299

PART III: FINANCIAL HIGHLIGHTS AND RISK MANAGEMENT

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED CONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE IN NOTE I. OF SECTION THREE

TÜRKİYE VAKIFLAR BANKASI TÜRK ANONİM ORTAKLIĞI AND

ITS FINANCIAL SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS AT AND

FOR THE YEAR ENDED 31 DECEMBER 2015

(Amounts expressed in thousands of Turkish Lira (“TL”) unless otherwise stated.)

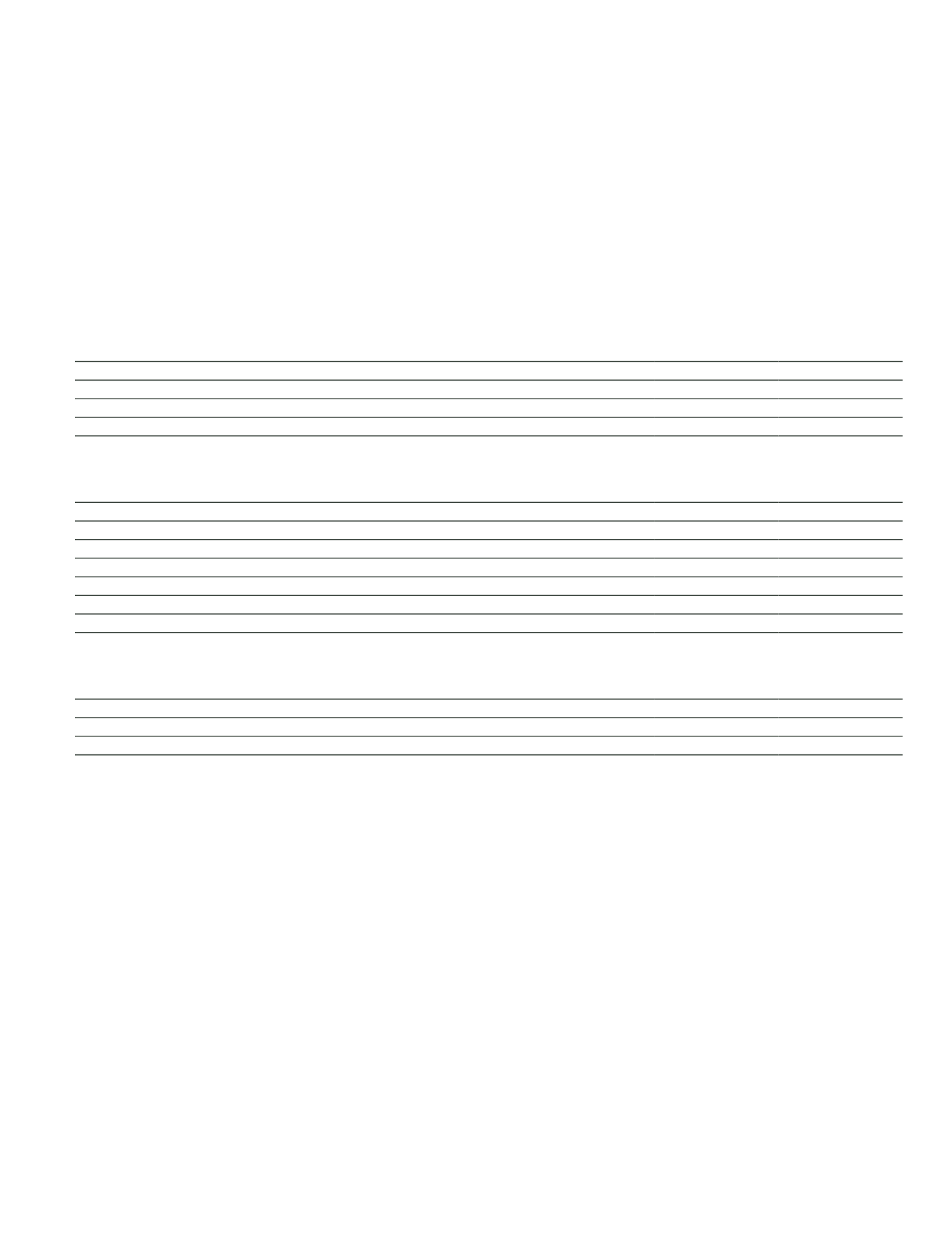

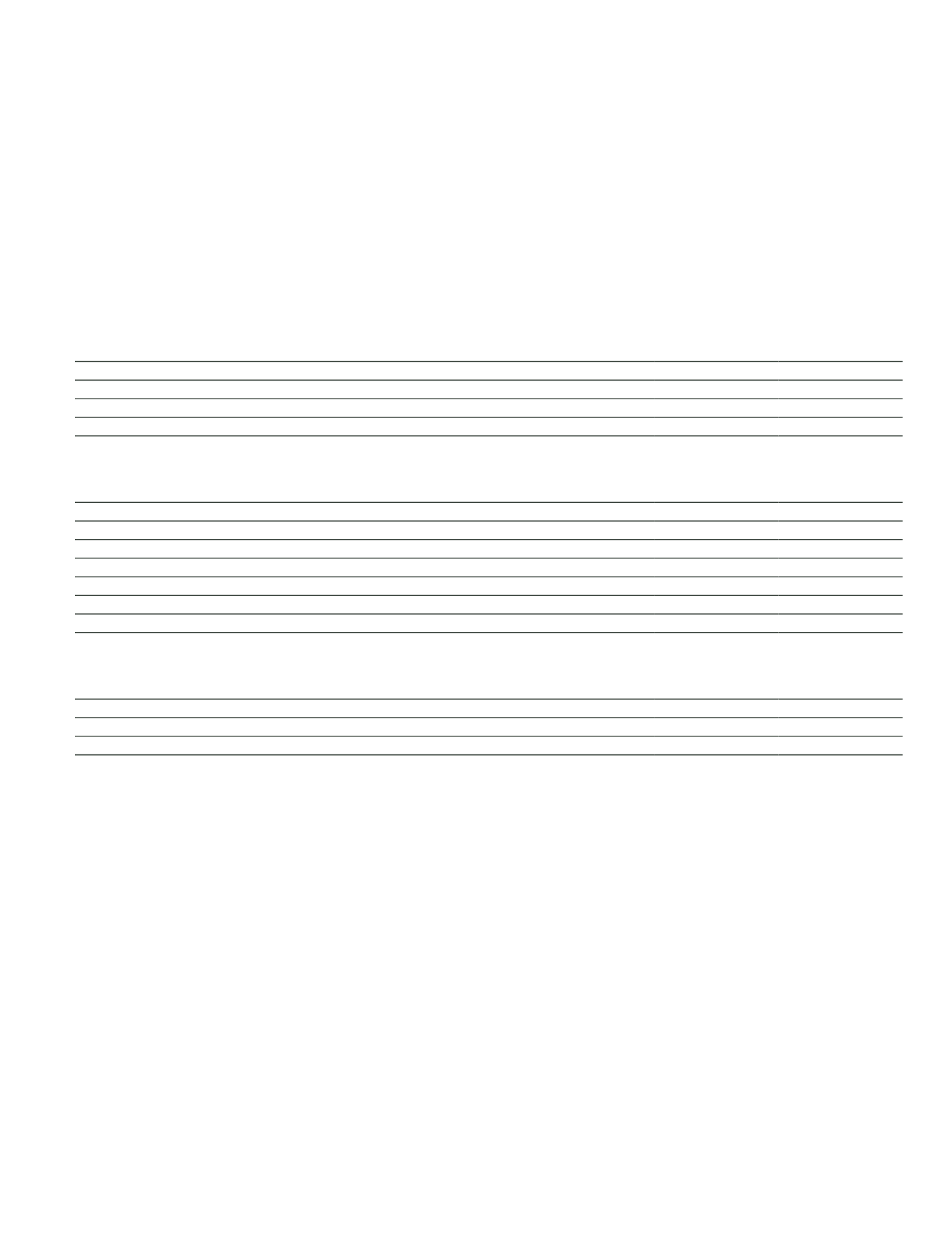

Valuation of consolidated subsidiaries in unconsolidated financial statements

Current Period

Prior Period

Measured at cost

-

-

Measured at fair value

1,350,170

1,187,597

Equity method of accounting

-

-

Total

1,350,170

1,187,597

Sectoral distribution of consolidated investments in financial subsidiaries

Current Period

Prior Period

Insurance companies

480,532

402,769

Banks

434,144

321,124

Factoring companies

62,163

65,273

Leasing companies

45,681

45,149

Financing companies

-

-

Other financial subsidiaries

327,650

353,282

Total

1,350,170

1,187,597

Quoted consolidated subsidiaries

Current Period

Prior Period

Quoted at domestic stock exchanges

330,703

378,037

Quoted at international stock exchanges

-

-

Total

330,703

378,037

Consolidated subsidiaries disposed during the period

There is not any disposal in the consolidated subsidiaries in the current year.

Consolidated investments in subsidiaries acquired during the period

The Parent Bank has not got any subsidiary that are purchased in the current period in the scope of consolidation. In the current period, the title of Vakıf

Finans Factoring Hizmetleri A.Ş. has been changed to Vakıf Faktoring A.Ş., the aforementioned change of title has been registered on 13 April 2015.

In the current period, subsequent to the approval of the decision to increase the paid-in capital of Vakıf Gayrimenkul Yatırım Ortaklığı A.Ş. from TL

