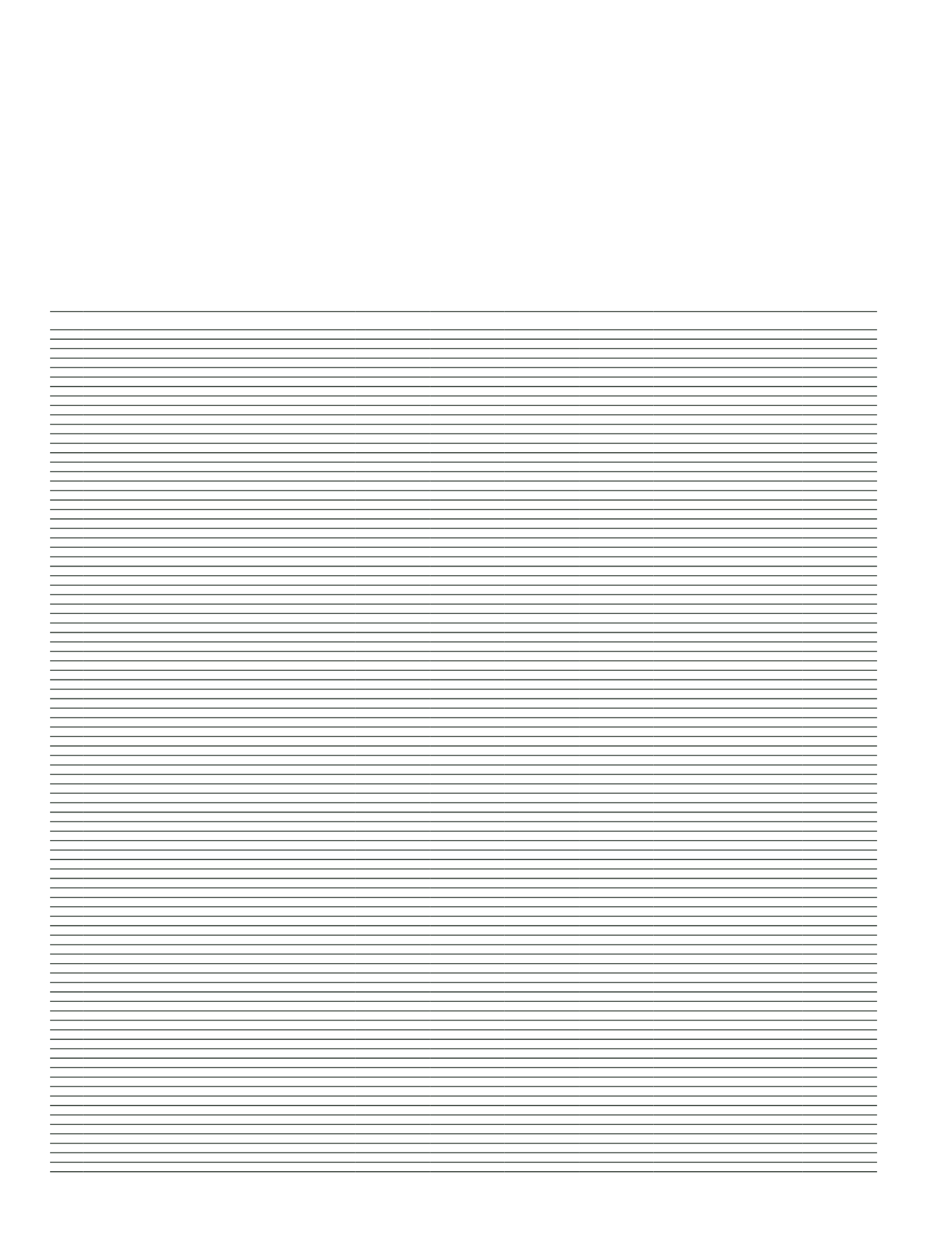

VAKIFBANK

2015 ANNUAL REPORT

118

Audited Current Period

31 December 2015

Audited Prior Period

31 December 2014

Notes

TL

FC

Total

TL

FC

Total

A.

OFF-BALANCE SHEET COMMITMENTS AND CONTINGENCIES (I+II+III)

54,047,046

63,505,765

117,552,811

42,543,635

48,918,083

91,461,718

I.

