VAKIFBANK

2015 ANNUAL REPORT

260

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED CONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE IN NOTE I. OF SECTION THREE

TÜRKİYE VAKIFLAR BANKASI TÜRK ANONİM ORTAKLIĞI AND

ITS FINANCIAL SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS AT AND

FOR THE YEAR ENDED 31 DECEMBER 2015

(Amounts expressed in thousands of Turkish Lira (“TL”) unless otherwise stated.)

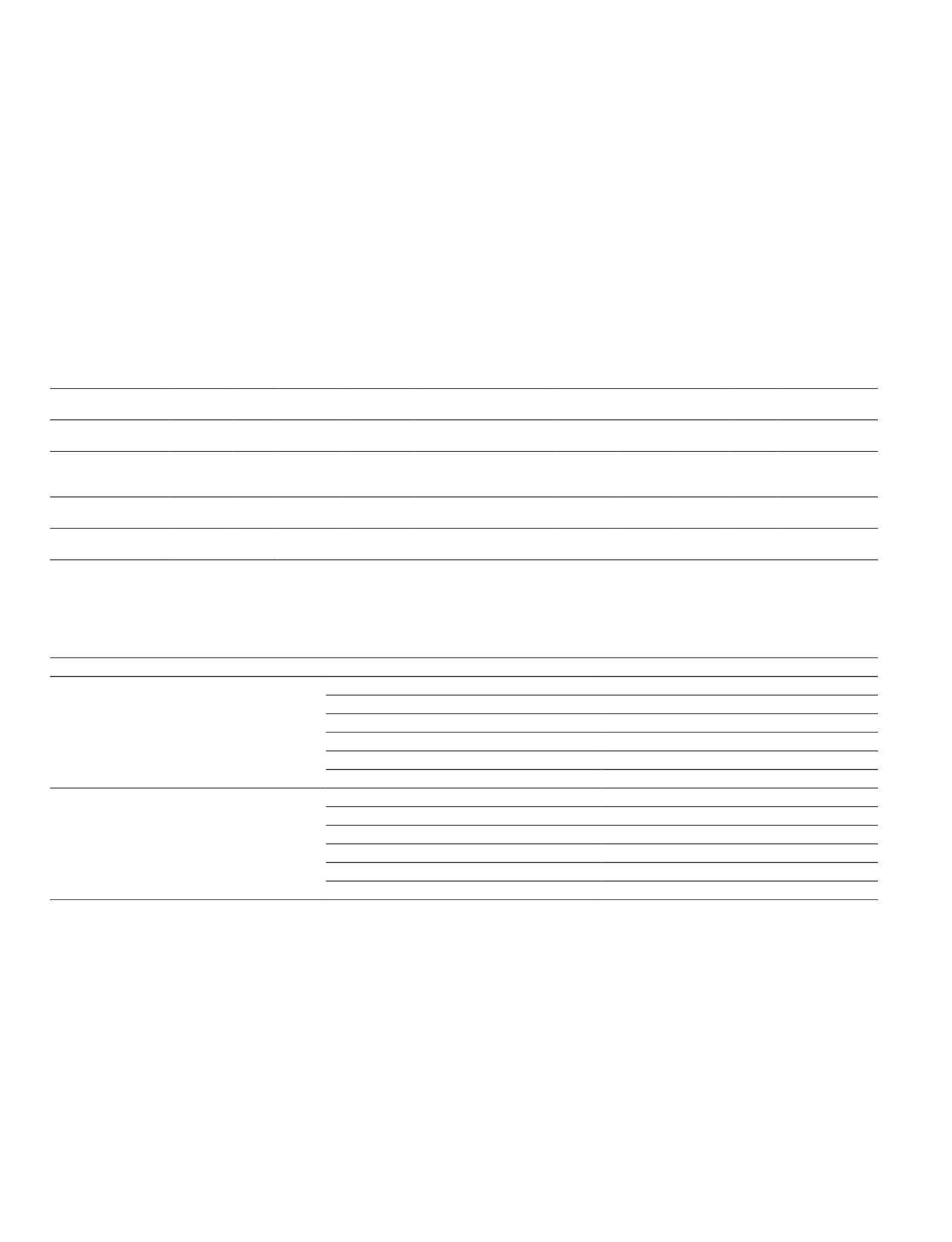

Risk balances according to risk weights

Risk Weights

Current Period

0% 10% 20% 50% 75% 100% 150% 200% 250% 1250%

Deductions from

the shareholders’

