149

PART III: FINANCIAL HIGHLIGHTS AND RISK MANAGEMENT

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED UNCONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE NOTE I. OF SECTION THREE

TÜRKİYE VAKIFLAR BANKASI TÜRK ANONİM ORTAKLIĞI

UNCONSOLIDATED FINANCIAL REPORT

FOR THE YEAR ENDED 31 DECEMBER 2015

(Amounts expressed in thousands of Turkish Lira (“TL”) unless otherwise stated.)

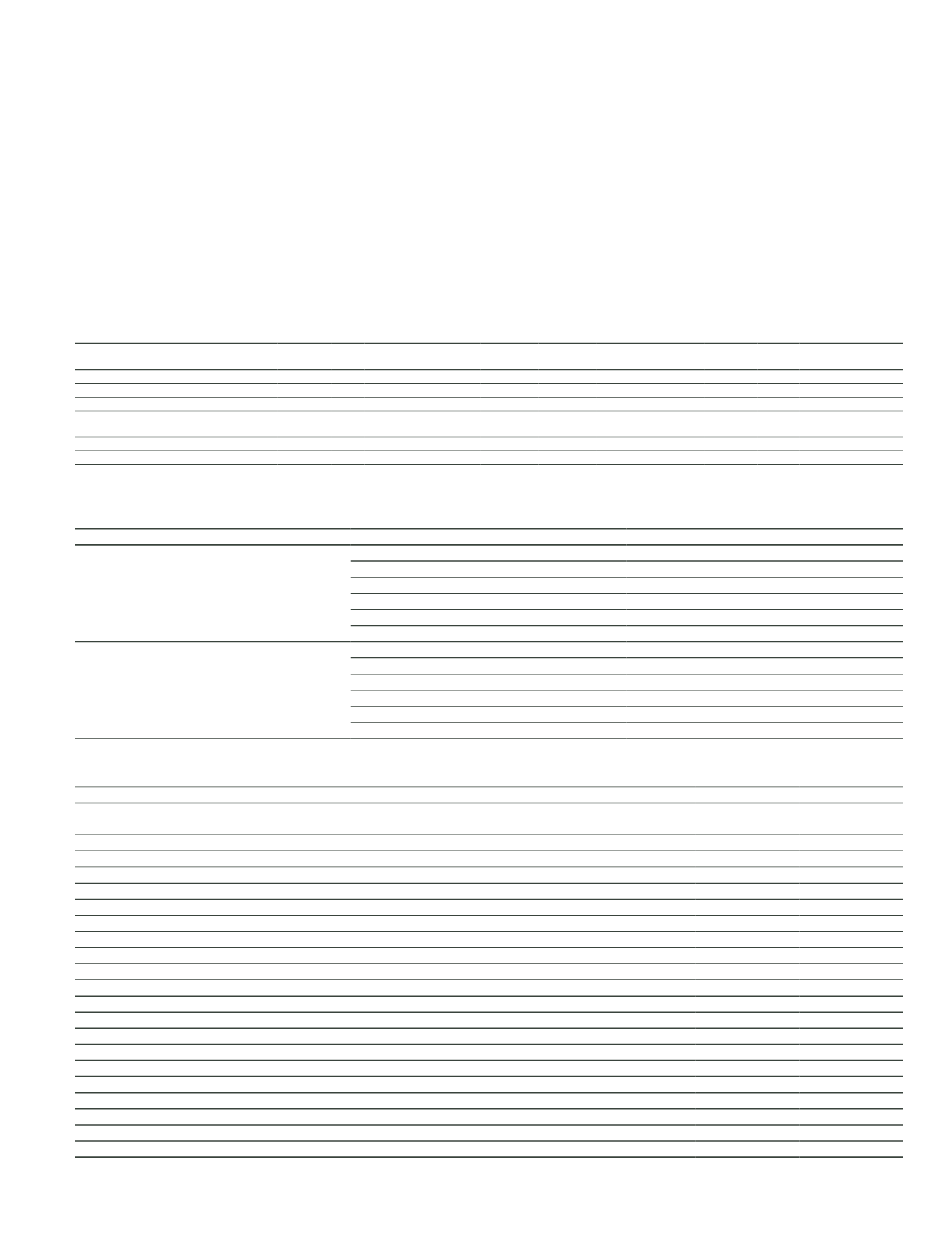

Risk balances according to risk weights

Risk Weights Current Period

0% 10% 20% 50% 75% 100% 150% 200% 250% 1250%

Deductions from the

shareholders’ equity

Pre-Amount of Credit Risk Mitigation

51,653,484

- 9,995,432 44,482,520 27,755,671 71,651,022 3,666,757 7,571,232 45,093

-

413,981

Amount after Credit Risk Mitigation

55,276,308

- 7,773,090 45,591,407 27,561,064 69,352,260 3,660,714 7,561,275 45,093

-

413,981

Risk Weights Prior Period

0% 10% 20% 50% 75% 100% 150% 200% 250% 1250%

Deductions from the

shareholders’ equity

Pre-Amount of Credit Risk Mitigation

47,554,085

- 16,779,325 37,737,598 23,535,298 57,619,942 2,990,704 9,446,254 97,738

-

359,114

Amount after Credit Risk Mitigation

54,978,227

- 10,597,030 37,813,961 23,371,738 56,480,407 2,986,884 9,434,959 97,738

-

359,114

Credit rating of the credit rating agency, related to the Bank's Capital Adequacy Assessment of the Measurement is listed in Appendix 1 which

corresponds to the credit quality step that is given in the table below.

