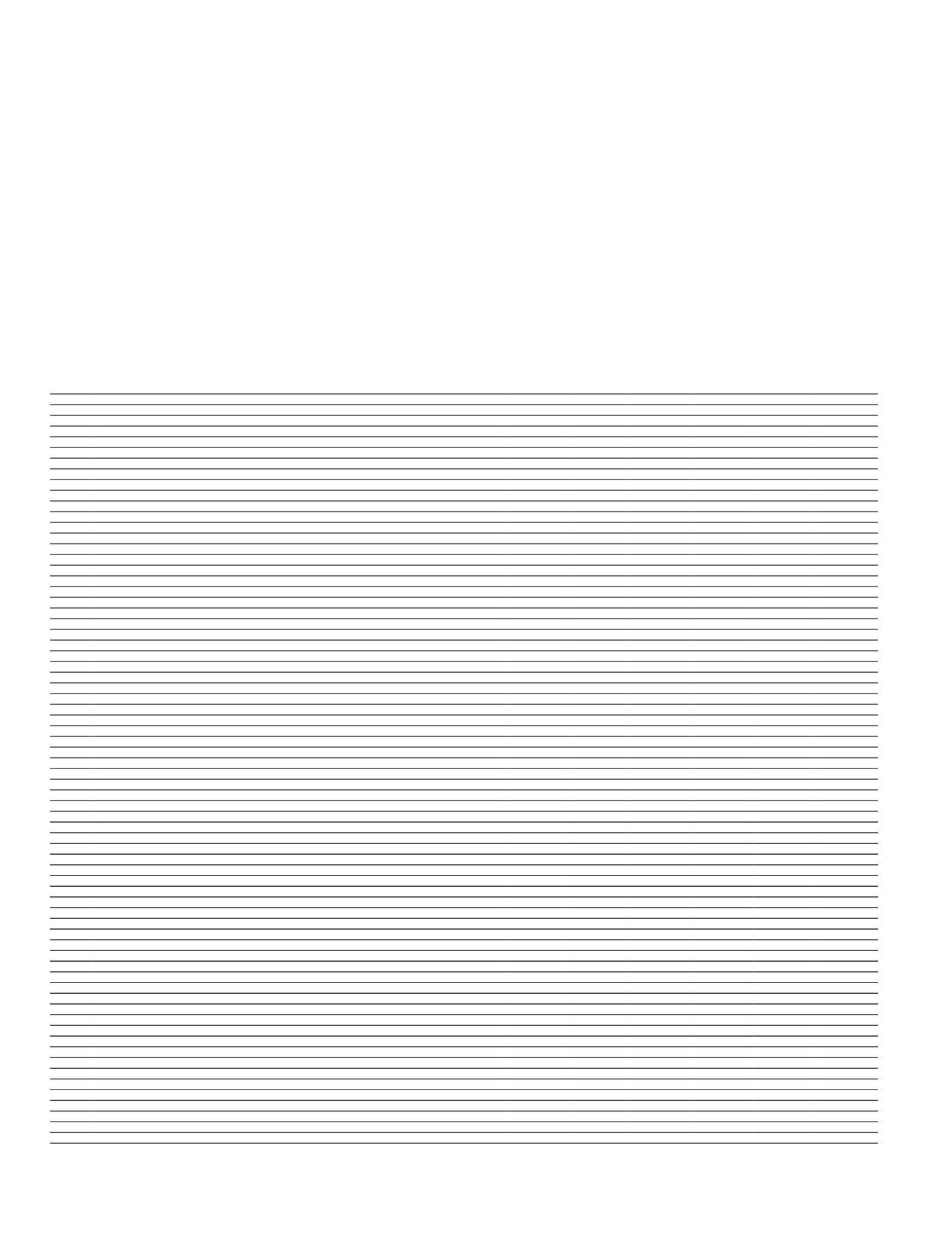

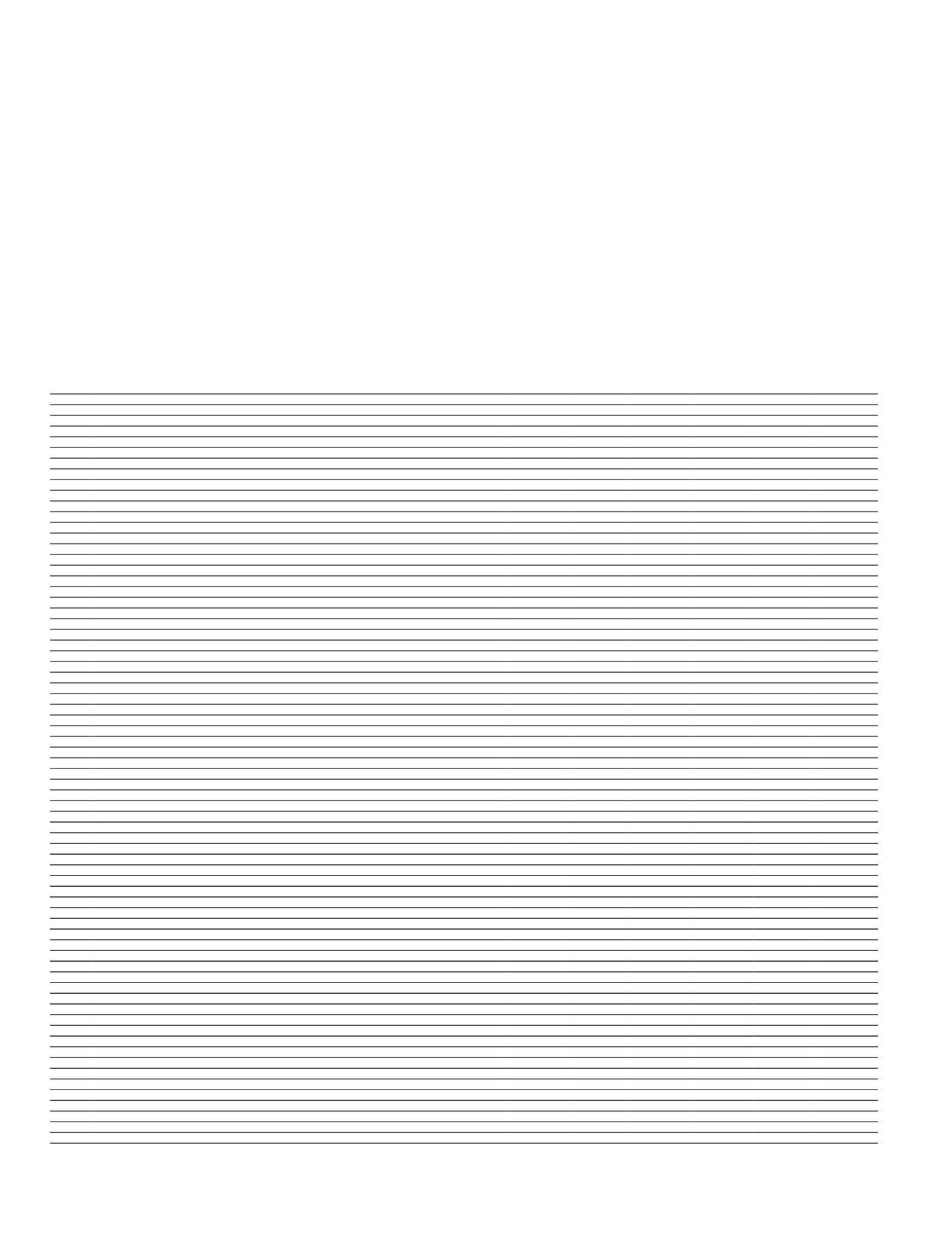

VAKIFBANK

2015 ANNUAL REPORT

224

The accompanying explanations and notes form an integral part of these consolidated financial statements.

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED CONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE IN NOTE I. OF SECTION THREE

TÜRKİYE VAKIFLAR BANKASI TÜRK ANONİM ORTAKLIĞI AND

ITS FINANCIAL SUBSIDIARIES

CONSOLIDATED BALANCE SHEET (STATEMENT OF FINANCIAL POSITION)

AS AT 31 DECEMBER 2015

(Amounts expressed in thousands of Turkish Lira (“TL”) unless otherwise stated.)

SECTION TWO

CONSOLIDATED FINANCIAL STATEMENTS

Audited Current Period

31 December 2015

Audited Prior Period

31 December 2014

ASSETS

Notes

TL

FC

Total

TL

FC

Total

I.

CASH AND BALANCES WITH THE CENTRAL BANK

V-I-1

2,134,017

19,355,897

21,489,914

4,126,368

17,764,713

21,891,081

II.

FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS (Net)

V-I-2

840,168

155,694

995,862

404,672

45,569

450,241

2.1

Financial assets held for trading purpose