GUARANTEES AND SURETIES

V-III-2-4

22,083,837

10,984,524

33,068,361

16,863,185

11,770,738

28,633,923

1.1

Letters of guarantee

21,980,769

4,810,034

26,790,803

16,842,349

4,610,122

21,452,471

1.1.1 Guarantees subject to State Tender Law

2,542,809

2,199,589

4,742,398

1,869,107

2,266,261

4,135,368

1.1.2 Guarantees given for foreign trade operations

1,030,530

-

1,030,530

913,389

-

913,389

1.1.3 Other letters of guarantee

18,407,430

2,610,445

21,017,875

14,059,853

2,343,861

16,403,714

1.2

Bank acceptances

86,762

1,389,251

1,476,013

20,836

1,943,257

1,964,093

1.2.1 Import letter of acceptance

1,590

189,471

191,061

2,190

78,990

81,180

1.2.2 Other bank acceptances

85,172

1,199,780

1,284,952

18,646

1,864,267

1,882,913

1.3

Letters of credit

16,306

4,772,403

4,788,709

-

5,212,911

5,212,911

1.3.1 Documentary letters of credit

16,306

4,772,403

4,788,709

-

5,212,911

5,212,911

1.3.2 Other letters of credit

-

-

-

-

-

-

1.4

Guaranteed pre-financings

-

2,314

2,314

-

1,845

1,845

1.5

Endorsements

-

-

-

-

-

-

1.5.1 Endorsements to the Central Bank of Republic of Turkey

-

-

-

-

-

-

1.5.2 Other endorsements

-

-

-

-

-

-

1.6

Marketable securities underwriting commitments

-

-

-

-

-

-

1.7

Factoring related guarantees

-

-

-

-

-

-

1.8

Other guarantees

-

10,522

10,522

-

2,603

2,603

1.9

Other sureties

-

-

-

-

-

-

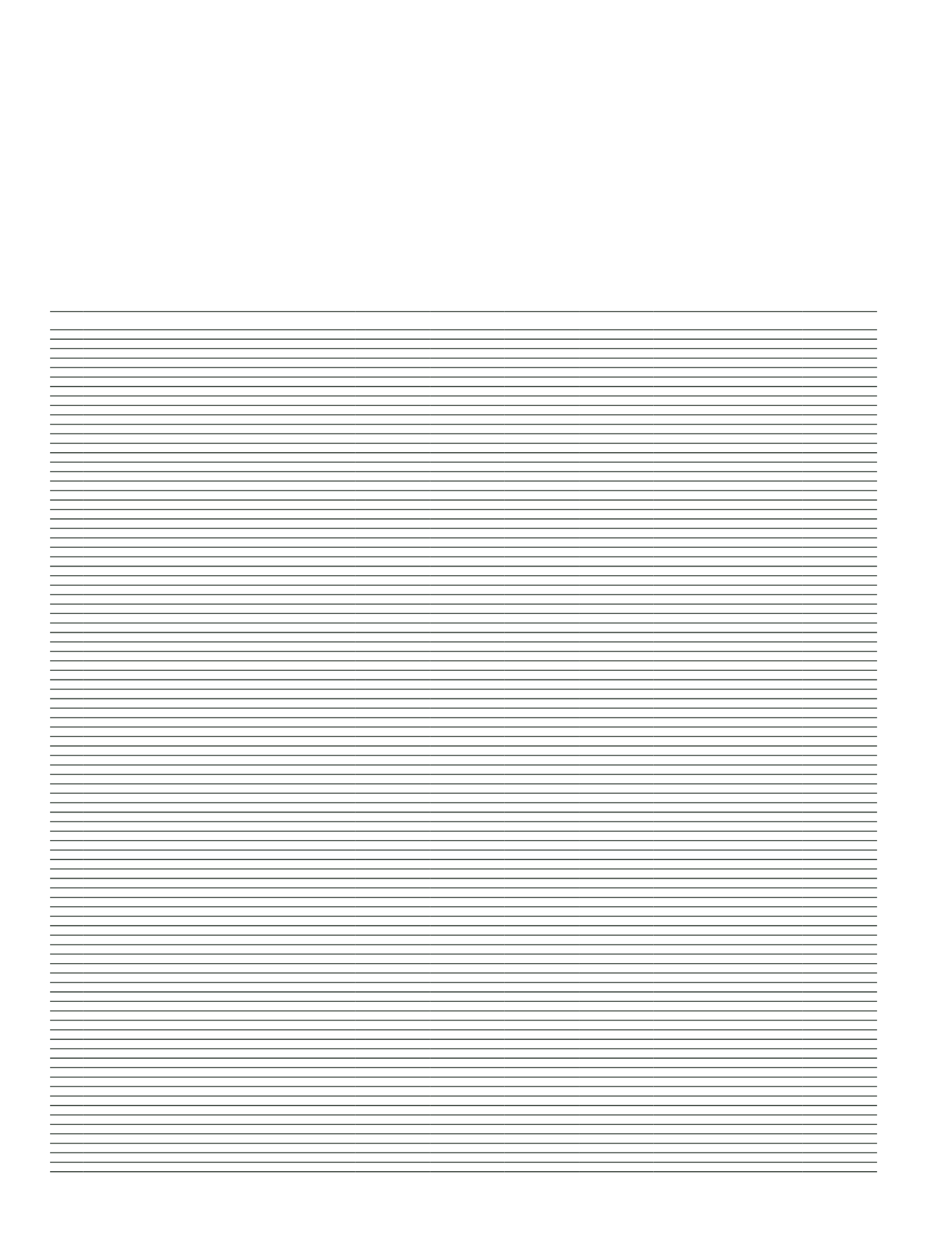

II.

COMMITMENTS

21,439,019

13,120,948

