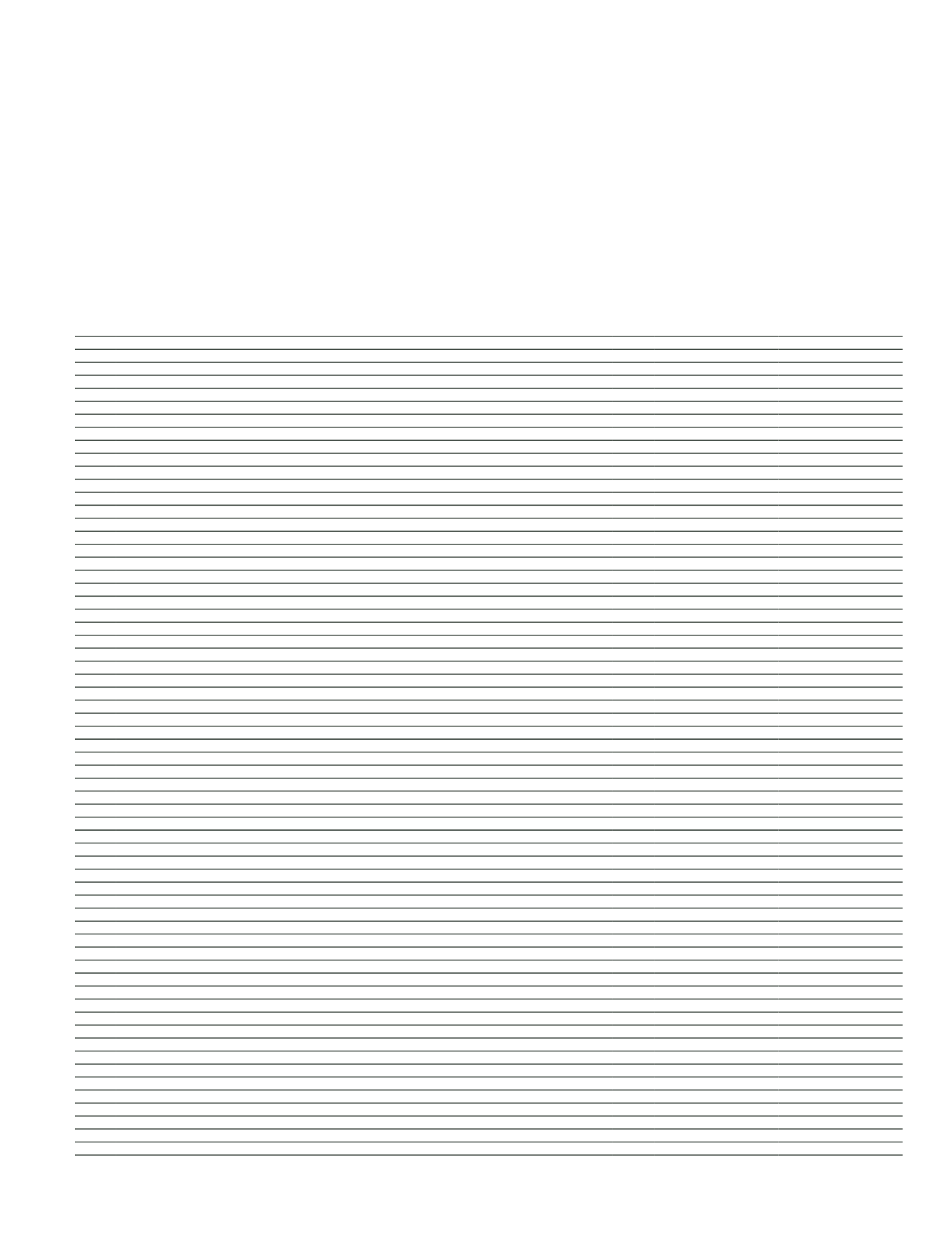

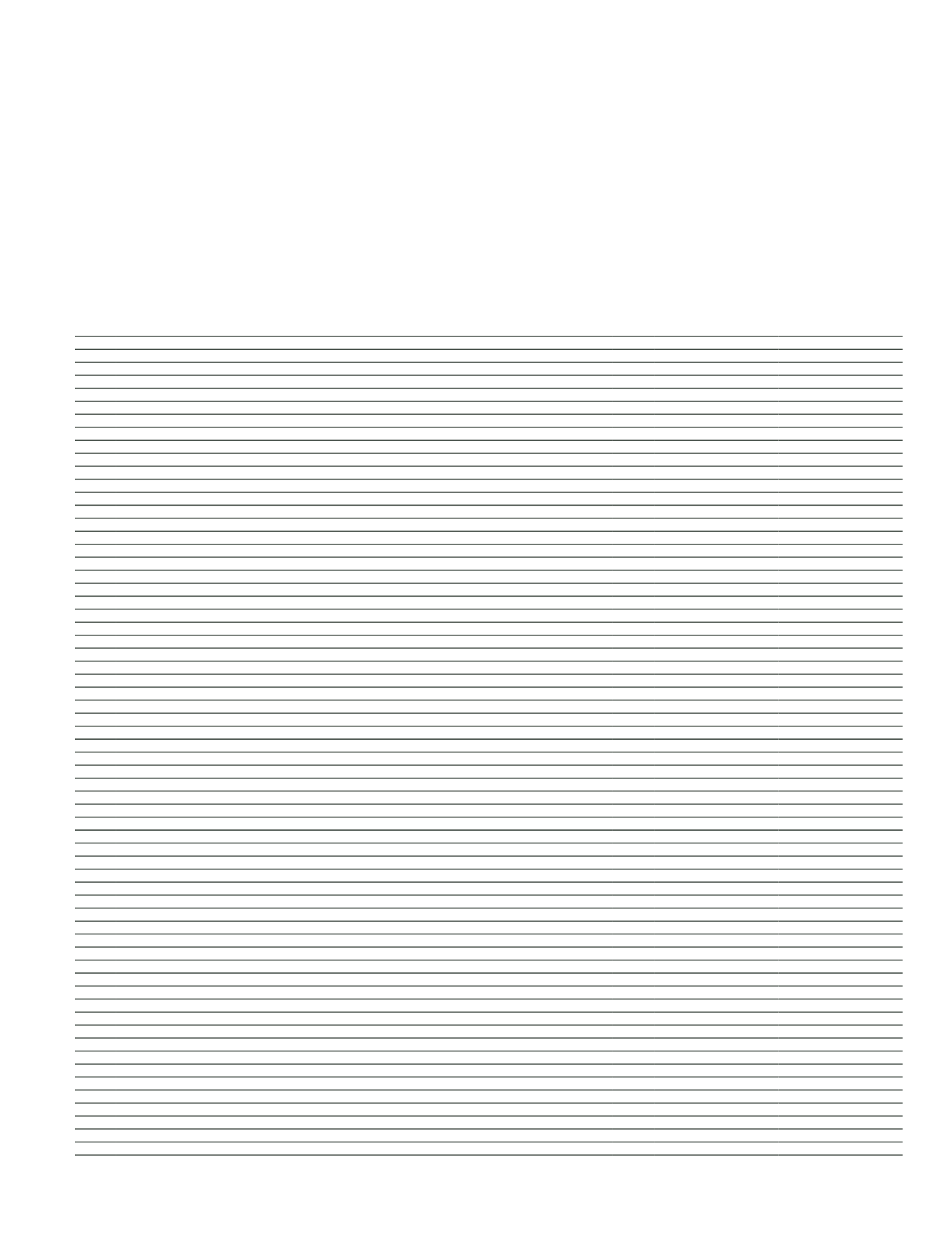

227

PART III: FINANCIAL HIGHLIGHTS AND RISK MANAGEMENT

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED CONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE IN NOTE I. OF SECTION THREE

TÜRKİYE VAKIFLAR BANKASI TÜRK ANONİM ORTAKLIĞI AND

ITS FINANCIAL SUBSIDIARIES

CONSOLIDATED STATEMENT OF INCOME

FOR THE YEAR ENDED 31 DECEMBER 2015

(Amounts expressed in thousands of Turkish Lira (“TL”) unless otherwise stated.)

The accompanying explanations and notes form an integral part of these consolidated financial statements.

Notes

Audited Current Period

31 December 2015

Audited Prior Period

31 December 2014

I.

INTEREST INCOME

13,973,432

11,664,524

1.1

Interest income from loans

V-IV-1

11,598,337

9,393,240

1.2

Interest income from reserve deposits

38,684

2,015

1.3

Interest income from banks

V-IV-1

78,724

67,307

1.4

Interest income from money market transactions

1,633

931

1.5

Interest income from securities portfolio

V-IV-1

2,072,208

2,061,241

1.5.1 Trading financial assets

V-IV-1

6,775

11,253

1.5.2 Financial assets designated at fair value through profit or loss

-

-

1.5.3 Available-for-sale financial assets

V-IV-1

1,409,589

1,489,664

1.5.4 Held-to-maturity investments

V-IV-1

655,844

560,324

1.6

Finance lease income

102,526

80,667

1.7

Other interest income

81,320

59,123

II.

