VAKIFBANK

2015 ANNUAL REPORT

274

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED CONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE IN NOTE I. OF SECTION THREE

TÜRKİYE VAKIFLAR BANKASI TÜRK ANONİM ORTAKLIĞI AND

ITS FINANCIAL SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS AT AND

FOR THE YEAR ENDED 31 DECEMBER 2015

(Amounts expressed in thousands of Turkish Lira (“TL”) unless otherwise stated.)

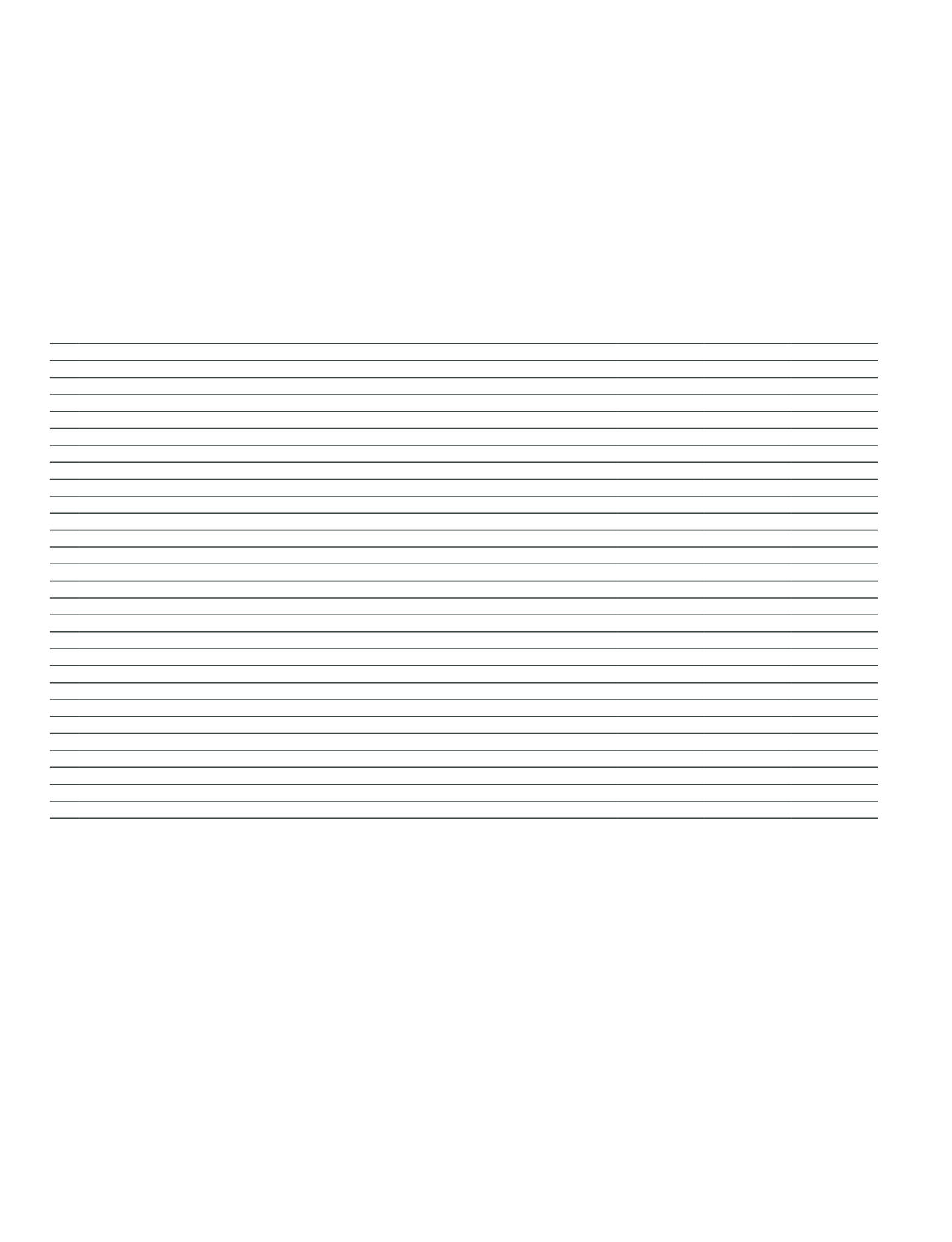

Prior Period

Total unweighted

value *

Total weighted

value*

TL+FC

FC

TL+FC

FC

HIGH QUALITY LIQUID ASSETS

1 Total High Quality Liquid Assets (HQLA)

21,740,602 15,890,234

CASH OUTFLOWS

2 Retail deposits and deposits from small business customers, of which:

33,211,281 14,381,935

2,350,923

818,618

3 Stable deposits

28,462,318

9,632,972

1,423,116

481,648

4 Less stable deposits

4,748,963

4,748,963

927,807

336,970

5 Unsecured wholesale funding, of which:

51,231,026 12,326,384 21,390,721

6,087,581

6 Operational deposits

32,362,586

5,491,432

8,090,647

1,372,858

7 Non-operational deposits

13,843,072

5,710,009

8,275,114

3,589,780

8 Unsecured debt

5,025,368

1,124,943

5,024,960

1,124,943

9 Secured wholesale funding

-

-

