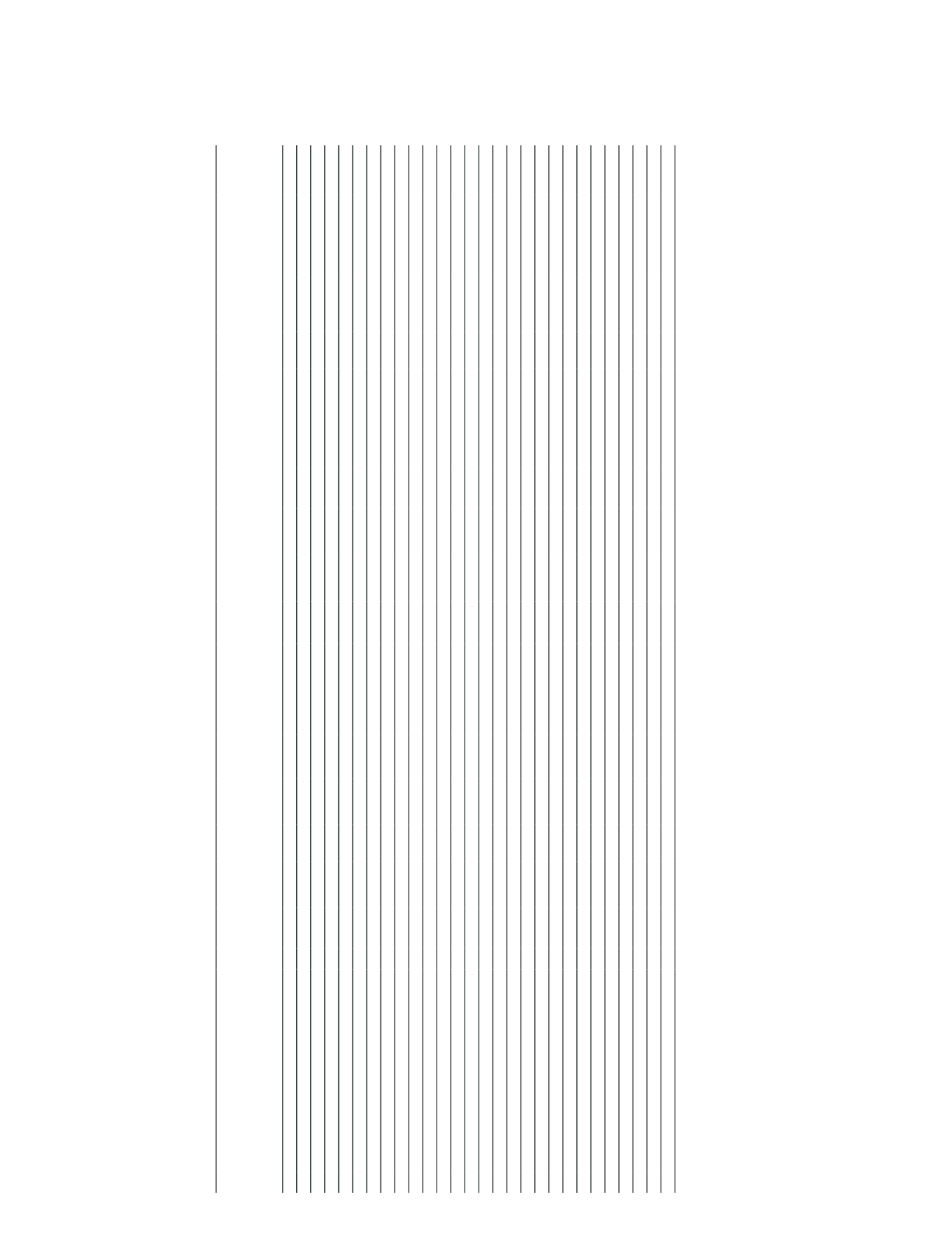

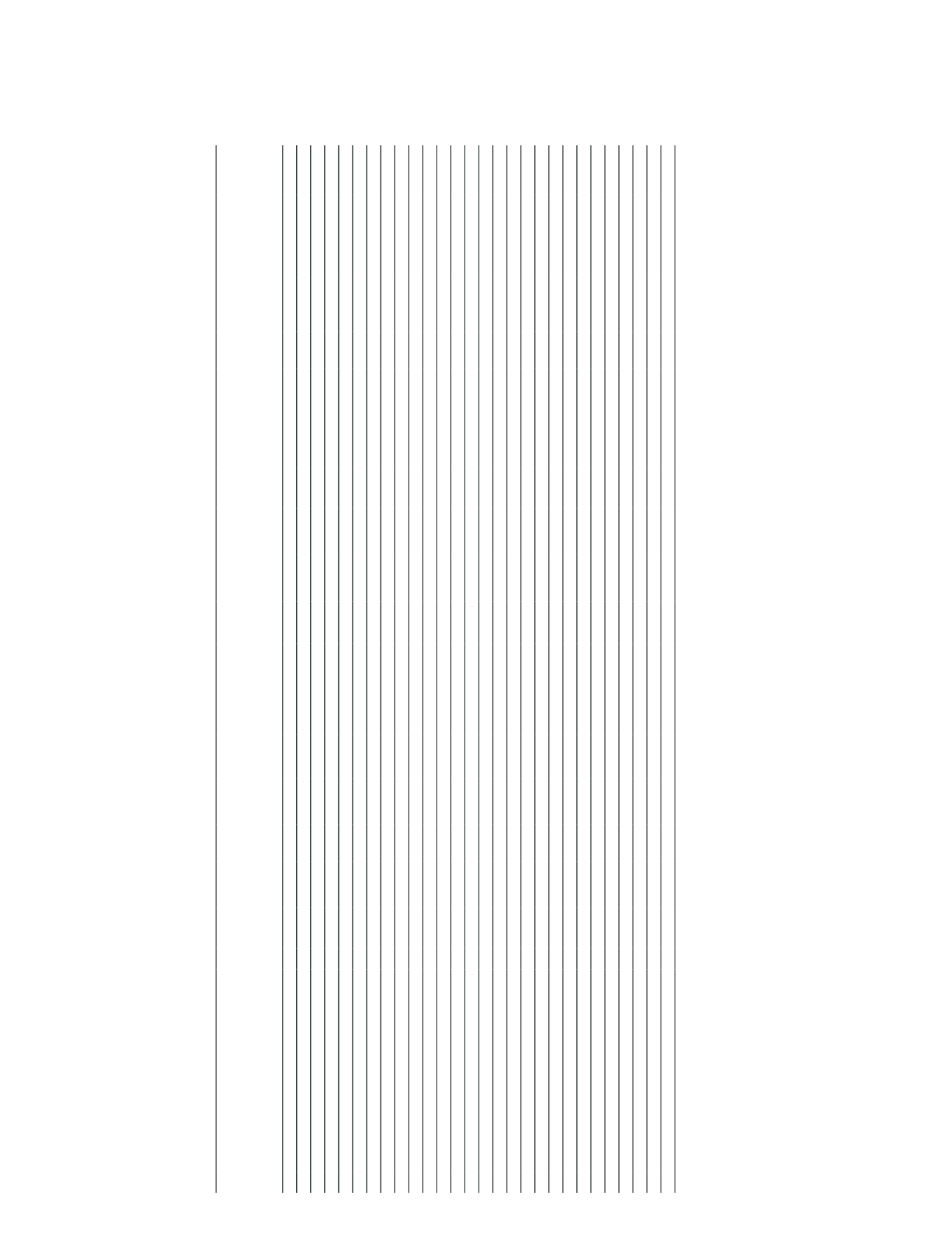

VAKIFBANK

2015 ANNUAL REPORT

122

AUDITED

Notes

Paid-in

Capital

Capital

Reserves

from Inflation

Adjustments

to Paid-in

Capital

Share

Premium

Share

Cancellation

Profits

Legal

Reserves

Status

Reserves

Extraordinary

Reserves

Other

Reserves

Current Period

Net Profit/

(Loss)

Prior Period

Net Profit/

(Loss)

Valuation

Differences

of the

Marketable

Securities

Revaluation

Surplus on

Tangible,

Intangible

Assets and

Investment

Property

Bonus Shares

of Associates,

Subsidiaries and

Joint Ventures

Hedging

Reserves

Revaluation

Surp. On Assets

Held for Sale

and Assets of

Discount. Op.s

Shareholders’

Equity before

Minority

Interest

Minority

Interest

Total

Shareholders’

Equity

CURRENT PERIOD – 31 December 2015

I.

Balances at the beginning of the period

2,500,000

- 723,918

- 1,012,796

-

7,214,708 235,227

-

1,753,273 1,216,969 45,637

69,222

-

-

14,771,750

-

14,771,750

Changes during the period

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

II.

Mergers

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

III.

Associates, Subsidiaries and "Available-for-sale" securities

-

-

-

-

-

-

-

-

-

- (386,556)

-

-

-

-

(386,556)

-

(386,556)

IV.

Hedges for risk management

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

4.1 Net cash flow hedges

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

4.2 Net foreign investment hedges

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

V.

Revaluation surplus on tangible assets

-

-

-

-

-

-

-

-

-

-

-

548,390

-

-

-

548,390

-

548,390

VI.

Revaluation surplus on intangible assets

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

VII.

Bonus shares of associates, subsidiaries and joint-ventures

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

VIII. Translation differences

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

IX.

Changes resulted from disposal of the assets

