279

PART III: FINANCIAL HIGHLIGHTS AND RISK MANAGEMENT

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED CONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE IN NOTE I. OF SECTION THREE

TÜRKİYE VAKIFLAR BANKASI TÜRK ANONİM ORTAKLIĞI AND

ITS FINANCIAL SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS AT AND

FOR THE YEAR ENDED 31 DECEMBER 2015

(Amounts expressed in thousands of Turkish Lira (“TL”) unless otherwise stated.)

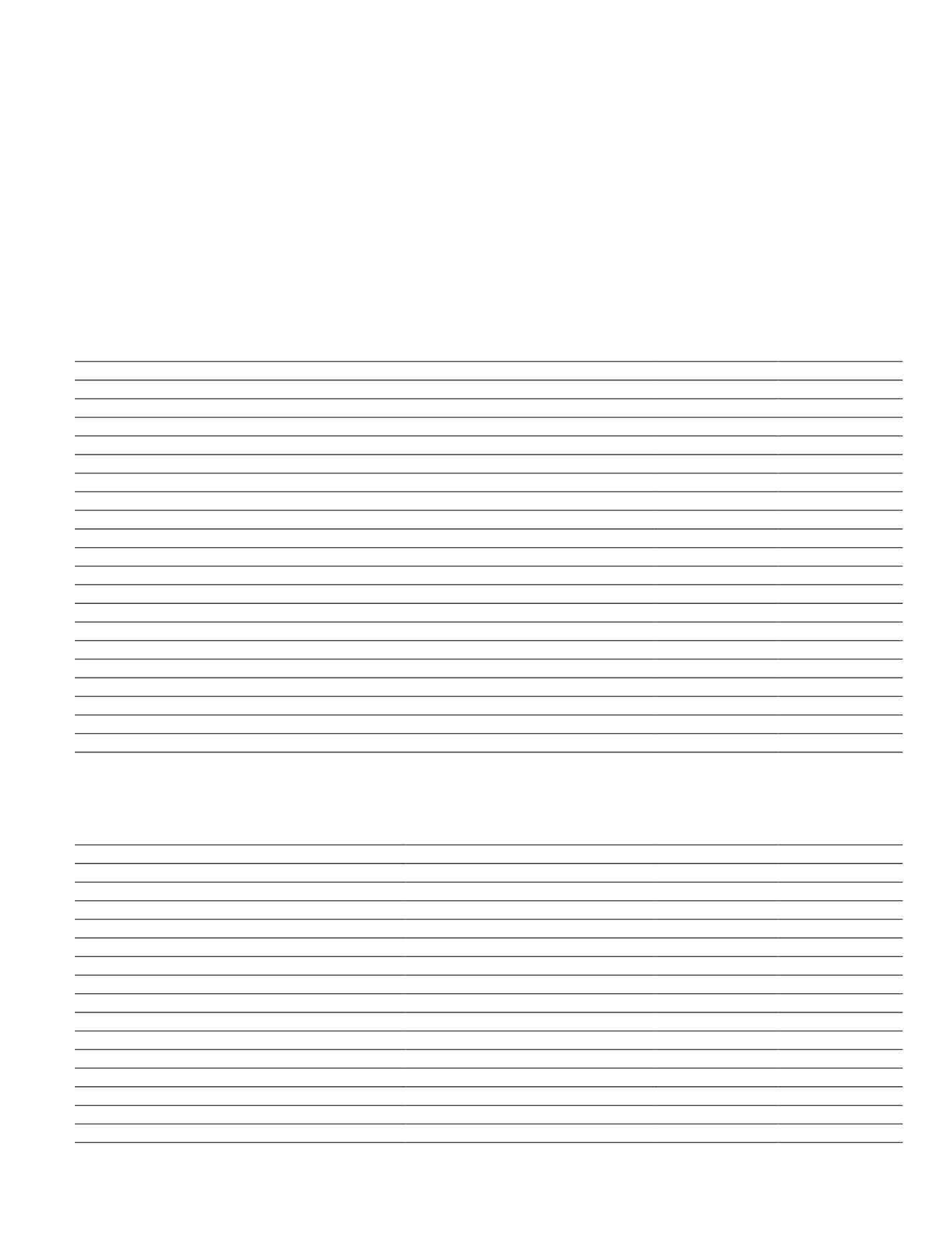

Leverage ratio common disclosure template

Current Period

(*)

Prior Period

(*)

On-balance sheet exposures

On-balance sheet items (exclude derivatives and SFTs; include collateral)

188,355,835

156,663,304

Assets deducted in determining Basel III Tier 1 capital

(357,384)

(257,930)

Total on-balance sheet exposures (excluding derivatives and SFTs)

187,998,451

156,405,374

Derivative exposures

Replacement cost

958,702

407,433

Add-on amount

380,597

233,847

Total derivative exposures

1,339,299

641,280

Securities financing transaction exposures

Gross SFT assets (with no recognition of accounting netting)

779,920

1,690,988

Agent transaction exposures

-

-

Total securities financing transaction exposures

779,920

1,690,988

Other off-balance sheet exposures

Off-balance sheet exposures with gross nominal amount

54,444,913

46,704,208

Adjustment amount off-balance sheet exposures with credit conversion factor

1,025,968

561,420

Total off-balance sheet exposures

55,470,881

47,265,628

Capital and total exposures

Tier 1 capital

16,514,311

14,331,294

Total exposures

245,588,551

206,003,270

Leverage ratio

Leverage ratio

6.72

6.96

(*)

Calculated by using 3 month average of balances in Leverage Rate Notification table.