10 Additional requirements of which:

1,279,692

1,222,956

1,279,692

1,222,956

11 Outflows related to derivative exposures and other collateral requirements

1,279,692

1,222,956

1,279,692

1,222,956

12 Outflows related to loss of funding on debt products

-

-

-

-

13 Credit and liquidity facilities

-

-

-

-

14 Other contractual funding obligations

12,266,490

9,756,311

613,325

487,816

15 Other contingent funding obligations

44,132,841 14,485,826

6,444,894

2,353,891

16 TOTAL CASH OUTFLOWS

32,079,555 10,970,862

CASH INFLOWS

17 Secured lending

-

-

-

-

18 Inflows from fully performing exposures

8,123,384

2,794,168

5,753,344

2,503,876

19 Other cash inflows

207,386

153,889

207,386

153,889

20 TOTAL CASH INFLOWS

8,330,770 2,948,057 5,960,730 2,657,765

Upper Limit Applied Values

21 TOTAL HQLA

21,740,602 15,890,234

22 TOTAL NET CASH OUTFLOWS

26,118,825 8,313,097

23 LIQUIDITY COVERAGE RATIO (%)

83.24

191.15

(*)

To be calculated by simple arithmetic average monthly and consolidated average calculated for the last three months to the liquidity coverage ratio, calculated weekly simple average of the last three months to the liquidity

coverage ratio is calculated by taking the arithmetic mean.

