185

PART III: FINANCIAL HIGHLIGHTS AND RISK MANAGEMENT

CONVENIENCE TRANSLATION OF PUBLICLY ANNOUNCED UNCONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH, SEE NOTE I. OF SECTION THREE

TÜRKİYE VAKIFLAR BANKASI TÜRK ANONİM ORTAKLIĞI

UNCONSOLIDATED FINANCIAL REPORT

FOR THE YEAR ENDED 31 DECEMBER 2015

(Amounts expressed in thousands of Turkish Lira (“TL”) unless otherwise stated.)

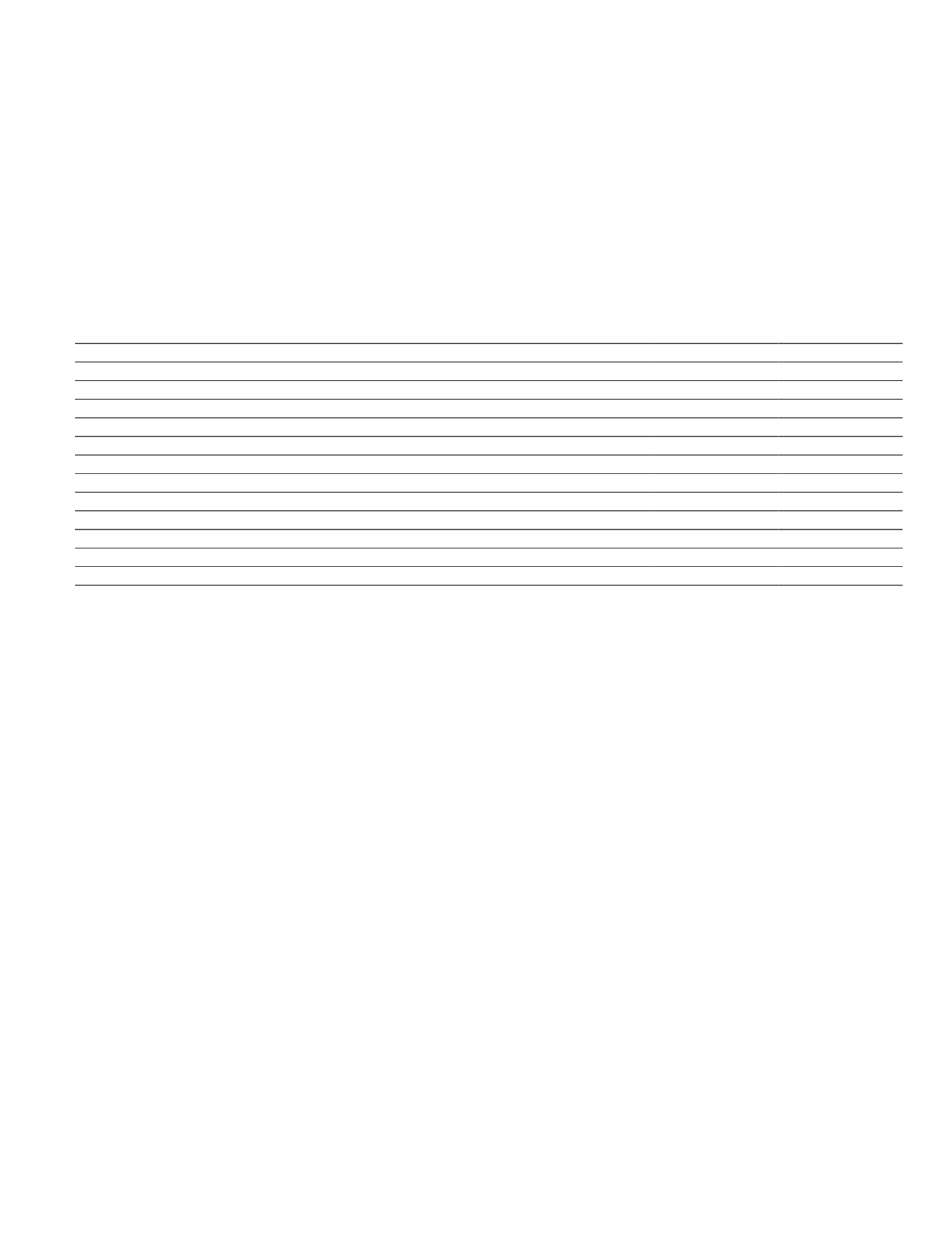

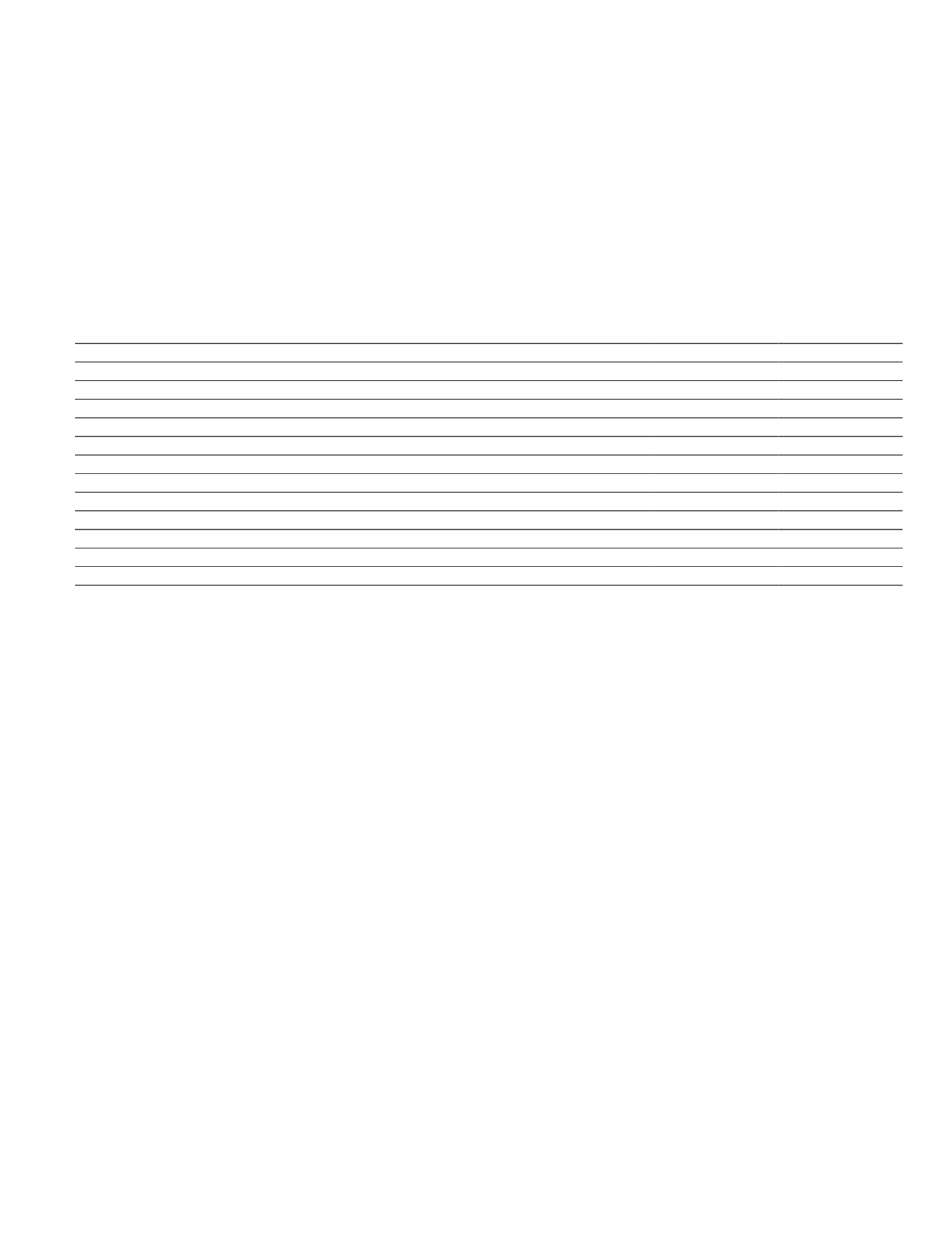

Movement table of investments in associates

Current Period

Prior Period

Balance at the beginning of the period

305,469

245,523

Movements during the period

(35,179)