840,168

155,694

995,862

404,672

45,569

450,241

2.1.1

Debt securities issued by the governments

312

9,566

9,878

106

8,468

8,574

2.1.2

Equity securities

1,832

-

1,832

1,565

-

1,565

2.1.3

Derivative financial assets held for trading purpose

V-I-2

739,339

146,128

885,467

342,475

37,101

379,576

2.1.4

Other securities

98,685

-

98,685

60,526

-

60,526

2.2

Financial assets designated at fair value through profit or loss

-

-

-

-

-

-

2.2.1

Debt securities issued by the governments

-

-

-

-

-

-

2.2.2

Equity securities

-

-

-

-

-

-

2.2.3

Other securities

-

-

-

-

-

-

2.2.4

Loans

-

-

-

-

-

-

III.

BANKS

V-I-3

1,185,799

4,990,220

6,176,019

784,978

2,783,530

3,568,508

IV.

RECEIVABLES FROM INTERBANK MONEY MARKETS

6,699

-

6,699

9,504

-

9,504

4.1

Interbank money market placements

-

-

-

-

-

-

4.2

Istanbul Stock Exchange money market placements

3,310

-

3,310

3,645

-

3,645

4.3

Receivables from reverse repurchase agreements

3,389

-

3,389

5,859

-

5,859

V.