INTEREST EXPENSE

8,238,164

6,809,744

2.1

Interest expense on deposits

V-IV-2

6,115,699

5,043,936

2.2

Interest expense on funds borrowed

V-IV-2

362,500

243,009

2.3

Interest expense on money market transactions

886,728

925,913

2.4

Interest expense on securities issued

V-IV-2

595,176

445,715

2.5

Other interest expenses

278,061

151,171

III.

NET INTEREST INCOME (I – II)

5,735,268

4,854,780

IV.

NET FEES AND COMMISSIONS INCOME

870,329

674,456

4.1

Fees and commissions received

1,351,513

1,109,503

4.1.1 Non-cash loans

186,784

162,970

4.1.2 Others

1,164,729

946,533

4.2

Fees and commissions paid

481,184

435,047

4.2.1 Non-cash loans

1,148

918

4.2.2 Others

480,036

434,129

V.

DIVIDEND INCOME

V-IV-3

37,169

12,229

VI.

TRADING INCOME/LOSSES (Net)

V-IV-4

139,931

248,795

6.1

Trading account income/losses

V-IV-4

46,761

176,073

6.2

Income/losses from derivative financial instruments

V-IV-4

(29,129)

(39,189)

6.3

Foreign exchange gains/losses

V-IV-4

122,299

111,911

VII.

OTHER OPERATING INCOME

V-IV-5

2,036,648

2,119,791

VIII.

TOTAL OPERATING PROFIT (III+IV+V+VI+VII)

8,819,345

7,910,051

IX.

PROVISION FOR LOSSES ON LOANS AND OTHER RECEIVABLES (-)

V-IV-6

1,635,860

1,747,665

X.

OTHER OPERATING EXPENSES (-)

V-IV-7

4,817,078

3,903,605

XI.

NET OPERATING PROFIT/LOSS (VIII-IX-X)

2,366,407

2,258,781

XII.

INCOME RESULTED FROM MERGERS

-

-

XIII.

INCOME/LOSS FROM INVESTMENTS UNDER EQUITY ACCOUNTING

34,617

33,077

XIV.

GAIN/LOSS ON NET MONETARY POSITION

-

-

XV.

INCOME/LOSS FROM CONTINUING OPERATIONS BEFORE TAXES (XI+XII+XIII+XIV)

V-IV-8

2,401,024

2,291,858

XVI.

CONTINUING OPERATIONS PROVISION FOR TAXES

V-IV-9

(527,111)

(478,015)

16.1 Current tax charges

V-IV-11

(417,396)

(612,250)

16.2 Deferred tax credits

V-IV-11

(109,715)

134,235

XVII.

NET INCOME/LOSS AFTER TAXES FROM CONTINUING OPERATIONS (XV±XVI)

V-IV-12

1,873,913

1,813,843

XVIII.

INCOME FROM DISCONTINUED OPERATIONS

-

-

18.1 Income from investment properties

-

-

18.2 Income from sales of subsidiaries, affiliates and joint-ventures

-

-

18.3 Other income from discontinued activities

-

-

XIX.

EXPENSES FROM DISCONTINUED OPERATIONS(-)

-

-

19.1 Investment property expenses

-

-

19.2 Losses from sales of subsidiaries, affiliates and joint ventures

-

-

19.3 Other expenses from discontinued activities

-

-

XX.

INCOME/LOSS FROM DISCONTINUED OPERATIONS BEFORE TAXES(XVIII-XIX)

-

-

XXI.

DISCONTINUED OPERATIONS PROVISION FOR TAXES(±)

-

-

21.1 Current tax charge

-

-

21.2 Deferred tax charge

-

-

XXII.

NET INCOME/LOSS AFTER TAXES FROM DISCONTINUED OPERATIONS(XX±XXI)

-

-

XXIII.

NET PROFIT/LOSS (XVI+XXII)

V-IV-12

1,873,913

1,813,843

23.1.

Equity holders of the Bank

1,948,588

1,805,677

23.2.

Non-controlling interest(-)

V-IV-13

(74,675)

8,166

Earnings per 100 Share (full TL)

III-XXIV

0.7496

0.7255