59,946

Transfers

-

-

Acquisitions and capital increases

-

-

Bonus shares received

21,453

19,985

Income/loss from investments under equity accounting

-

-

Sales and liquidations

-

-

Fair value changes

(56,632)

39,961

Impairment losses

-

-

Balance at the end of the period

270,290

305,469

Capital commitments

-

-

Share percentage at the end of the period (%)

-

-

In current period, one of the bank’s associate, Tasfiye Halinde World Vakıf UBB Ltd, is removed from the banks account and transferred to Other Trading

Business account starting from December 2015.

In the current period, subsequent to the approval of the decision to increase the paid-in capital of Türkiye Sınai Kalkınma Bankası AŞ from TL 1,500,000

to TL 1,750,000 in the Ordinary Meeting of General Assembly of the Company dated 26 March 2015, the share of the Bank amounting to TL 20,944 is

presented in the movement table of investments in associates as bonus shares received.

In the current period, subsequent to the approval of the decision of the capital of Kredi Garanti Fonu A.Ş. in the Ordinary Meeting of General Assembly

of the Company dated 31 March 2015, an associate of the Bank, has been increased from TL 240,000 to TL 278,439, TL 29,000 is paid from company’s

own resources and TL 9,439 is paid cash by two new shareholders and registered to commercial register on 10 April 2015. After the capital increase,

Bank’s current nominal share has been increased from TL 4,211 to TL 4,719 by a bonus increase of TL 509 and Bank’s share percentage will be

decreased from 1.75% to 1.69% after the involvement of two shareholders as at 10 April 2015. The share of the Bank amounting to TL 509 is

presented as bonus shares received in the movement table of investments in associates.

In the prior period, subsequent to the approval of the decision of the capital of İstanbul Takas ve Saklama Bankası A.Ş. in the Ordinary Meeting of

General Assembly of the Company dated 28 March 2014, an associate of the Bank, has been increased from TL 420,000 to TL 600,000, TL 120,000 has

been paid from bonus shares and TL 60,000 has been paid in cash amounting to TL 180,000 in total. The share of the Bank amounting to TL 3,230 is

presented as bonus shares received in the movement table of investments in associates. The stock right in cash capital commitment has been removed

related to the capital increase and the usage of Istanbul Stock Exchange, Banks’ share percentage has been decreased from 4.86% to 4.37%.

In the prior period, subsequent to the approval of the decision to increase the paid-in capital of Türkiye Sınai Kalkınma Bankası AŞ from TL 1,300,000

to TL 1,500,000 in the Ordinary Meeting of General Assembly of the Company dated 27 March 2014, the share of the Bank amounting to TL 16,755 is

presented in the movement table of investments in associates as bonus shares received.

The title of World Vakıf Off Shore Banking Ltd, a subsidiary of the Bank, was changed as World Vakıf UBB. Ltd. on 4 February 2009. Pursuant to the 4

March 2010 dated and 764 numbered decision of Board of Directors of Central Bank of Turkish Republic of Northern Cyprus, the official authorisation

of World Vakıf UBB Ltd., operating in NCTR, is abrogated due to incompliance with the 7th and 9th articles of 41/2008 numbered Law of International

Banking Units. According to 24 May 2010 dated decision of the Nicosia Local Court, World Vakıf UBB Ltd. will be liquidated and NCTR Company

Registrar is appointed to carry out liquidation process. In year 2010, due to loss of control over Company, World Vakıf UBB Ltd. has been reclassified

as “Investments in associates”. The liquidation process of World Vakıf UBB Ltd, an associate of the Bank, has been carried out by NCTR Collecting and

Liquidation Office. The application of the company for cancellation of the liquidation has been rejected and the decision of liquidation has been agreed

on 27 August 2013. Thus, the company’s title has been changed as “World Vakıf UBB Ltd in Liquidation”.