34,559,967

19,162,556

7,458,391

26,620,947

2.1

Irrevocable commitments

19,031,959

3,730,953

22,762,912

17,652,664

2,640,634

20,293,298

2.1.1 Asset purchase commitments

V-III-1

112,420

3,730,953

3,843,373

46,228

2,640,634

2,686,862

2.1.2 Deposit purchase and sales commitments

-

-

-

-

-

-

2.1.3 Share capital commitments to associates and subsidiaries

V-III-1

-

-

-

-

-

-

2.1.4 Loan granting commitments

V-III-1

8,482,816

-

8,482,816

8,053,342

-

8,053,342

2.1.5 Securities issuance brokerage commitments

-

-

-

-

-

-

2.1.6 Commitments for reserve deposit requirements

-

-

-

-

-

-

2.1.7 Commitments for cheque payments

V-III-1

1,805,569

-

1,805,569

1,638,976

-

1,638,976

2.1.8 Tax and fund obligations on export commitments

-

-

-

-

-

-

2.1.9 Commitments for credit card limits

V-III-1

7,399,361

-

7,399,361

7,641,987

-

7,641,987

2.1.10 Commitments for credit card and banking operations promotions

196,037

-

196,037

247,938

-

247,938

2.1.11 Receivables from "short" sale commitments on securities

-

-

-

-

-

-

2.1.12 Payables from "short" sale commitments on securities

-

-

-

-

-

-

2.1.13 Other irrevocable commitments

1,035,756

-

1,035,756

24,193

-

24,193

2.2

Revocable commitments

2,407,060

9,389,995

11,797,055

1,509,892

4,817,757

6,327,649

2.2.1 Revocable loan granting commitments

2,407,060

9,389,995

11,797,055

1,509,892

4,817,757

6,327,649

2.2.2 Other revocable commitments

-

-

-

-

-

-

III.