equity

Pre-Amount of

Credit Risk Mitigation 52,398,384

- 10,754,016 45,380,875 27,765,430 75,641,154 3,666,757 7,571,232 168,857

-

447,024

Amount after

Credit Risk Mitigation

56,021,211

- 8,531,672 46,489,761 27,570,823 73,342,392 3,660,714 7,561,275 168,857

-

447,024

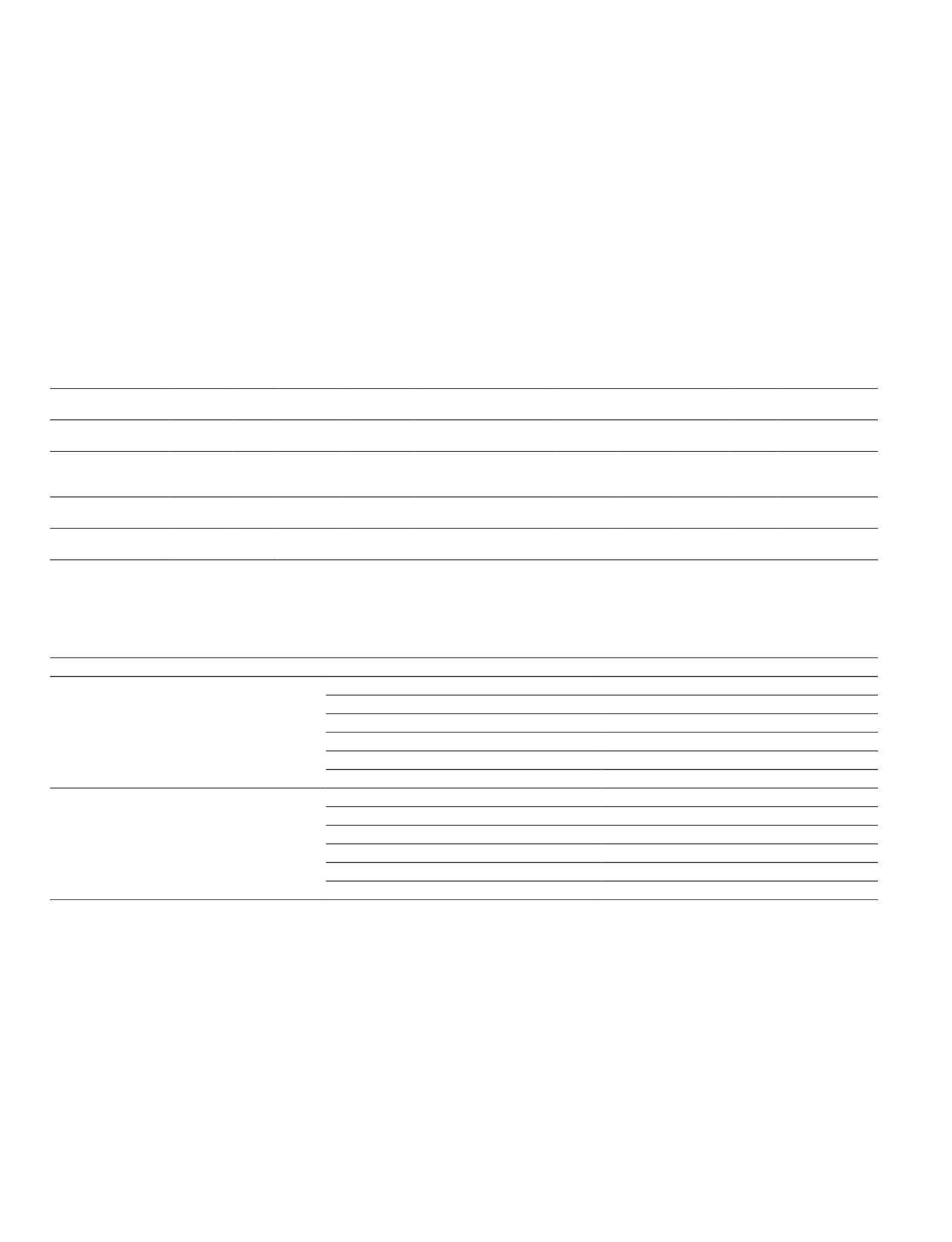

Risk Weights

Prior Period

0% 10% 20% 50% 75% 100% 150% 200% 250% 1250%

Deductions from

the shareholders’

equity

Pre-Amount of

Credit Risk Mitigation 48,195,850

- 17,821,331 38,592,192 23,546,411 60,377,604 2,990,704 9,446,254 198,260

-

382,261

Amount after

Credit Risk Mitigation

55,620,001

- 11,639,035 38,668,549 23,382,850 59,238,068 2,986,884 9,434,959 198,260

-

382,261

In determining the risk weights of the receivables from overseas banks, the risk rates which are given by International Credit Rating Agency Fitch

Ratings. The risk rates of Fitch Ratings are also used for foreign currency securities issued by the Republic of Turkey Prime Ministry Undersecretariat of

Treasury, and for other foreign currency risks associated with the Central Government of Republic of Turkey.

Ratings Matched

Credit Quality Rank

Fitch

Long Term Credit Ratings

1

AAA between AA-

2

A+ between A-

3

BBB+ between BBB-

4

BB+ between BB-

5

B+ between B-

6

CCC+ and below

Short Term Credit Ratings

1

F1+ between F1

2

F2

3

F3

4

F3 and below

5

-

6

-