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

X.

Changes resulted from reclassifications of the assets

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

XI.

Effect of change in equities of associates on the Bank’s equity

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

XII.

Capital increase

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

12.1 Cash

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

12.2 Internal sources

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

XIII. Share issuance

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

XIV. Share cancellation profits

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

XV.

Capital reserves from inflation adjustments to paid-in capital

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

XVI. Other

-

-

-

-

-

-

-

3,855

-

-

-

-

-

-

-

3,855

-

3,855

XVII. Current period’s net profit/loss

-

-

-

-

-

-

-

-

1,930,109

-

-

-

-

-

-

1,930,109

-

1,930,109

XVIII. Profit distribution

-

-

-

-

161,214

-

1,114,821 141,116

- (1,753,273)

-

236,122

-

-

-

(100,000)

-

(100,000)

18.1 Dividends

VI-1

-

-

-

-

-

-

-

-

-

(100,000)

-

-

-

-

-

(100,000)

-

(100,000)

18.2 Transferred to reserves

VI-1

-

-

-

-

161,214

-

1,114,821 141,116

- (1,653,273)

-

236,122

-

-

-

-

-

-

18.3 Other

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Balances at the end of the period

2,500,000

- 723,918

- 1,174,010

-

8,329,529 380,198 1,930,109

-

830,413 830,149

69,222

-

-

16,767,548

-

16,767,548

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED UNCONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE NOTE I. OF SECTION THREE

TÜRKİYE VAKIFLAR BANKASI TÜRK ANONİM ORTAKLIĞI

UNCONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEAR ENDED 31 DECEMBER 2015

(Amounts expressed in thousands of Turkish Lira (“TL”) unless otherwise stated.)

The accompanying explanations and notes form an integral part of these financial statements.