AVAILABLE-FOR-SALE FINANCIAL ASSETS (Net)

V-I-4

12,100,346

5,235,765

17,336,111

12,631,871

4,239,244

16,871,115

5.1

Equity securities

15

79,238

79,253

15

-

15

5.2

Debt securities issued by the governments

12,100,331

5,028,990

17,129,321

12,629,806

4,085,677

16,715,483

5.3

Other securities

-

127,537

127,537

2,050

153,567

155,617

VI.

LOANS AND RECEIVABLES

V-I-5

88,452,140

37,507,539

125,959,679

76,724,198

29,631,473

106,355,671

6.1

Performing loans and receivables

V-I-5

87,548,356

37,502,389

125,050,745

76,408,786

29,626,228

106,035,014

6.1.1

Loans provided to risk group

V-VII-1

1,071

822

1,893

6,132

123

6,255

6.1.2

Debt securities issued by the governments

-

-

-

-

-

-

6.1.3

Other

87,547,285

37,501,567

125,048,852

76,402,654

29,626,105

106,028,759

6.2

Loans under follow-up

5,071,771

66,342

5,138,113

4,153,756

28,209

4,181,965

6.3

Specific provisions (-)

V-I-5

4,167,987

61,192

4,229,179

3,838,344

22,964

3,861,308

VII.

FACTORING RECEIVABLES

622,754

94,973

717,727

498,067

12,314

510,381

VIII.

HELD-TO-MATURITY INVESTMENT SECURITIES (Net)

V-I-6

7,546,748

130,981

7,677,729

6,761,749

92,844

6,854,593

8.1

Debt securities issued by the governments

7,546,748

-

7,546,748

6,761,749

-

6,761,749

8.2

Other securities

-

130,981

130,981

-

92,844

92,844

IX.

INVESTMENTS IN ASSOCIATES (Net)

V-I-7

295,332

3

295,335

264,184

3

264,187

9.1

Associates, consolidated per equity method

245,549

-

245,549

214,929

-

214,929

9.2

Unconsolidated associates

49,783

3

49,786

49,255

3

49,258

9.2.1

Financial associates

37,434

-

37,434

36,915

-

36,915

9.2.2

Non-Financial associates

12,349

3

12,352

12,340

3

12,343

X.

INVESTMENTS IN SUBSIDIARIES (Net)

V-I-8

271,017

-

271,017

258,927

-

258,927

10.1

Unconsolidated financial subsidiaries

-

-

-

-

-

-

10.2

Unconsolidated non-financial subsidiaries

271,017

-

271,017

258,927

-

258,927

XI.

INVESTMENTS IN JOINT-VENTURES (Net)

V-I-9

-

-

-

-

-

-

11.1

Joint-ventures, consolidated per equity method

-

-

-

-

-

-

11.2

Unconsolidated joint-ventures

-

-

-

-

-

-

11.2.1

Financial joint-ventures

-

-

-

-

-

-

11.2.2

Non-financial joint-ventures

-

-

-

-

-

-

XII.

LEASE RECEIVABLES

V-I-10

318,359

1,007,466

1,325,825

246,618

843,369

1,089,987

12.1

Finance lease receivables

401,084

1,134,987

1,536,071

311,605

962,197

1,273,802

12.2

Operational lease receivables

-

-

-

-

-

-

12.3

Other

-

-

-

-

-

-

12.4

Unearned income (-)

82,725

127,521

210,246

64,987

118,828

183,815

XIII.

DERIVATIVE FINANCIAL ASSETS HELD FOR RISK MANAGEMENT PURPOSE

V-I-11

-

-

-

-

-

-

13.1

Fair value hedges

-

-

-

-

-

-

13.2

Cash flow hedges

-

-

-

-

-

-

13.3

Hedges of net investment in foreign operations

-

-

-

-

-

-

XIV.

TANGIBLE ASSETS (Net)

V-I-12

1,648,900

5,218

1,654,118

782,871

2,002

784,873

XV.

INTANGIBLE ASSETS (Net)

V-I-13

201,506

31

201,537

162,074

161

162,235

15.1

Goodwill

-

-

-

-

-

-

15.2

Other intangibles

201,506

31

201,537

162,074

161

162,235

XVI.

INVESTMENT PROPERTIES (Net)

V-I-14

287,726

-

287,726

192,000

-

192,000

XVII.

TAX ASSETS

V-I-15

139,972

2,944

142,916

175,352

6,938

182,290

17.1

Current tax assets

V-I-15

787

2,944

3,731

2,393

6,938

9,331

17.2

Deferred tax assets

V-I-15

139,185

-

139,185

172,959

-

172,959

XVIII.

ASSETS HELD FOR SALE AND ASSETS RELATED TO THE DISCONTINUED OPERATIONS (Net)

V-I-16

994,991

-

994,991

747,482

-

747,482

18.1

Assets held for sale

994,991

-

994,991

747,482

-

747,482

18.2

Assets related to the discontinued operations

-

-

-

-

-

-

XIX.

OTHER ASSETS

V-I-17

2,789,299

1,263,054

4,052,353

2,523,844

834,543

3,358,387

TOTAL ASSETS

119,835,773

69,749,785

189,585,558

107,294,759

56,256,703

163,551,462