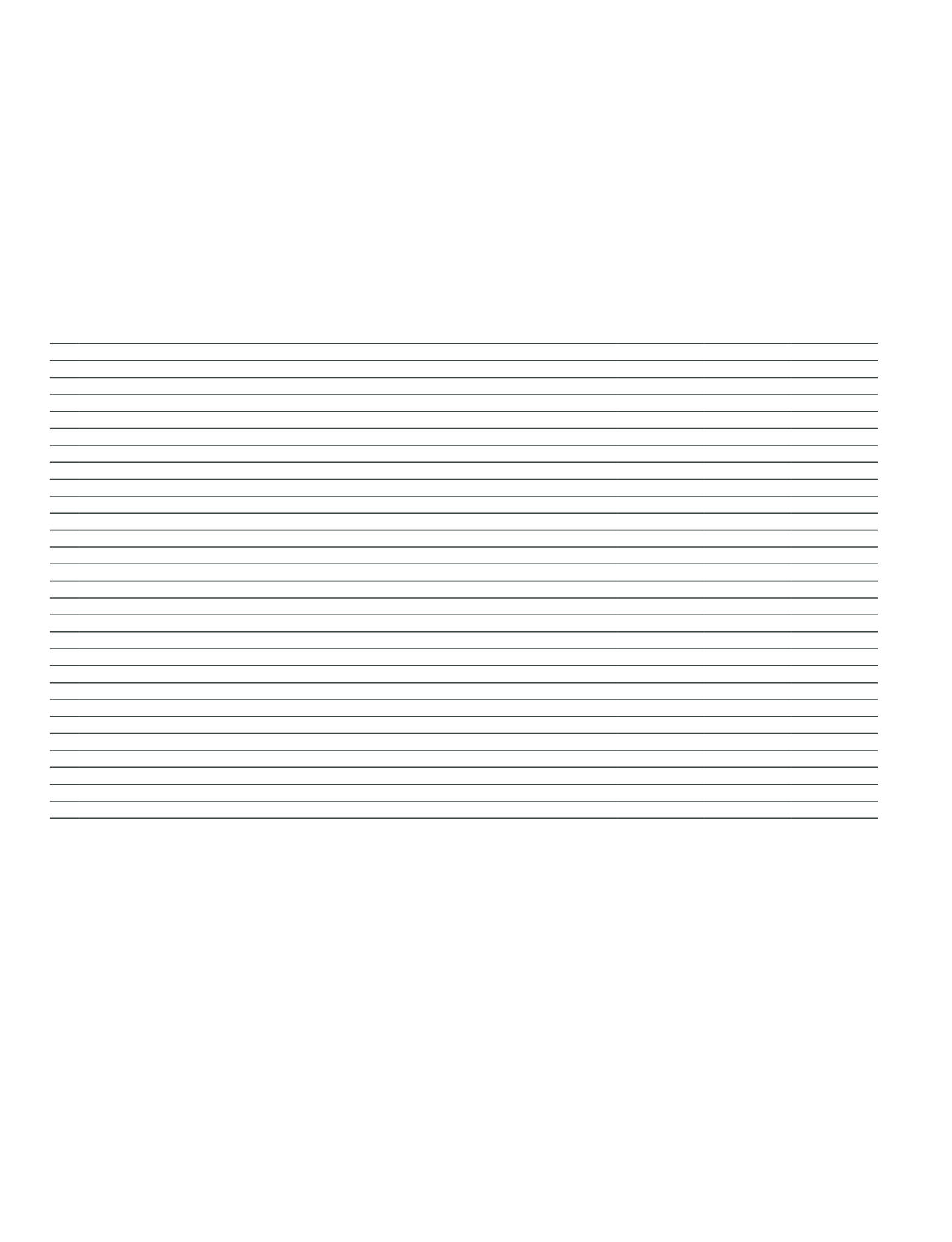

The highest value in foreign currency took place during 30 November 2015 period in the level of 187.8%, whereas the lowest value took place during

31 October 2015 period in the level of 180.55%.

The highest value in total took place during 31 December 2015 period in the level of 109.55%, whereas the lowest value took place during 30

November 2015 period in the level of 99.1%.

Between 30 September 2015 and 31 December 2015, as a result of the decrease of cash inflows in foreign currency and total liquidity coverage ratio is

less than decrease of cash outflows, the ratios increased from %175.14 to %186.07 on foreign currency, and from %105.68 to %109.55 in total.

With the “Liquidity Coverage Rate” which is prepared under the framework of “Regulations Regarding Banks’ Calculations of Liquidity Coverage Rate”

published by BRSA, the balance between banks’ net cash outflows and high quality liquid asset stock.

Bank’s high quality liquid asset stock consists of cash and debt instruments issued by CBRT and Republic of Turkey Undersecretariat of Treasury.

Whereas the Banks’ important fund sources are deposits, funds obtained from other financial institutions, marketable securities issued and funds

obtained from repo transactions.

Derivatives transactions with 30 or less days to maturity are included into liquidity coverage calculation with cash outflows created by the transactions

as of the calculated liquidity coverage rate. In case of a liability resulting from derivatives transactions and security fulfillment liablity resulting from

other liabilities, actions are taken accordingly to the related regulation.