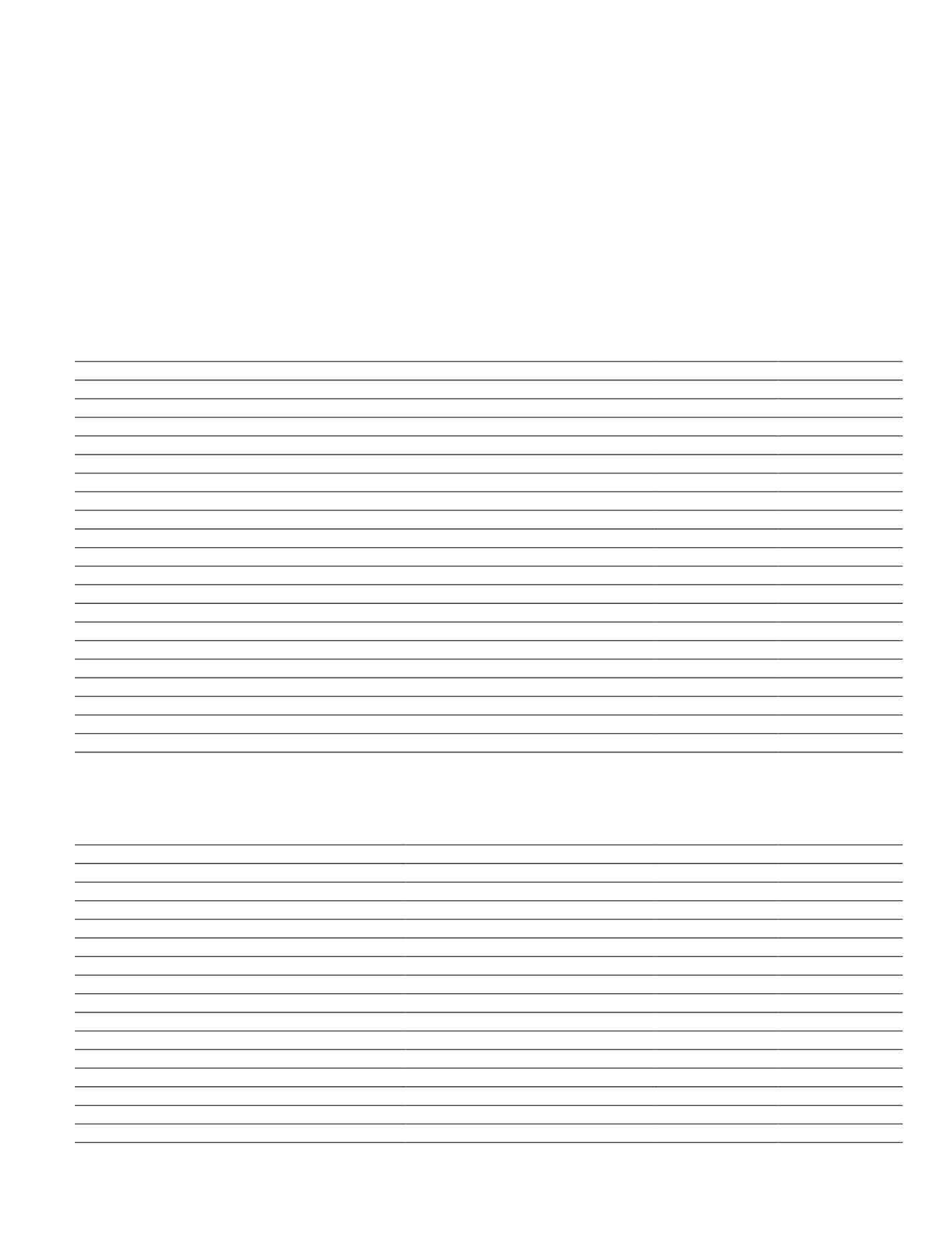

VIII. FAIR VALUES OF FINANCIAL ASSETS AND LIABILITIES

Carrying Value

Fair Value

Current Period

Prior Period

Current Period

Prior Period

Financial Assets:

Receivables from Interbank Money Markets

6,699

9,504

6,699

9,504

Banks

6,176,019

3,568,508

6,176,019

3,568,508

Available-for-Sale Financial Assets

17,336,111

16,871,115

17,336,111

16,871,115

Held-to-Maturity Investments

7,677,729

6,854,593

7,496,076

6,983,593

Loans

125,959,679

106,355,671

127,521,403

107,248,004

Financial Leasing Receivables

1,325,825

1,089,987

1,325,825

1,089,987

Factoring Receivables

717,727

510,381

717,727

510,381

Financial Liabilities:

Bank Deposits

5,578,475

4,750,416

5,610,321

4,750,416

Other Deposits

106,431,522

88,652,197

106,428,225

88,696,535

Funds Borrowed

20,195,047

16,260,655

20,508,451

16,260,391

Securities Issued

10,646,708

10,384,708

10,569,723

10,315,024

Subordinated Loans

4,155,551

2,126,436

4,155,551

2,126,436

Miscellaneous Payables

4,397,761

3,344,419

4,397,761

3,344,419