DERIVATIVE FINANCIAL INSTRUMENTS

V-III-5

10,524,190

39,400,293

49,924,483

6,517,894

29,688,954

36,206,848

3.1

Derivative financial instruments held for risk management

-

-

-

-

-

-

3.1.1 Fair value hedges

-

-

-

-

-

-

3.1.2 Cash flow hedges

-

-

-

-

-

-

3.1.3 Net foreign investment hedges

-

-

-

-

-

-

3.2

Trading derivatives

10,524,190

39,400,293

49,924,483

6,517,894

29,688,954

36,206,848

3.2.1 Forward foreign currency purchases/sales

211,514

257,246

468,760

242,929

312,275

555,204

3.2.1.1 Forward foreign currency purchases

106,014

128,693

234,707

121,619

156,202

277,821

3.2.2.2 Forward foreign currency sales

105,500

128,553

234,053

121,310

156,073

277,383

3.2.2 Currency and interest rate swaps

9,442,940

30,544,698

39,987,638

5,631,655

22,183,274

27,814,929

3.2.2.1 Currency swaps-purchases

4,382,013

12,050,672

16,432,685

1,659,308

10,977,077

12,636,385

3.2.2.2 Currency swaps-sales

4,160,927

6,080,268

10,241,195

3,772,347

3,927,959

7,700,306

3.2.2.3 Interest rate swaps-purchases

450,000

6,206,879

6,656,879

100,000

3,639,119

3,739,119

3.2.2.4 Interest rate swaps-sales

450,000

6,206,879

6,656,879

100,000

3,639,119

3,739,119

3.2.3 Currency, interest rate and security options

258,134

255,396

513,530

385,290

671,258

1,056,548

3.2.3.1 Currency call options

65,004

185,976

250,980

192,645

335,629

528,274

3.2.3.2 Currency put options

193,130

69,420

262,550

192,645

335,629

528,274

3.2.3.3 Interest rate call options

-

-

-

-

-

-

3.2.3.4 Interest rate put options

-

-

-

-

-

-

3.2.3.5 Security call options

-

-

-

-

-

-

3.2.3.6 Security put options

-

-

-

-

-

-

3.2.4 Currency futures

-

-

-

-

-

-

3.2.4.1 Currency futures-purchases

-

-

-

-

-

-

3.2.4.2 Currency futures-sales

-

-

-

-

-

-

3.2.5 Interest rate futures

-

-

-

-

-

-

3.2.5.1 Interest rate futures-purchases

-

-

-

-

-

-

3.2.5.2 Interest rate futures-sales

-

-

-

-

-

-

3.2.6 Other

611,602

8,342,953

8,954,555

258,020

6,522,147

6,780,167

B.

CUSTODY AND PLEDGED ITEMS (IV+V+VI)

899,689,613

421,931,972

1,321,621,585

706,821,902

298,845,575

1,005,667,477

IV.

ITEMS HELD IN CUSTODY

74,007,877

3,193,339

77,201,216

58,297,898

2,105,489

60,403,387

4.1

Customers' securities held

-

28,306

28,306

-

22,567

22,567

4.2

Investment securities held in custody

63,189,794

118,086

63,307,880

48,295,375

94,082

48,389,457

4.3

Checks received for collection

8,967,543

2,282,378

11,249,921

8,300,087

1,452,398

9,752,485

4.4

Commercial notes received for collection

1,065,285

310,417

1,375,702

1,129,279

182,687

1,311,966

4.5

Other assets received for collection

2,152

116

2,268

2,152

93

2,245

4.6

Assets received through public offering

-

-

-

-

6,818

6,818

4.7

Other items under custody

309

48,883

49,192

309

77,724

78,033

4.8

Custodians

782,794

405,153

1,187,947

570,696

269,120

839,816

V.

PLEDGED ITEMS

235,391,497

82,272,386

317,663,883

180,351,054

59,408,743

239,759,797

5.1

Securities

435,193

14,171

449,364

241,614

18,614

260,228

5.2

Guarantee notes

792,339

429,076

1,221,415

943,912

232,965

1,176,877

5.3

Commodities

28,164,121

681,732

28,845,853

25,696,626

590,812

26,287,438

5.4

Warranties

-

-

-

-

-

-

5.5

Real estates

191,738,765

67,309,165

259,047,930

142,283,678

47,319,679

189,603,357

5.6

Other pledged items

13,657,901

13,683,601

27,341,502

10,332,202

11,114,594

21,446,796

5.7

Pledged items-depository

603,178

154,641

757,819

853,022

132,079

985,101

VI.

CONFIRMED BILLS OF EXCHANGE AND SURETIES

590,290,239

336,466,247

926,756,486

468,172,950

237,331,343

705,504,293

TOTAL OFF-BALANCE SHEET ITEMS (A+B)

953,736,659

485,437,737

1,439,174,396

749,365,537

347,763,658

1,097,129,195

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED UNCONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE NOTE I. OF SECTION THREE

TÜRKİYE VAKIFLAR BANKASI TÜRK ANONİM ORTAKLIĞI

UNCONSOLIDATED OFF-BALANCE SHEET ITEMS

AS AT 31 DECEMBER 2015

(Amounts expressed in thousands of Turkish Lira (“TL”) unless otherwise stated.)

The accompanying explanations and notes form an integral part of these financial statements.