203,320 to TL 205,400 by a bonus increase of TL 2,080 in the Ordinary Meeting of General Assembly of the Company dated 31 March 2015. After

the capital increase, Bank’s current nominal share has been increased from TL 78,690 to TL 79,495 by bonus increase of TL 805 and Bank’s share

percentage has been remained the same 38.70%. The share of the Bank amounting to TL 805 is presented as bonus shares received in the movement

table of investments in subsidiaries.

In the current period, in total full TL 12 nominal share of Vakıf Portföy Yönetimi A.Ş. has been purchased by Bank from other real person shareholders

and Bank has signed share transfer contract with real person shareholders on 11 February 2015. Thus, Bank’s nominal share has been increased from

full TL 2,999,988 to full TL 3,000,000. Bank’s share percentage has been increased from 99.99% to 100.00%.

In the prior period, Vakıf Menkul Kıymet Yatırım Ortaklığı A.Ş. has decided to increase the capital of TL 15,000 to TL 20,000 in its registered capital

ceiling amounting to TL 50,000 in accordance with Capital Markets Board’s temporary clause 1 of “Communique on Securities Investment Associations”

(III-48.2). In the capital increase, Bank’s nominal share amount has increased from TL 1,763 to TL 2,351 with an increase of TL 588 by using stock rights

on 25 November 2014. Besides, in order to finalize the capital increase, Bank has purchased additional shares from stock rights that have not been

used in due, amounting to TL 2,228 from Istanbul Stock Exchange Share Market on 2 December 2014. In this context, The Parent Bank’s total nominal

share has increased to TL 4,579 and share percentage has increased to 22.89%. The share of the Bank amounting to TL 2,815 is presented in the

acquisitions and capital increases in the movement table of investments in subsidiaries.