Ratings Matched

Credit Quality Rank

Fitch

Long Term Credit Ratings

1

AAA between AA-

2

A+ between A-

3

BBB+ between BBB-

4

BB+ between BB-

5

B+ between B-

6

CCC+ and below

Short Term Credit Ratings

1

F1+ between F1

2

F2

3

F3

4

F3 and below

5

-

6

-

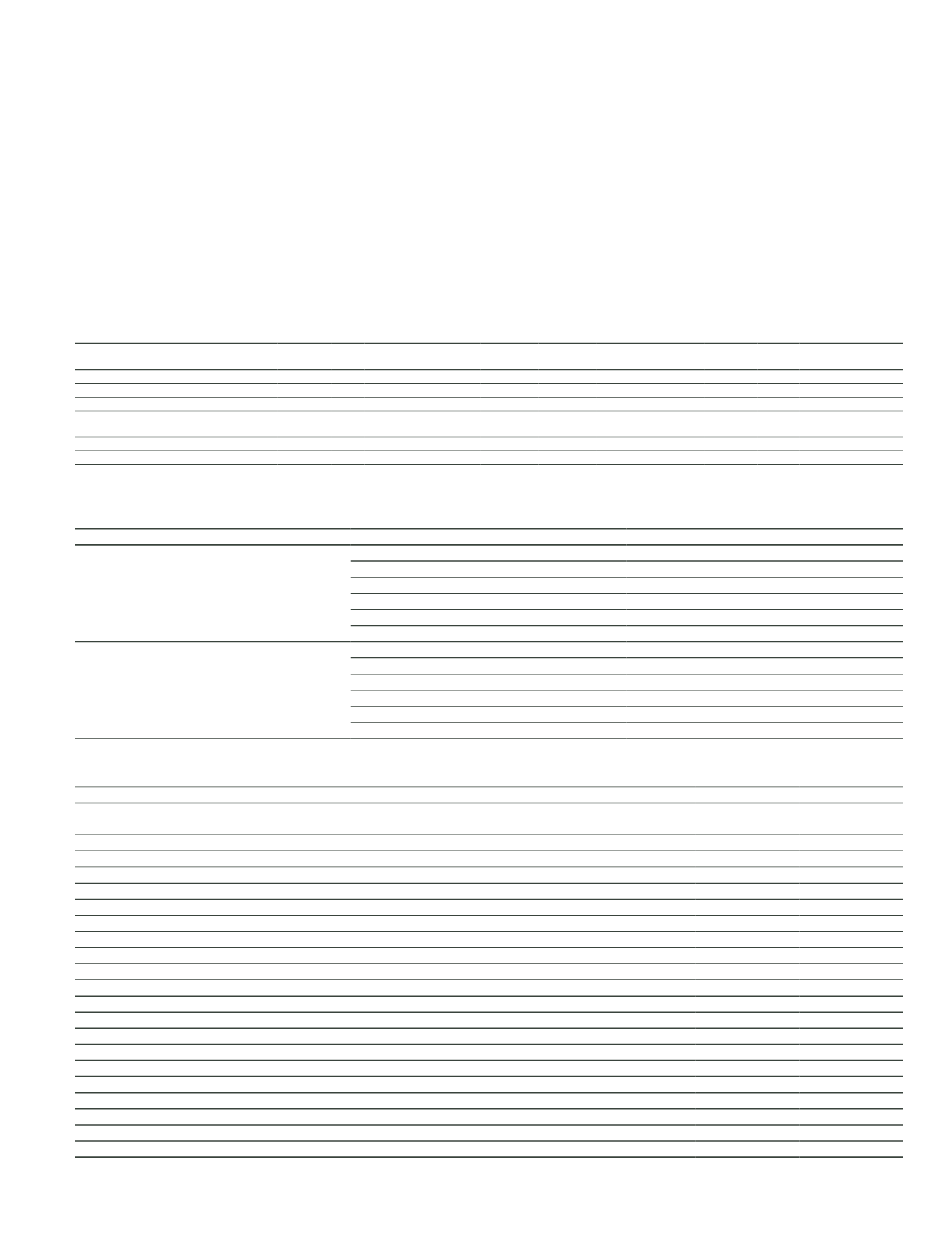

Information According to Sectors and Counterparties

Loans

Current Period

Impaired

(*)

Past Due

(**)

Value

Adjustments

(***)

Provisions

Agricultural

87,877

63,490

1,082

80,444

Farming and raising livestock

77,331

57,860

995

70,949

Forestry

8,408

3,188

75

7,669

Fishing

2,138

2,442

12

1,826

Manufacturing

948,135

263,507

6,344

831,505

Mining

100,016

7,731

63

63,998

Production

842,374

250,811

6,197

762,493

Electric, Gas, Water

5,745

4,965

84

5,014

Construction

527,749

214,734

4,877

460,814

Services

1,477,456

1,344,869

26,214

1,259,443

Wholesale and retail trade

958,068

596,895

12,883

810,598

Hotel, Food and Beverage Services

53,562

82,970

1,283

39,021

Transportation and telecommunication

303,162

448,813

8,132

265,365

Financial Institutions

4,482

4,873

89

4,315

Real estate and renting services

11,426

21,350

311

9,007

Self-employment services

117,833

145,031

2,792

104,951

Education services

6,353

17,877

333

5,782

Health and social services

22,570

27,060

391

20,404

Other

1,808,996

2,797,820

74,248

1,411,832

Total

4,850,213

4,684,420

112,765

4,044,038

(*)

Impaired loans are composed of group three, four and five loans.

(**)

Past due loans and other receivables consist of loans and other receivables that are past due up to ninety days.

(***)

Value adjustments represents general provisions of non-performing loans.