VAKIFBANK

2015 ANNUAL REPORT

330

EVALUATION OF THE BANK’S FINANCIAL

POSITION, PROFITABILITY AND SOLVENCY

Acting with the vision of becoming its region’s

most preferred bank that creates value,

VakıfBank continues its services with its 15,410

employees in its 920 branches as of year-end

2015.

ASSESSMENT ON THE ASSETS

VakıfBank continued the growth in its assets also

in 2015 while its assets increased by 15.63%

compared to the previous year-end and reached

TL 182,947 million. VakıfBank’s interest bearing

assets’ ratio to total assets increased to 94.45%.

63.93% of the total assets was in Turkish Liras

while 36.07% was in foreign currency. When

we examine the structure of the total assets;

we see that total loans with 67.66% share are

the most important item in the assets. In 2015,

VakıfBank’s performing loans, the fundamental

intermediary function in the banking sector,

increased by 17.86% and reached TL 122,974

million. 70.23% of total performing loans are

composed of commercial loans while 29.77%

is composed of personal loans. VakıfBank

increased its commercial loans by 20.80% while

increasing personal loans by 11.45%. When we

examine the structure of personal loans; we see

that credit cards are in the first position with

22.48% increase. Mortgage loans increased by

5.59% while auto loans increased by 7.24%,

and general consumer loans increased by

14.86%.

In 2015, VakıfBank’s non-performing loans ratio

was 3.8%. In the same period, VakıfBank’s

securities portfolio increased by 5.49% and

reached TL 24,452 million. The share of the

securities portfolio in the assets is 13.37%.

ASSESSMENT ON THE LIABILITIES

In 2015, while VakıfBank’s total liabilities

increased by 15.63% the increase in deposits

was 19.80%. The share of deposits in total

assets increased by 2.09 points and reached

60.08%. The most important deposits item in

the funding structure, as of year-end 2015, is

TL 109,923 million. 69.57% of the deposits

are in TL deposits while 30.43% is in foreign

currency deposits. Furthermore, the balance

between term and demand deposits was

81.55% and 18.45% respectively.

Diversifying the sources of funds and performing

effective cost management, VakıfBank increased

the securities issued to TL 10,548 million.

The local and foreign investors’ demand for

the securities issued by the Bank, made a

contribution to the diversification of funding

sources and the extension of the maturity

structure.

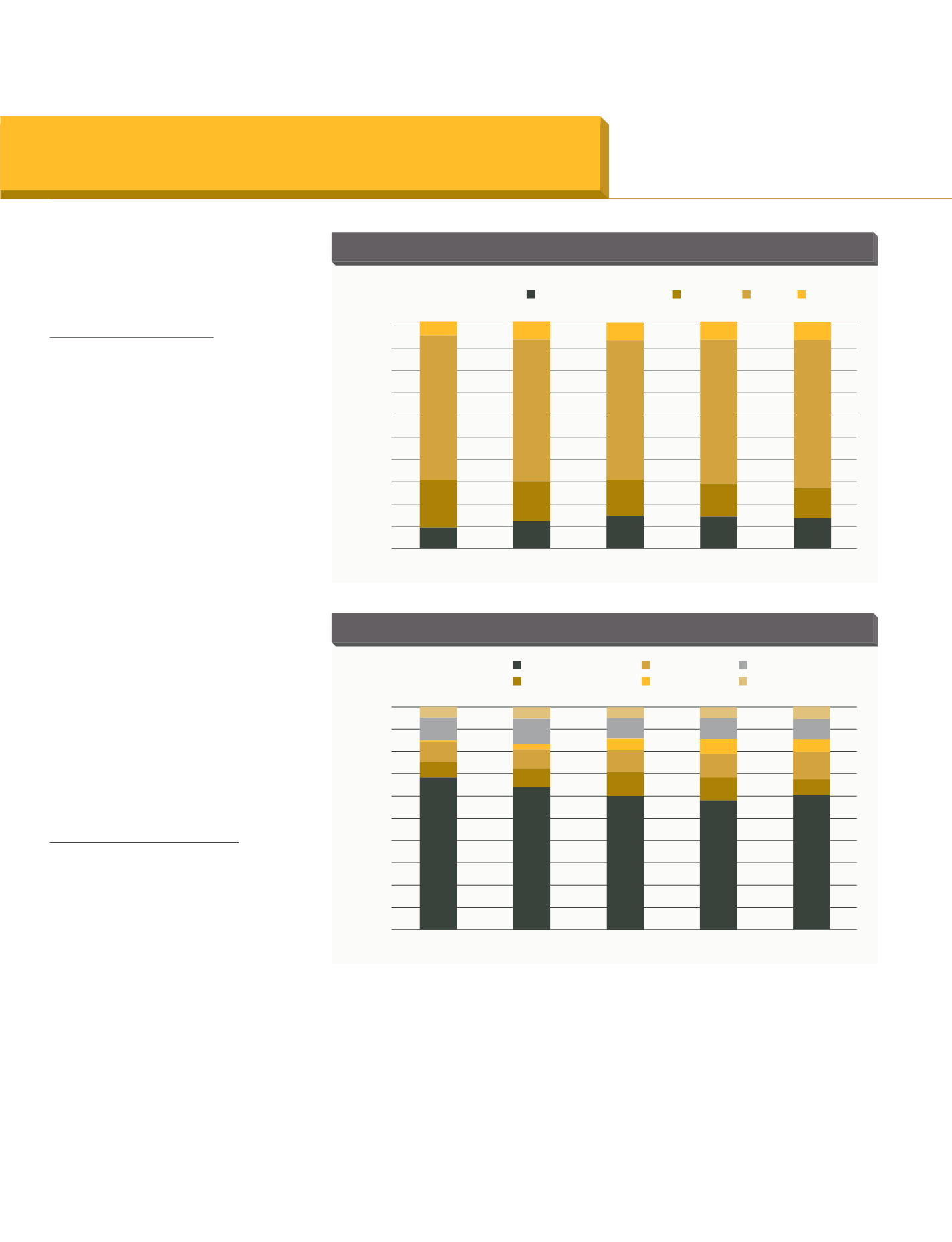

DISTRIBUTION OF ASSETS

(%)

100.00

90.00

80.00

70.00

60.00

50.00

40.00

30.00

20.00

10.00

0.00

2011

2012

2013

2014

2015

3.71

3.62

4.02

3.79

4.37

66.10

67.66

14.65

13.37

14.60

15.46

64.03

16.01

15.95

65.15

17.58

13.66

64.26

21.43

10.60

Other

Loans

Securities

Cash Reserves (Including mm)

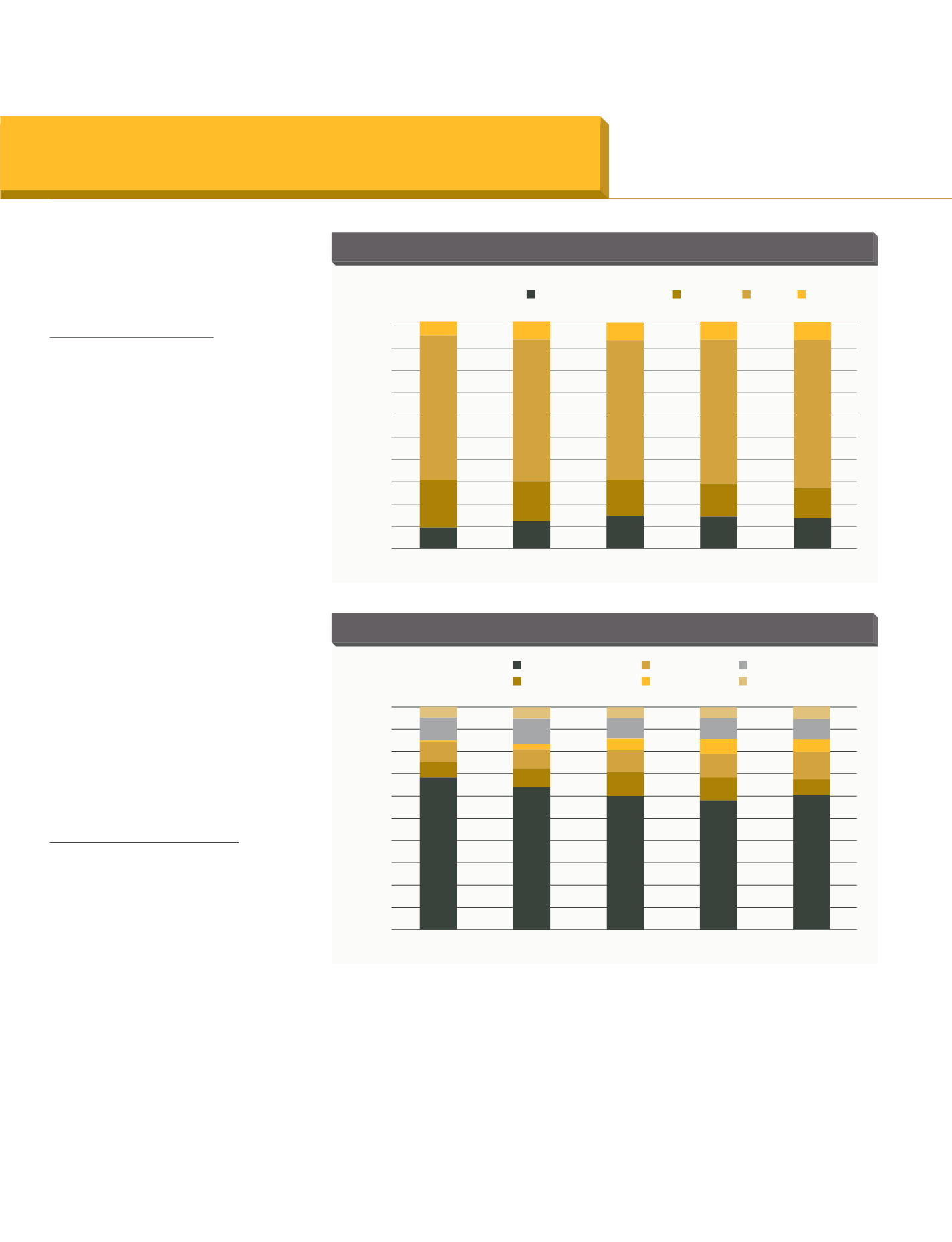

DISTRIBUTION OF LIABILITIES

(%)

100.00

90.00

80.00

70.00

60.00

50.00

40.00

30.00

2011

2012

2013

2014

2015

Deposits

Funds Borrowed

Shareholders’ Equity

Interbank Money Market

Securities Issued

Other

0.55

68.33

6.66

9.24

10.43

4.79

8.72

2.32

11.40

5.15

64.30

8.12

5.08

9.31

4.88

60.17

10.68

9.87

57.99

10.36

10.79

6.61

9.34

4.91

60.08

6.97

12.42

5.77

9.17

5.59